Daily Market Outlook, February 18, 2020

As a proxy for the wider macroeconomic impact, the market focused on an Apple statement which said that the company will miss its previous revenue guidance for Q1 as a result of the coronavirus outbreak. It said the resumption of production in China has been slower than anticipated, while demand has also been hit. Demand outside of China was said to be in line with expectations. Risk sentiment fell during the Asian trading session.

Most Asian equity indices fell during Asia trading, while the US 10-year Treasury declined to 1.54% and Brent crude oil fell below $57 a barrel. The Australian dollar also fell after RBA minutes revealed policy makers reviewed the case for further rate cuts. Sterling markets will focus most immediately on this morning’s UK labour market report. Last night, the UK’s chief Brexit negotiator, David Frost, insisted the UK will not accept EU rules as a condition for a future deal.

Yesterday, the PBOC cut its medium term loan (MLF) rate by 10bps, to 3.15%, and it is expected to follow this up with a 10bp cut to the 1-year loan prime rate on Thursday. The PBOC’s easing follows Finance Minister Liu Kun’s comments over the weekend that China would implement “targeted and phased” cuts to taxes and expenses for businesses. China’s CSI300 index rose 2.3% yesterday and it has now more-than-fully recovered from its 8% plunge after the market reopened after an extended Lunar New Year break.

UK house prices climbed further in Feb: The Rightmove House Price Index added another 0.8% MOM in February (Jan: +2.3%) as house prices climbed to a near-record high of £309,399 following a spike in January thanks to a significant lift in Brexit uncertainties. This left the annual index to record a gain of 2.9% YOY (Jan: 2.7%), reflecting a surge in buyers activity and interests compared to a year ago that’s fueling a recovery in the UK housing market.

Japan industrial production rebounded at year-end: Japan industrial production recovered to increase 1.2% MOM in December (Jan: -1.0%) after contracting for two straight months in 4Q as manufacturing activity was disrupted by typhoon at early October. This left the annual contraction to narrowed to 3.1% YOY (Nov: -8.2%); December marked industrial production’s third straight month of decline and the effect of the downturn alongside tax-hike related consumption weakness was reflected in the weaker-than-expected 4Q GDP print (-0.4% vs +1.7%) released earlier.

Japan is at risk of a technical recession, with the economy likely to be hampered by the COVID-19 outbreak this quarter. Tokyo has cancelled its annual marathon and Japan’s health minister asked the public to avoid crowds and “non-essential gatherings”, including commuter trains. BoJ Governor Kuroda labelled the virus the biggest uncertainty for the economy.

Today’s UK labour market report for the three months to December is likely to be mixed. Employment is forecast to have remained buoyant and, as a result, the unemployment rate is expected to stay at 3.8%. That suggests the labour market remains tight, but also that weak productivity growth remains an issue considering that output stagnated in Q4. Wage growth, however, is expected to edge down again.. January vacancies should also be watched for signs the market has picked up.

Although Eurozone GDP growth in Q4 was weak (0.1%QOQ), most business surveys at the start of the year appeared to signal scope for firmer activity, helped by lower trade tensions. The impact of the coronavirus outbreak, however, has added a new downside risk to the outlook. Markets expect today’s German ZEW survey to show a relatively modest fall in the economic expectations component to around 23.0 in February from 26.7.

The US will release the NY Fed Empire manufacturing and the NAHB housing surveys. On a similar theme to above, it will be interesting to see what impact the pandemic may be having on sentiment. The Empire survey, for example, had risen in the past two months.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: No major nearby expiries

- GBPUSD: No major nearby expiries

- USDJPY: No major nearby expiries

- AUDUSD: No major nearby expiries

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.0850 Bullish above)

EURUSD From a technical and trading perspective, the sustained trade through 1.0850 will now have bears mounting a move to fill the French Election ‘GAP’ at 1.0778/1.021. Note the DXY is testing its Yearly first resistance pivot point, if this level holds there is a window for a recovery in the EUR, however, unless we close above 1.09 this will more likely prove a ‘dead cat’ bounce before the next leg lower. The grind lower continues while 1.0840 caps corrections no relief in sight and the GAP continues to act as a magnet for bears

GBPUSD (Intraday bias: Bullish above 1.30 Bearish below)

GBPUSD From a technical and trading perspective, as 1.30 now acts as support look for a pivotal test of the descending trendline resistance sited at 1.31, a failure to find additional buyers here will likely result in another false break and lead to yet another retest of range support back down towards 1.29. Another false break appears to be playing out without an upside surprise in jobs data 1.2920 support likely to be tested next

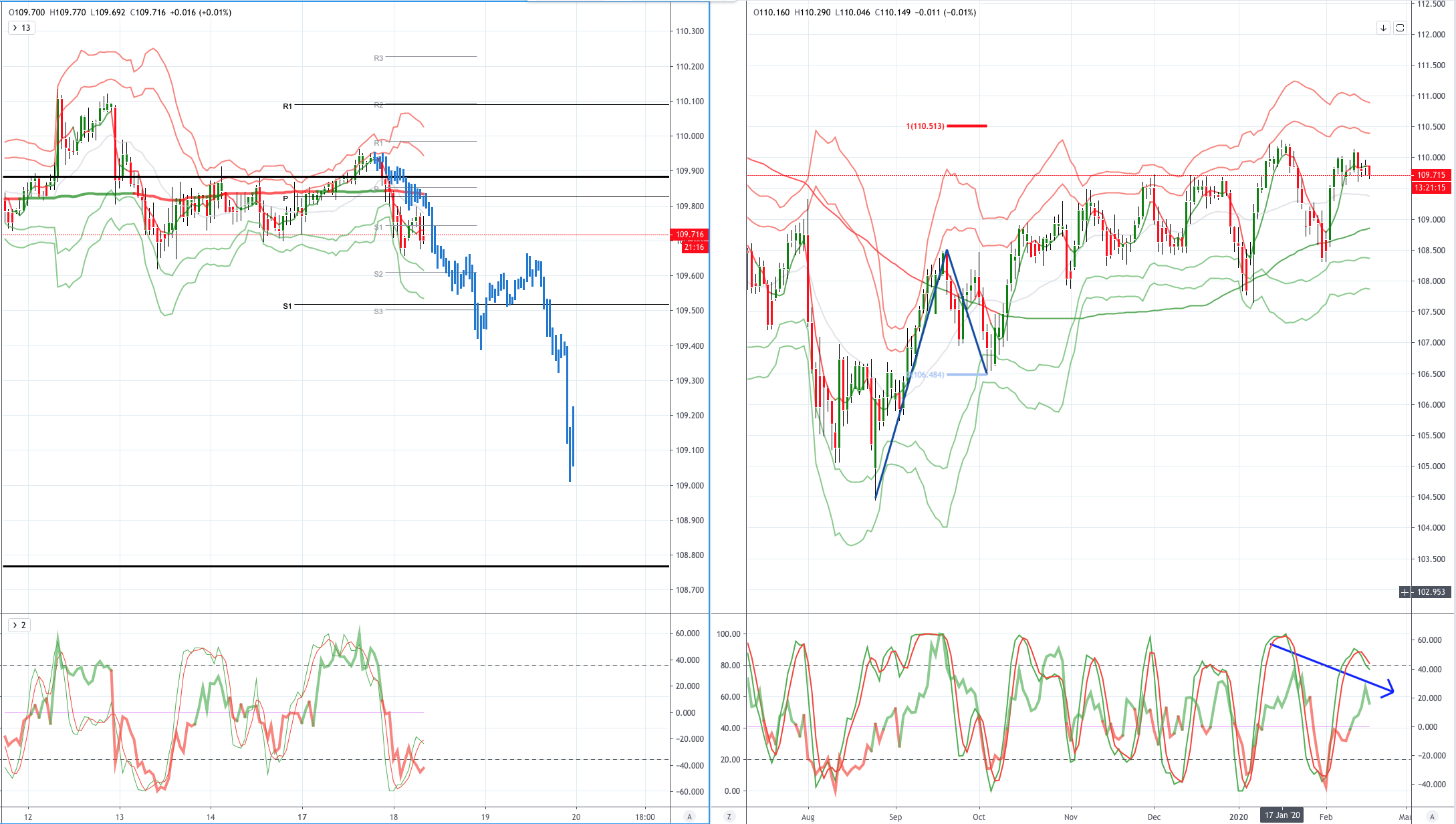

USDJPY (intraday bias: Bullish above 109.60 Bearish below)

USDJPY From a technical and trading perspective, the sustained grind higher continues, as 109.40 caps corrections look for a test of offers and stops to 110.50. Caution counselled as we test these levels with significant sentiment divergence likely to be addressed once again. The highlighted momentum and sentiment divergence is starting to weigh on prices 109.50 pivotal to the bullish case failure here will likely see an acceleration lower to test buds back to 109.00

AUDUSD (Intraday bias: Bearish below .6740 Bullish above)

AUDUSD From a technical and trading perspective only sustained trading above .6740 would suggest minimum conditions for cycle completion have been met and as such another corrective phase is underway, a move through .6770 would encourage further short covering suggesting further upside corrective action. A failure below .6700 would suggest another failed upside attempt and open another test of bids towards .6670, a failure to find sufficient buying here opens a move to test the equality target down to .6600

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!