Daily Market Outlook, February 21, 2020

The US market tracked lower European benchmarks to finish modestly lower on Thursday on the back of renewed concerns about the Covid-19 outbreak in China after the country reported new infection cases in its capital Beijing while new deaths took the nationwide total death tolls to surpass 2000. .

Gold prices jumped to a seven-year high of $1619.56/ounce, in its third winning session. Brent crude was little changed at $59.31/barrel. Traders bid for safe havens to seek refuge, leading treasuries yields to slip around 3-6bps along the curve where the benchmark 10Y UST yield was seen closing 5bps lower at 1.52%

The PBOC cut its benchmark one year Loan Prime Rate (LPR) by 10 bps to 4.05% yesterday as expected in a bid to inject liquidity into the market and lower borrowing cost for companies.

ECB more optimistic on outlook prior to virus outbreak: ECB meeting minutes revealed policy makers’ renewed optimism of the global economy prior to the acceleration of the Covid-19 outbreak in China. Members broadly agreed that incoming new data and survey pointed to “some stabilization in euro area growth dynamics' '. This was driven by household consumption as external demand and corporate investment remained subdued. The Governing Council also made a point about being cautious on becoming too optimistic. Although manufacturing PMI had improved, it still signalled a contraction in activity, pointing to continuous decline in Germany’s automobile sector and industrial production that could affect other country’s value chain. Headline HICP inflation is likely to hover around current levels (1.3% YOY in Dec) in the coming months.Underlying inflation remained generally muted. Wage growth remained resilient and was broad-based. Members agreed that the ECB needed to emphasise that a prolonged accomodative monetary policy stance was required and was tied to its inflation outlook., thus would be maintained until inflation “robustly converges” to a level close to below 2%.

US Philly Fed Index jumped 20pts: The Philly Fed Manufacturing Index beat estimates by adding nearly 20pts to 36.7 in February (Jan:17.0). The-midAtlantic gauge, alongside the recently upbeat reading of NY Fed Empire State Manufacturing offer tentative signs that the US manufacturing sector is staging a comeback this month.

US Initial jobless claims climbed by 4k last week: Initial jobless claims rose by 4k to 210k last week (previous: 206k revised), still hovering at historically low level that reflects a tight US Labour market. The 4-week moving average stood at 209k (previous: 212.25k). On a separate note, the Conference Board Leading Index rebounded to add 0.8% MOM in January (Feb: -0.3%) thanks mainly to low jobless claims and higher building permits and equity prices.

Smaller decline in Eurozone consumer confidence index: The flash European Commission Consumer Confidence Index picked up to -6.6 in February (Jan: -8.1), better than analysts’ estimate of -8.2 thus reflecting smaller decline in the Eurozone’s consumer confidence level this month. UK retail sales surprised to the upside: Retail sales rose 0.9% MOM in January (Dec: -0.5% revised), beating analysts’ estimate of a 0.7% gain. January print was the largest increase in sales since March last year, boosted by both food stores (+1.7%) and non-food (+1.3%). Within non-food stores, gains were recorded in textile, clothing and footwear (+3.9%), department stores (+1.6%). Online sales were seen picking up faster as well, adding 2.5% MOM but sales at petrol stations dropped by 5.7% potentially due to higher fuel cost. Excluding auto fuel sales, retail sales surged by 1.6% MOM (Dec: -0.8%), its largest gain in more than 1.5 years. YOY, retail sales growth eased slightly to 0.8% (Dec: +0.9%).

Slight improvement in UK post-Brexit manufacturing order book: The CBI Trends Total Order Index gained 4 pts to -18 in February (Jan: -22), reflecting slight improvement in UK factory order book after the country formally withdrew from the EU in January. The improved reading reflects smaller contraction in exports orders alongside higher expected output volume for the next three months.

Japan core inflation rose on higher gasoline prices: Japan headline CPI registered a 0.7% YOY reading in January (Dec: +0.8%), in line with expectations. The BOJ’s favoured gauge, the CPI ex fresh food (core CPI) rose 0.8% YOY (Dec: +0.7%), marking its fourth straight month of gain, thanks to higher cost of gasoline. Nonetheless, inflation remains well below the central bank’s 2% target and is unlikely picking up near the target level given that the ongoing ultra-loose easing program has proven to be ineffective in boosting prices.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- USDJPY: 112.00 (USD625mn)

- AUDUSD: 0.6680 (AUD475mn); 0.6700 (AUD364mn)

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.0820 Bullish above)

EURUSD From a technical and trading perspective, the failure to mount a meaningful assault on 1.0820 suggests that contrarian players will once again throw in the towel and we likely get a test of bids and stops below 1.0750. On the day only a sustained breach of 1.0850 would likely see some short covering in the near term

GBPUSD (Intraday bias: Bearish below 1.2920)

GBPUSD From a technical and trading perspective, prices back testing range support below 1.29 as 1.2950 caps upside attempts bears will now look to target 1.2830 as the next downside objective ahead of a more meaningful confluence target towards 1.27, only a close back through 1.30 would frustrate bears again and extend further range trading conditions

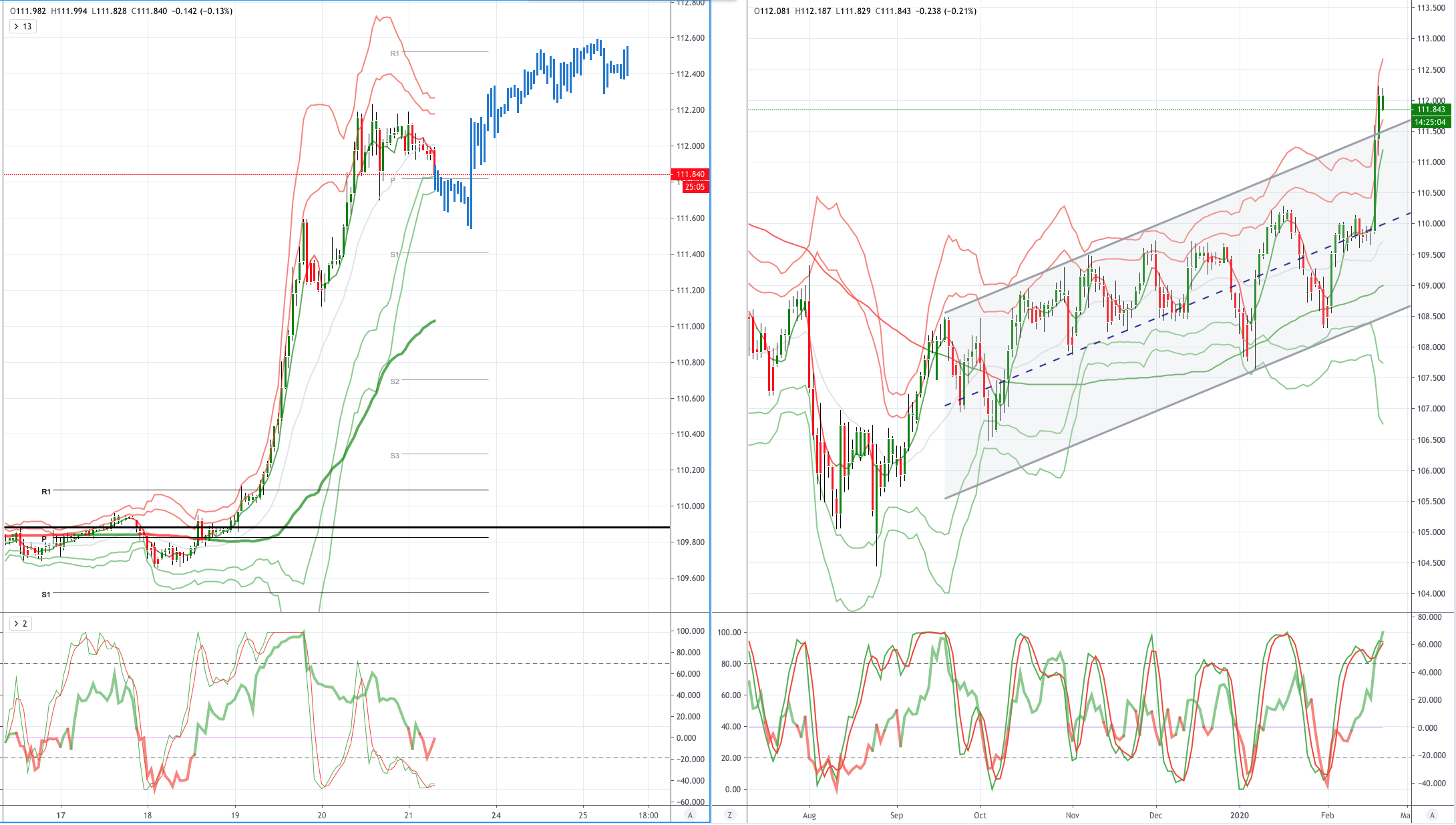

USDJPY (intraday bias: Bullish above 111.00 Bearish below)

USDJPY From a technical and trading perspective, test of offers and stops to 110.50 saw little to know resistance offered, yesterday's surge now targets a test of offers and stops above 112.50, would anticipate that this area will likely see profit taking emerge and the potentially for a correction to retest bids back towards 111.00

AUDUSD (Intraday bias: Bearish below .6640 Bullish above)

AUDUSD From a technical and trading perspective the equality target down to .6600 has been achieved, anticipate the potential for some profit taking around current levels, as .6570 supports we may witness an attempt to base here for a retest of offers back towards .6650

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!