Daily Market Outlook, December 13, 2021

Daily Market Outlook, December 13, 2021

Overnight Headlines

- Fed Hikes Seen Starting As Yield Curve Flattest In Generation

- Biden Warns Russia Of Economic Penalty If Ukraine Attacked

- Senate Democrats Brace For Build Back Better Delay To 2022

- Covid-19 Cases Increase In Many US States Post Thanksgiving

- Bank Of Canada To Show New Inflation Mandate On Monday

- China Seen Adding Fiscal Stimulus Soon After Show Priorities

- ECB’s Guindos Tests Positive For Covid Before Policy Meeting

- UK PM Warns Of Covid Emergency, Sets New Booster Target

- UK Offer Concession Over Northern Ireland Trading Relations

- Germany Scholz Seeks To Ensure Gas Flows Through Ukraine

- Greece Plans To Make Push For ECB To Keep Buying Its Bonds

- Israeli Study Finds Pfizer Booster Protects Vs Omicron Variant

The Day Ahead

- Asian equity markets are down this morning as risk sentiment turns more cautious. Reports suggest that China’s key annual conference for officials to discuss the economy will be primarily focused on supporting economic growth. That contrasts to the situation in the US and some other countries where the focus is increasingly turning to concerns about higher inflation. A vote on the latest Covid restrictions will be held in the House of Commons on Tuesday. Reports suggest that many Conservative MPs may either abstain or vote against the measures possibly causing the government to rely on opposition support.

- Just released UK GDP data showed a lower-than-expected monthly rise of just 0.1% for October. That belies indications from business surveys that growth had picked up heading into Q4. Services output grew by 0.4% on the month but industrial production fell by 0.6% and construction output by 1.8%, possibly reflecting the ongoing impact of supply constraints. The data will probably lead to some downgrade of Q4 GDP expectations and possibly also for Q1 given the recent evidence of the new Covid variant, which has prompted a tightening in some restrictions.

- Also of interest in the UK today will be the latest Bank of England inflation attitudes survey. The BoE’s forecast that inflation will fall sharply through the second half of next year (after peaking in Q2) is partly predicated on inflation expectations remaining low and so this survey will be watched for whether expectations of future price rises remain well anchored.

- In the US, for today’s November CPI report look for a rise from 6.2%y/y in October to 6.7%, which would make it the highest since 1982. Meanwhile, core inflation, excluding food and energy, is expected to rise from 4.6% to 4.8%. Also of interest will be how widespread is the rise in prices. For most of this year, the bulk of the increase in inflation has been from commodity prices and goods affected by supply chain disruptions. However last month’s report indicated that price rises may be broadening to services, adding pressure on policymakers to rein back monetary support.

- The December University of Michigan consumer sentiment survey will provide evidence on US households’ reaction to the latest news including the ongoing rise in inflation and Omicron. Sentiment slipped sharply last month to its lowest level in more than a decade reflecting rising concerns about both current conditions and the future. The survey also includes questions about inflation expectations. Unsurprisingly short-term expectations have moved up sharply this year, but longer-term expectations have been more stable. The Federal Reserve is likely to be particularly interested in whether that is still the case in December.

CFTC Data

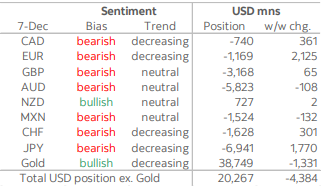

IMM data for the week through December 7th show speculative investors remain reluctant to extend aggregate long USD positioning much beyond recent peaks. This week’s data reflected an overall decline of USD 4.4bn in the netted long USD exposure against all the major currencies we monitor in this report. The aggregated net USD long stands at USD20.3bn, keeping USD bullish sentiment firm but hardly excessive.

The latest week’s data reflected a broad reduction is speculative shorts against a range of currencies, possibly reflecting investor concerns about the evolution of the Omicron variant. The largest decline came in the net EUR short position that had accumulated recently; investors slashed this position USD2.2bn in the week to USD1.2bn. The second largest position reduction was in the JPY where investors have maintained a large net short since March of last year; net JPY short covering of USD1.8bn continued a trend of JPY risk reduction evident since late October and takes the net short back to levels prevailing in late September. Interestingly, our research suggests that both the EUR and JPY are the most positively correlated major currencies with the VIX now (i.e., they are the prime refuge currencies for investors in times of heightened vol).

Positioning changes elsewhere were more muted. Net CAD shorts were cut USD361mn and net CHF shorts were trimmed just over USD300mn. CAD positioning/sentiment still leans modestly negative but there is little real conviction evident in these data. Investors added slightly to net AUD shorts over the week (up USD108mn) but added ever so marginally to net NZD longs. Net MXN positioning was little changed. Beyond the major currencies, net gold longs were cut USD1.3bn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1250 (1.0BLN), 1.1290-1.1300 (820M), 1.1320-25 (680M)

1.13-50-60 (530M), 1.1375-85 (1.75BLN)

USD/JPY: 112.50-55 (302M), 113.10-20 (1.2BLN), 113.50-60 (555M)

113.95-00 (780M), 114.25 (1.145BLN)

USD/CHF: 0.9140-45 (380M), 0.9250 (400M), 0.9340-50 (340M)

GBP/USD: 1.3200 (860M), 1.3225 (229M), 1.3250 (588M), 1.3300 (263M)

EUR/GBP: 0.8540 (200M). NZD/USD: 0.6925 (251M)

AUD/USD: 0.6900 (1BLN), 0.7000 (580M), 0.7100-05 (880M), 0.7115 (412M)

0.7185 (306M)

AUD/NZD: 1.0275 (330M), 1.0375 (400M), 1.0400 (330M). AUD/JPY: 78.10 (250M)

USD/CAD: 1.2615 (320M), 1.2740-45 (650M), 1.2800 (303M),1.2850 (714M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- EUR sags in Asia, dovish ECB later this week to blame?

- EUR tad heavy in Asia into a week jam-packed with central bank meetings

- Russia-Ukraine tensions and Omicron spread also concerns

- EUR/USD 1.1319 early to 1.1293 EBS, back below 1.1301-10 hourly Ichi cloud

- Through 1.1297 100-HMA, flat Ichi kijun just below at 1.1295 too

- Trading light, inside day, range Friday 1.1266-1.1319

- Large option expiries both sides - 1.1250 E1.4 bln, 1.1320 E2 bln

- EUR/JPY 128.44 early Asia to 128.26, EUR/GBP 0.8525-34, also tad heavy

- EUR/CHF indicated 1.0415-23

- DTCC traded FX option data shows massive nearby strikes expiring Monday

- Related delta hedging helps contain, adds to support and resistance

- 1.5-billion euros 1.1250, 1.1-billion 1.1270-1.1300, 2-billion 1.1320

- Option implied volatility supported ahead of key cen-bank meetings

- Shows market wary of post cen-bank volatility, despite being quiet ahead

- 1-month risk reversals have erased long term downside premium

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Softer on Omicron growth, as BoE hike fears fade

- -0.15% in a 1.3234-1.3260 range with only occasional interest

- Opened lower on UK's PM warns of Omicron 'tidal wave'...

- COVID alert level raised from 3 to 4... – vote on 'Plan B' Tuesday

- BOE WATCH closed with no rate change Thursday at 75.5% - likely higher today

- Charts; 5, 10 & 21 day moving averages, 21 day Bollinger bands head lower

- Bearish setup targets a break of 1.3166, 38.2% of the 2020-2021 rise

- Close above 1.3328 falling 21 day moving average needed to end downtrend

- Earlier 1.3234 Asian low and 1.3276 NY high are initial support, resistance

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY propped by solid daily cloud support this month

- Thick daily cloud, that spans the 111.90-113.26 region, underpins

- Daily cloud support has limited the downside throughout December so far

- That increases scope for further gains to challenge kijun line at 114.03

- A break and daily close above will accelerate further up to the 114.38 Fibo

- 114.38 Fibo is a 61.8% retrace of the 115.52 to 112.54 November drop

- EUR/JPY has seen a 128.15-128.44 range, according to EBS price data

AUDUSD Bias: Bearish below 0.7250 Bullish above

- Offered despite upbeat risk appetite, as USD firms

- -0.05% with safe haven USD a touch firmer, despite E-Mini S&P +0.4%

- Regional stocks are bid, commodities higher and UST yields steady

- Omicron cases rise, but vaccination levels high as borders open

- Economic outlook optimistic, as booster shots rolled out

- Charts; daily momentum studies flat line, 21 day Bollinger bands contract

- 5, 10 & 21 day moving averages conflict - neutral setup, but downtrend holds

- Sustained 0.7175 21 DMA & 0.7208, 38.2% Oct-Dec fall break would be bullish

- Close below 0.7116 10 day moving average would bring downtrend back in play

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!