Daily Market Outlook, February 19, 2020

There was a rebound in risk sentiment during the Asian trading session, the market cheered reports that China may bail out its airline industry badly hit by the coronavirus outbreak, and a broader sense that authorities will provide support for the economy.

The number of deaths in China exceeded 2,000, although the rate of increase in new cases in Hubei province, where the pandemic began, may be slowing.

US stocks broadly fell yesterday after equities in Europe and Asia generally closed lower earlier as concerns over the Covid-19 outbreak continued to dominate market sentiment. The Dow Jones Industrial Average lost 165pts of 0.6%, weighed down by falling Apple’s share price (-1.8%) after the phone maker’s downbeat revenue warning yesterday.

Bonds yields slipped lower by 2-3bps alongside higher gold prices as markets were risk-off; 10Y UST yield was seen dropping by 3bps to 1.56%. Gold prices gained 1.3% to breach $1600 mark at $1601.61/ounce while crude oils were little changed.

The USD regained momentum and outperformed nearly all currencies save for the JPY which was flat. US Treasury data showed that foreign purchase of US treasuries rose to $41.07bn in Dec, its highest level since Aug-18 following four consecutive months of selling. China’s holding of US treasuries declined for the sixth month to $1.07tn.

U.K. new Chancellor of Exchequer Rishi Sunak said that the government will keep the 11 March budget delivery date following the abrupt resignation of his predecessor Sajid Javid last week

US homebuilders’ sentiment remained strong: The NAHB Housing Market index slipped only by 1pt to 74 in February (Jan: 75) to indicate little change in the currently upbeat homebuilders’ sentiment. Details show that homebuilders’ view of current sales of single family units that makes up the largest part of the index remains quite steady (80 vs 81), supported by high buyers’ interest in a low rates environment.

New York manufacturing activity surged in Feb: The New York Fed Empire State Manufacturing Survey showed that its headline general business condition index jumped by 8pts to 12.9 in February (Jan: 4.8), its highest level since May last year, pointing to a strong comeback of the state’s manufacturing activity after months of lacklustre reading. The increase across sub-indexes was broad-based with new order, shipments and inventories each adding a whopping 16pts, 10pts and 14pts to help propel the headline reading.

German investors bearish on outlook: The German ZEW Economic Sentiment index for Germany dropped sharply to 8.7 in February (Jan: 26.7) and the same index for the broader Eurozone slid to 10.4 (from 25.6), reflecting poorer-than-expected investors’ sentiment amid the Covid-19 outbreak. ZEW President Professor Achim Wambach said that “The feared negative effects of the Coronavirus epidemic in China on world trade have been causing a considerable decline of the ZEW Indicator of Economic Sentiment for Germany”. The fall in both current situation and expectations subindexes indicate that economic development is “rather fragile” for now.

Wage growth waned in a strong UK job market: UK job data dump offers mixed signals of the labour market - Unemployment rate met expectation, coming in unchanged at 3.8% in the three months to December 2019, its lowest level since early 1975. The economy added 180k jobs in the same period (3 months to Nov: +208k) to a record high of 32.93 million, beating analysts’ estimate of 148k. However, wage growth as measured by the average weekly earnings missed forecast and slowed to increase 2.9% YOY (3 months to Nov:+3.2%), its first sub-3% growth in 2019 and the slowest pace since the three months to August 2018. Excluding bonuses, the less volatile gauge of wage growth also eased to 3.2% YOY (3months to Nov: +3.4%). Nonetheless, it appears that the labour market remains solid, lifting some pressure off the BOE to cut rate; we look towards today’s CPI for further guidance.

Japan exports fell in Jan; core machine orders plunged in Dec: Japan exports contracted at a slower pace of 2.6% YOY in January (Dec: -6.3%), beating analysts’ forecast of a 7.0% decline but nonetheless marked its 14th consecutive month of contraction amid weak global trade. Imports also saw a smaller drop of 3.6% YOY (Dec: -4.9%). Meanwhile, core machine orders, a key gauge of business investment slumped by 12.5% MOM in December (Nov: +18.0%) after a November surge. YOY, orders dropped 3.5% (Nov: +5.3%).

Australia Westpac Leading Index points to weak underlying momentum: The six-month annualised growth rate in the Westpac–Melbourne Institute Leading Index fell to -0.46% in January (Dec: -0.28%). Westpac said that the 14th straight month of sub-0% reading indicates that (growth) momentum will track well below trend and has been consistent with the persistent below trend growth of the Australian economy. The index points to weak underlying economic momentum extending into the first half of 2020.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0785 1.2bn

- GBPUSD: 1.3080 201m

- USDJPY: 109.85 491m 110.00 1.1bn

- AUDUSD: 0.6700 2.4bn 0.6740 522m 0.6750 890m

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.0840 Bullish above)

EURUSD From a technical and trading perspective, the sustained trade through 1.0850 will now have bears mounting a move to fill the French Election ‘GAP’ at 1.0778/1.021. Note the DXY is testing its Yearly first resistance pivot point, if this level holds there is a window for a recovery in the EUR, however, unless we close above 1.09 this will more likely prove a ‘dead cat’ bounce before the next leg lower. The grind lower continues while 1.0840 caps corrections no relief in sight and the GAP continues to act as a magnet for bears. Interestingly Implied vols which determine option premiums, costs haved spiked over recent sessions one month EURUSD implied vol new recent high at 4.85 up from record low 3.75 early February - 5.15 was early January peak markets eye a test, three month now 4.7 vs 4.1 record low early February, one year 5.4 vs 4.95, dealing desks are clearly concerned about increased volatility and a deeper EUR decline, risk reversals show implied vol premium for EUR puts over calls (downside).Huge 1.0785 vanilla expiry Wed - related bids may underpin prices

GBPUSD (Intraday bias: Bullish above 1.30 Bearish below)

GBPUSD From a technical and trading perspective, as 1.30 now acts as support look for a pivotal test of the descending trendline resistance sited at 1.31, a failure to find additional buyers here will likely result in another false break and lead to yet another retest of range support back down towards 1.29. Another false break appears to be playing out without an upside surprise in jobs data 1.2920 support likely to be tested next. Anticipated Jobs upside surprise spike proves short lived, range continues to contract, expect a sustained move on a breach of 1.31 or 1.2950

USDJPY (intraday bias: Bullish above 109.60 Bearish below)

USDJPY From a technical and trading perspective, the sustained grind higher continues, as 109.40 caps corrections look for a test of offers and stops to 110.50. Caution counselled as we test these levels with significant sentiment divergence likely to be addressed once again. The highlighted momentum and sentiment divergence is starting to weigh on prices 109.50 pivotal to the bullish case failure here will likely see an acceleration lower to test buds back to 109.00

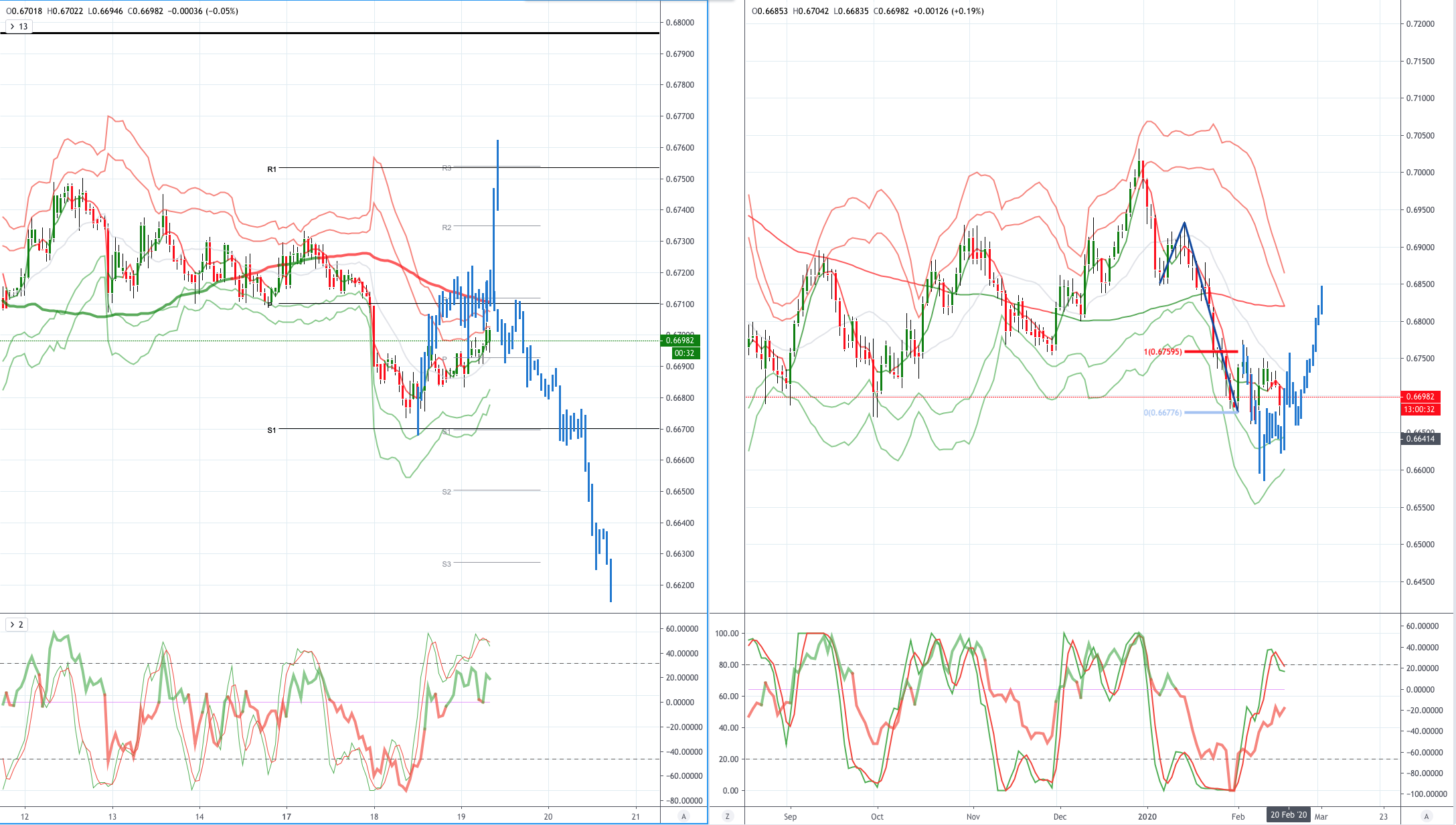

AUDUSD (Intraday bias: Bearish below .6710 Bullish above)

AUDUSD From a technical and trading perspective only sustained trading above .6740 would suggest minimum conditions for cycle completion have been met and as such another corrective phase is underway, a move through .6770 would encourage further short covering suggesting further upside corrective action. A failure below .6700 would suggest another failed upside attempt and open another test of bids towards .6670, a failure to find sufficient buying here opens a move to test the equality target down to .6600

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!