Daily Market Outlook, February 17, 2020

The US market broadly gained on Friday and closed the week at record highs despite growing uncertainties over the coronavirus outbreak in China and the potential impact it could bring about on the global economy.

Earlier on Friday, European equities ended on the down side while Asian shares were mixed. The Dow Jones was little changed while the S&P500 and NASDAQ picked up around 0.2% after hitting all-time highs in a streak last week.

Risk aversion lingered in the market ahead of the weekend as US bond yields slipped further by around 2-3bps while gold prices added another 0.5% to $1,584.06/ounce. Crude oil continued to gain by 1.2-1.7% on ongoing expectations of more output cut. US stock market is closed today for President’s Day

Yesterday, China reported a fall in the number of new COVID-19 cases for the third consecutive day, which should provide a bid to risk assets to start the week. However, trading activity is likely to be lower than usual with the US out for Presidents Day.

The COVID-19 outbreak remains the market’s main focus. Yesterday, China reported 2,009 new cases, bringing the total on the mainland to 68,500. Encouragingly, yesterday was the third consecutive day with a lower number of new cases (using the new methodology), which may boost market confidence that the outbreak is starting to come under control.Risk assets open higher to start the week. The death toll in China stood at 1,665 on Sunday.While the rate of change of new COVID-19 cases appears to be declining, many protective measures to stop the spread of the virus remain in place, so the economic fallout will be meaningful, at least on a short-term basis.

A Reuters’ poll on Friday showed that Q1 Chinese GDP was expected to slow to 4.5%, down from 5.9% in Q4, before recovering to 5.7% in Q2. To cushion the impact on the economy, China is expected to add more fiscal stimulus, with Finance Minister Liu Kun writing over the weekend that the government would implement “targeted and phased” cuts to taxes and expenses for businesses.

The investment community, as seen through the CFTC data, have also continued to move against the EUR. Non-commercial accounts moved deeper into an implied long USD position, with much of the gain seen against the EUR. Leveraged accounts and asset managers are largely unchanged in terms of their implied USD positions.

US retail sales rose in January; consumer sentiment turned higher: US retail sales picked up 0.3% MOM in January (Dec: +0.2%), its largest gain since October last year following a lacklustre holiday season thanks to an increase in sales of motor vehicles, furniture, building materials as well as higher online sales. The so-called retail sales for control group, a gauge of core consumer spending meanwhile was flat (Dec: +0.2%), reflecting moderate spending among Americans at the start of the year. Consumer sentiment however appears to be upbeat as evident in the University of Michigan Consumer Sentiment Index that rose to 100.9 in February (Jan: 99.8). Interestingly, the personal finances and evaluations of the national economy each posted large gains, while consumers' views on buying conditions for household durables saw a significant loss. Respondents also pointed out uncertainties surrounding the coronavirus outbreak and the presidential election this year.

US Industrial output fell in January: Federal Reserve data show that industrial production slipped for the second consecutive month by 0.3% MOM in January (Dec: -0.4%) while January data was revised lower to a 0.4% contraction. The fall in output reflects a 0.1% and 0.4% MOM drop in manufacturing and utilities respectively. Boeing halted production of its 737 Max model due to regulatory reasons, weighing down overall manufacturing output. Utilities meanwhile have been falling for the second month thanks to a warmer US weather.

Low imported inflation in US: Import price index was unchanged in January (Dec: +0.3%), leaving the annual pace of growth to moderate to 0.3% YOY (Dec: +0.5%), adding to signs of lower imported inflation. Imported inflation is likely to moderate further in February amidst stronger US dollar.

Eurozone 4Q GDP moderated; trade balance widened: The second estimate of Eurozone GDP growth for 4Q19 was unrevised at 0.1% QOQ (3Q: +0.3%), a large moderation form Q3. YOY, GDP grew 0.9% (3Q: +1.2%), its slowest since Q413, leaving the full-year 2019 GDP growth at a modest 1.2% (2018: +1.9%). The German economy stagnated in 4Q, recording no gain (3Q: +0.2%) compared to the previous quarter while its YOY growth eased to 0.5% YOY (+0.6%). In the same release, employment was reported to have increased by 0.3% QOQ (3Q: +0.1%) and a steady 1.0% YOY (3Q: +1.0%). On a separate note, the Euro area trade surplus widened to €22.2b in December (Nov: €19.2b) thanks to a 0.9% MOM increase in exports and 0.7% MOM fall in imports.

Japan economy took a huge blow in 4Q: Preliminary reading released this morning shows that Japan 4Q GDP contracted by a whopping 1.6% QOQ (3Q:+0.4%), larger than analysts’ expectation of a 1.0% QOQ decline. The contraction reflects a large negative contribution from domestic demand (- 2.1ppt), residential investment and investment as economic activitiy was disrupted by an October typhoon while the higher sales tax imposed in the same month temporarily dragged down consumer consumption. Net exports added 0.5ppts to overall headline growth. YOY, GDP slipped by 0.4% (3Q: +1.7%), leaving the full-year GDP growth at 0.8% (2018: 0.3%).

The calendar is relatively light on Eurozone and US data, save for German ZEW (Tue) and Feb preliminary PMIs (Fri). We will however, also keep an eye on AU jobs and wages data (Thu). A heavy schedule of central bank releases though, with minutes of the latest RBA, FOMC and ECB meetings on tap (Tue through Thu), and a heavy line-up of appearances interspersed throughout the week.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0950 (EUR697mn)

- GBPUSD: No major nearby expiries

- USDJPY: No major nearby expiries

- AUDUSD: 0.6815 (AUD671mn)

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.0860 Bullish above)

EURUSD From a technical and trading perspective, the sustained trade through 1.0850 will now have bears mounting a move to fill the French Election ‘GAP’ at 1.0778/1.021. Note the DXY is testing its Yearly first resistance pivot point, if this level holds there is a window for a recovery in the EUR, however, unless we close above 1.09 this will more likely prove a ‘dead cat’ bounce before the next leg lower

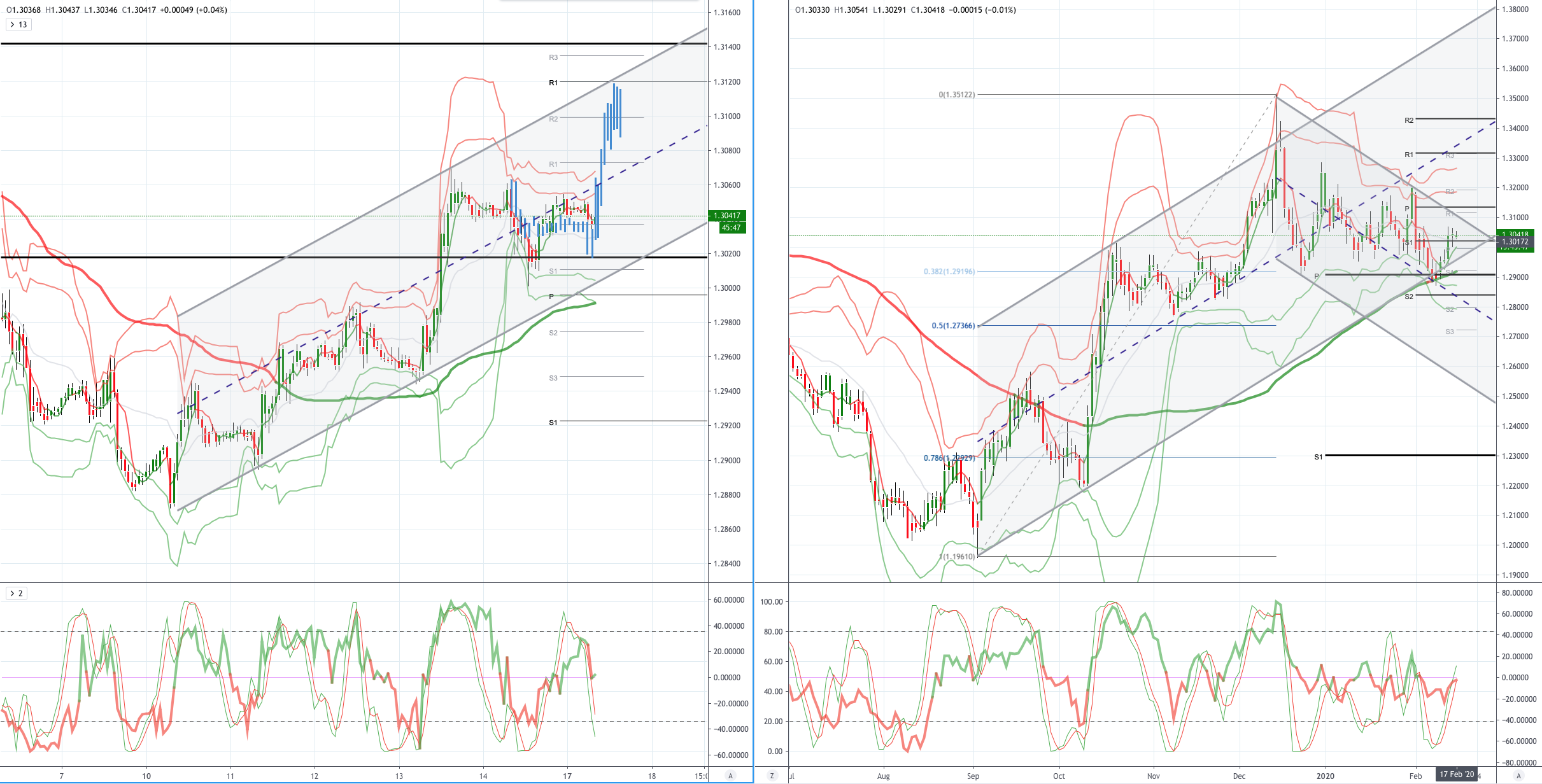

GBPUSD (Intraday bias: Bullish above 1.30 Bearish below)

GBPUSD From a technical and trading perspective, as 1.30 now acts as support look for a pivotal test of the descending trendline resistance sited at 1.31, a failure to find additional buyers here will likely result in another false break and lead to yet another retest of range support back down towards 1.29. Sustained trade through the descending trendline should open a quick test of offers and stops to 1.32

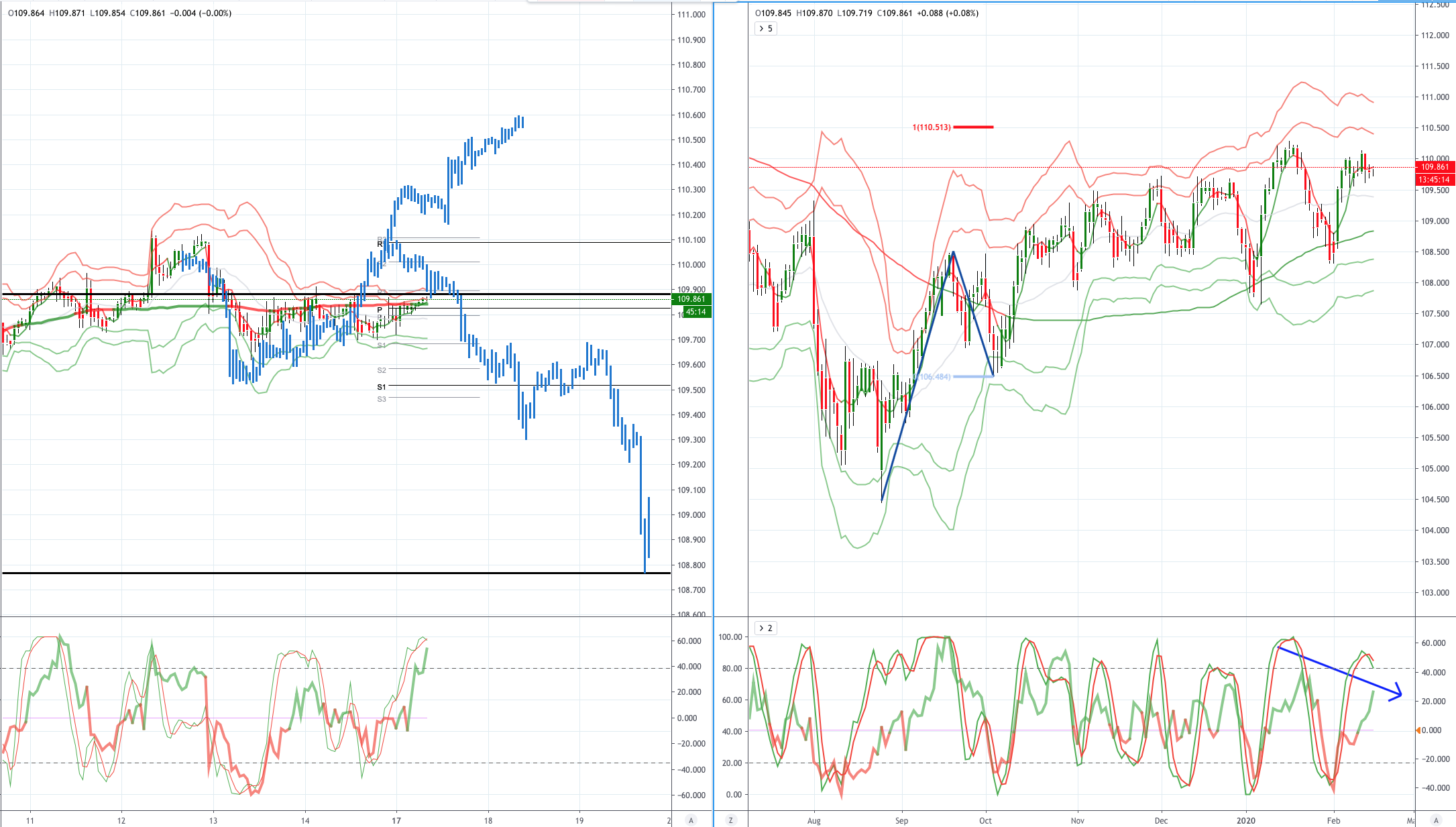

USDJPY (intraday bias: Bullish above 109.60 Bearish below)

USDJPY From a technical and trading perspective, the sustained grind higher continues, as 109.40 caps corrections look for a test of offers and stops to 110.50. Caution counselled as we test these levels with significant sentiment divergence likely to be addressed once again

AUDUSD (Intraday bias: Bearish below .6740 Bullish above)

AUDUSD From a technical and trading perspective only sustained trading above .6740 would suggest minimum conditions for cycle completion have been met and as such another corrective phase is underway, a move through .6770 would encourage further short covering suggesting further upside corrective action. A failure below .6700 would suggest another failed upside attempt and open another test of bids towards .6670, a failure to find sufficient buying here opens a move to test the equality target down to .6600

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!