Daily Market Outlook, February 10, 2020

Continued concerns over the global impact of the coronavirus have seen the Asian equity market, outside of China, start the week lower. However, reports that a number of major manufacturers, including Sony and Apple, have been given the green light by Chinese authorities to resume production has been met with a positive reaction in China.

Saturday’s general election in Ireland saw support for the Sinn Fein party surge, raising the prospect of the nationalists featuring in coalition talks.

Despite further rises in coronavirus cases and deaths, market sentiment remained relative upbeat last week. However, it is likely that the outbreak will weigh on China’s economic growth this year, but the extent of the impact will depend in part on when the disease can be contained. S&P lowered its 2020 growth forecast for China to 5% from 5.7%, based on an assumption the virus is contained by March. Such a downgrade, if broadly correct, would represent a temporary reduction in Chinese growth and relatively limited worldwide economic impact – as was the case during the SARS outbreak back in 2003. It’s still too early for the effect to be clearly visible in the economic statistics.

Policymakers are obviously keeping a close watch on developments and the extent to which spill over effects are seen affecting the US economy will likely be a key topic of discussion when Federal Reserve Chairman Jerome Powell delivers his semi-annual testimonies to Congress later this week. Ahead of that, however, fellow Fed members Daly, Bowman and Harker are due to speak at various events today, of which the last two are voting members of the Fed’s rate-setting committee. In recent speeches both have expressed satisfaction with the current monetary policy setting, noting that the economy was in a good place, a view that is likely to have been strengthened by Friday’s strong January payrolls report.

Based on CFTC data, the investment community is seen moving back to the USD on the growth concerns and risk-off dynamics. Noncommercial accounts rebuild implied USD longs, from an approximately neutral position, especially against the AUD and EUR. Long term asset managers also cut their implied USD shorts.

Following Friday’s strong US payrolls report, the USD has been on the front foot. Most notably, GBPUSD has dropped below 1.29, while EURUSD has continued to hover just below 1.10. Today’s limited data and events calendar will provide little direction for markets ahead of Fed Chairman Powell’s testimonies to Congress tomorrow and Wednesday. In particular, markets will be watching for any concerns expressed by Mr Powell over the impact of the coronavirus on US economic growth and the weakness of US inflation

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0950 (EUR578mn); 1.1000 (EUR301mn); 1.1062 (EUR452mn)

- GBPUSD: 1.2700 (GBP809mn); 1.2900 (GBP377mn)

- USDJPY: 108.50 (USD1.1bn); 109.50 (USD608mn); 109.70 (USD300mn)

- AUDUSD: 0.6585 (AUD726mn); 0.6625 (AUD1.4bn); 0.6750 (AUD919mn)

Technical & Trade Views

EURUSD (Intraday bias: Bearish below 1.0990)

EURUSD From a technical and trading perspective, 1.0950/30 pivotal support, below here look for a quick move to test 1.09 bids & stops below. Only a daily close above 1.1030 would frustrate bears and suggest yet another false break

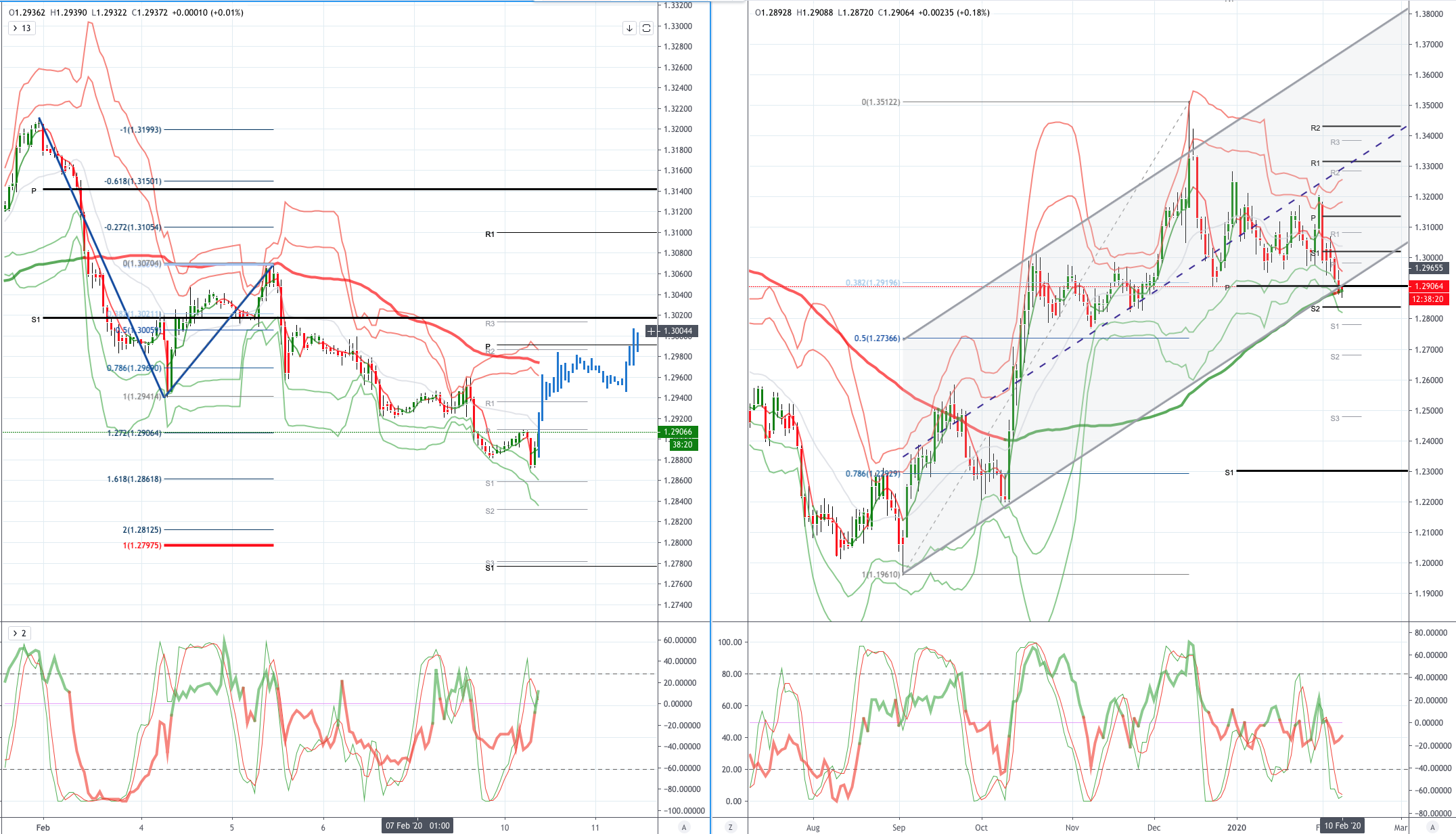

GBPUSD (Intraday bias: Bearish below 1.2970)

GBPUSD From a technical and trading perspective, anticipated test of the yearly pivot underway, the closing breach of this level opens a test of bids towards 1.28 and stops below. On the day only a close back through 1.2970 would confirm further range trade

USDJPY (intraday bias: Bullish above 109.60)

USDJPY From a technical and trading perspective, the sustained grind higher continues, as 109.20 caps corrections look for a test of offers and stops to 110.50. Caution counselled as we test these levels with significant sentiment divergence likely to be addressed once again

AUDUSD (Intraday bias: Bearish below .6720)

AUDUSD From a technical and trading perspective, as anticipated lows vulnerable for retest, beyond here look for a move to test price projection at .6600. On the day only a close above .6720 would suggest minimum conditions for cycle completion have been met and another corrective phase would ensue

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!