Daily Market Outlook, August 26, 2022

Daily Market Outlook, August 26, 2022

Overnight Headlines

- Jackson Hole Symposium Likely To Underline Current Fed Strategy

- Fed's Bullard: Inflation Likely To Be More Persistent Than Expected

- Fed's Harker: Would Like To Get Rates Above 3.4% And 'Sit For A While'

- Fed’s George Says It Has To Get Rates Higher To Slow Down Demand

- Decision To End ECB Reinvestments Takes Back Seat To Rate Hikes - RTRS

- US And China Close To Deal Resolving Impasse Over Audit Inspections

- China Greenlights $70bn-Plus In Infrastructure Bonds To Lift Economy

- China Newspaper Sees GDP Gain From Extra Infrastructure Stimulus

- Tokyo Aug Core Consumer Prices Rise At Fastest Pace In Nearly 8 Years

- Hottest Tokyo Prices Since 1992 Ramp Up Heat On BoJ Messaging

- RBNZ’s Orr Sees Central Banks Needing To Push Toward Zero Growth

- Oil Set For Weekly Gain On Tighter Supply Before Powell Speech

- Aus Stocks Lead Gains In Asia Ahead Of Powell’s Jackson Hole Speech

- China's A Shares Are Still Resilient Despite Recent Fall - Daily

- Dell Revenue Growth Slows On Strong Dollar, China Lockdowns

- Bridgewater Sees Stocks, Bonds Dropping Up To 25% On Fed QT

The Day Ahead

- An announcement has just been made on Ofgem’s energy price cap which is set to rise to £3,549 from £1,971 on 1st October. With wholesale gas prices still rising further increases are being forecast for early 2023 with some predicting the price cap could move above £5,000 by April. Reports suggest that the Conservative Party leadership candidates are discussing possible support measures for both households and businesses. Some reports say that a package could be announced in the second week of September soon after the new UK PM is confirmed. Meanwhile, the latest German consumer confidence measure fell to a record low on the back of higher energy prices.

- Today’s US Federal Reserve policy symposium has been eagerly awaited by markets. The event is primarily an opportunity for central bank policymakers to meet with economists and discuss a key topic of the day. This week’s theme is “Reassessing constraints on the economy & policy”. Typically, of most immediate wider interest are the comments of Fed Chair Powell who is scheduled to speak at 3pm BST. Last year, Fed Chair Powell said that inflationary pressures were temporary - a comment that he later had cause to regret. This time markets will be looking for signals on the size of the probable US rate hike in September, indications of whether he thinks inflation has now peaked and what evidence he and his colleagues will want to see before ending monetary tightening. The likelihood is that his message will be hawkish, highlighting that not only do they want to see a fall in headline inflation but are equally focused on whether domestic inflationary pressures - such as the tight labour market – have settled.

- Today’s data calendar outside the US is light with nothing of note in the UK. In the Eurozone, July M3 money supply data will be watched for any signs of the effects of the recent pivot in monetary policy. In the US, the Fed’s preferred inflation measure (the personal consumption expenditure deflator) is expected to confirm the message from the CPI data that inflation fell modestly in July but is still well above target. Consumer spending is expected to have risen modestly in July, while the trade deficit in goods is forecast to be little different from June.

- Citi month-end FX model points to EUR buying and JPY selling

- Fixed income indices have seen renewed losses in August while equities have shown mixed performance, the bank says, where the MSCI US equity index is broadly unchanged in the month, but European equities are down and Japanese equities up.

- "The signals to buy EUR and sell JPY are driven by respective under and outperformance of local assets," Citi said, adding that "fixed income hedge rebalancing needs explain about 80% of the signal, which is unusual by historic standards."

- Citi says that its real money clients have been modest net buyers of JPY in recent days, suggesting no early rebalancing on the JPY sell signal.

- Flows into EUR have been positive, on the margin, in line with the model's signal - Source: CT News

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9850 (536M), 1.0000-10 (2.0BLN), 1.0050-55 (1.08BLN), 1.0150 (1.75BLN)

- USD/JPY: 135.00 (360M), 137.00-10 (1.3BLN)

- USD/CHF: 0.9755 (250M)

- USD/CAD: 1.2870 (226M), 1.2875-85 (524M), 1.2900 (210M), 1.3000 (350M)

Technical & Trade Views

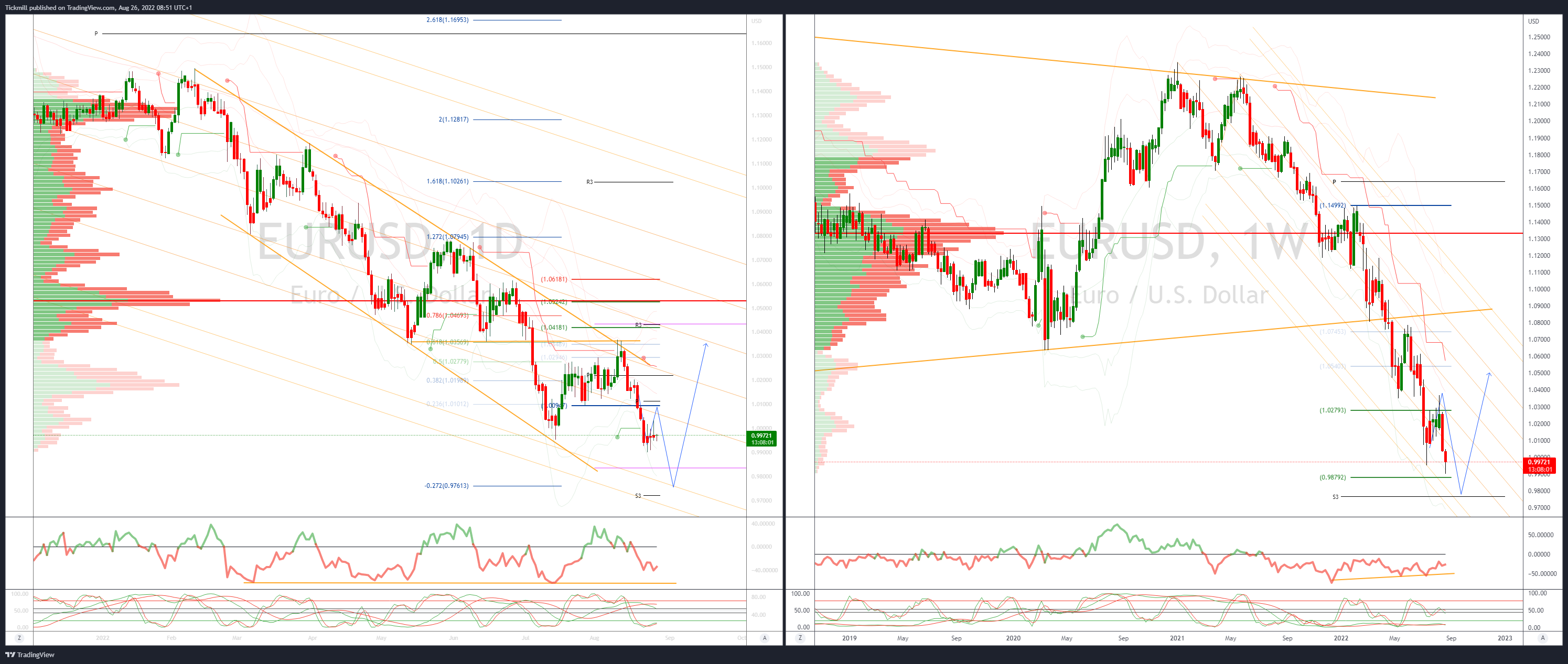

EURUSD Bias: Bearish below 1.0250

- Consolidation within 3 Day range ahead of Jackson Hole

- Today's event risk is FED Chair Powell Speech 3pm BST

- Close above 1.02 needed to end downside bias

- More than €2bn of 0.9850 put strikes due this Friday

- Monthly and weekly projected range support sited at 9830/50

- 20 Day VWAP bearish, 5 Day bearish

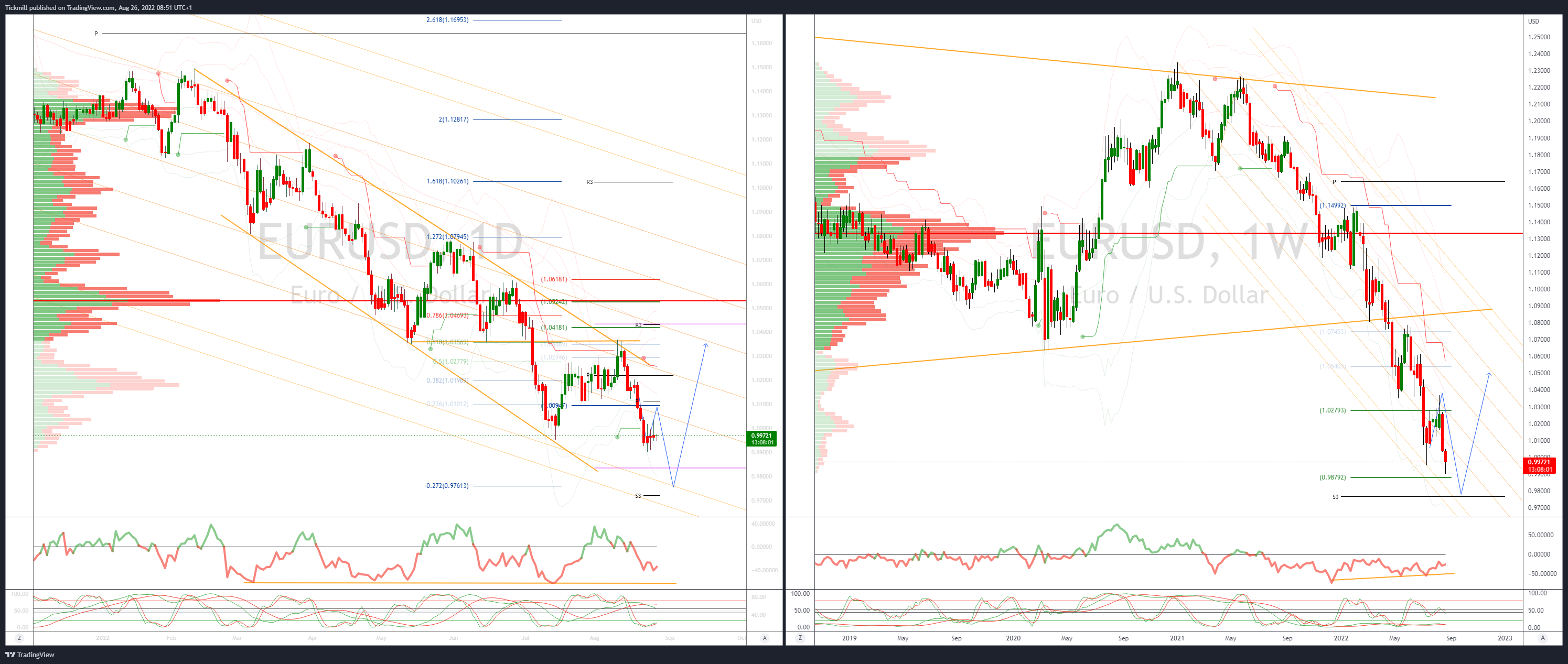

GBPUSD Bias: Bearish below 1.2050

- Bounce short lived and reversing into LDN – trend is lower below 1.2050

- No domestic event risk today, all eyes on Jackson Hole

- Close above 1.2050 needed to relieve downside pressure

- Supported sited at 1.17 ahead of weekly projected range support at 1.16

- 20 Day VWAP is bearish, 5 Day bearish

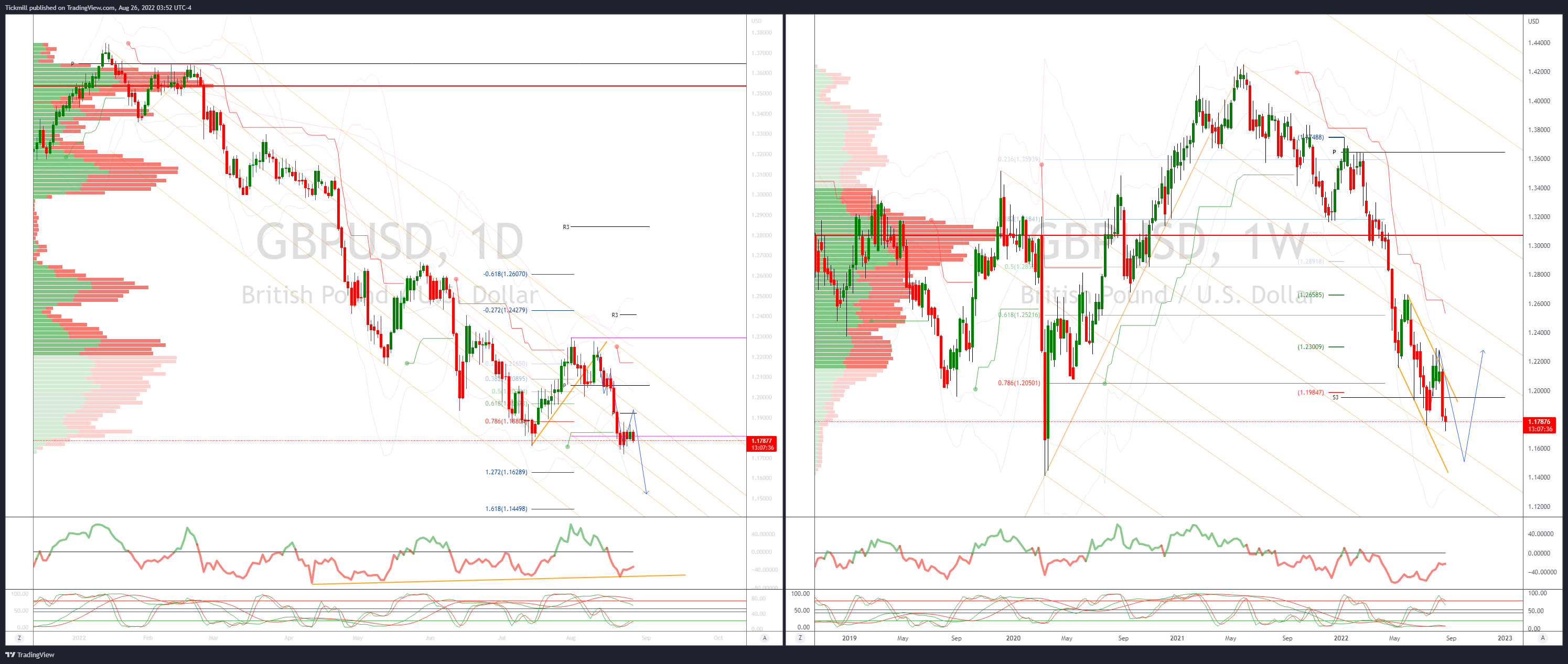

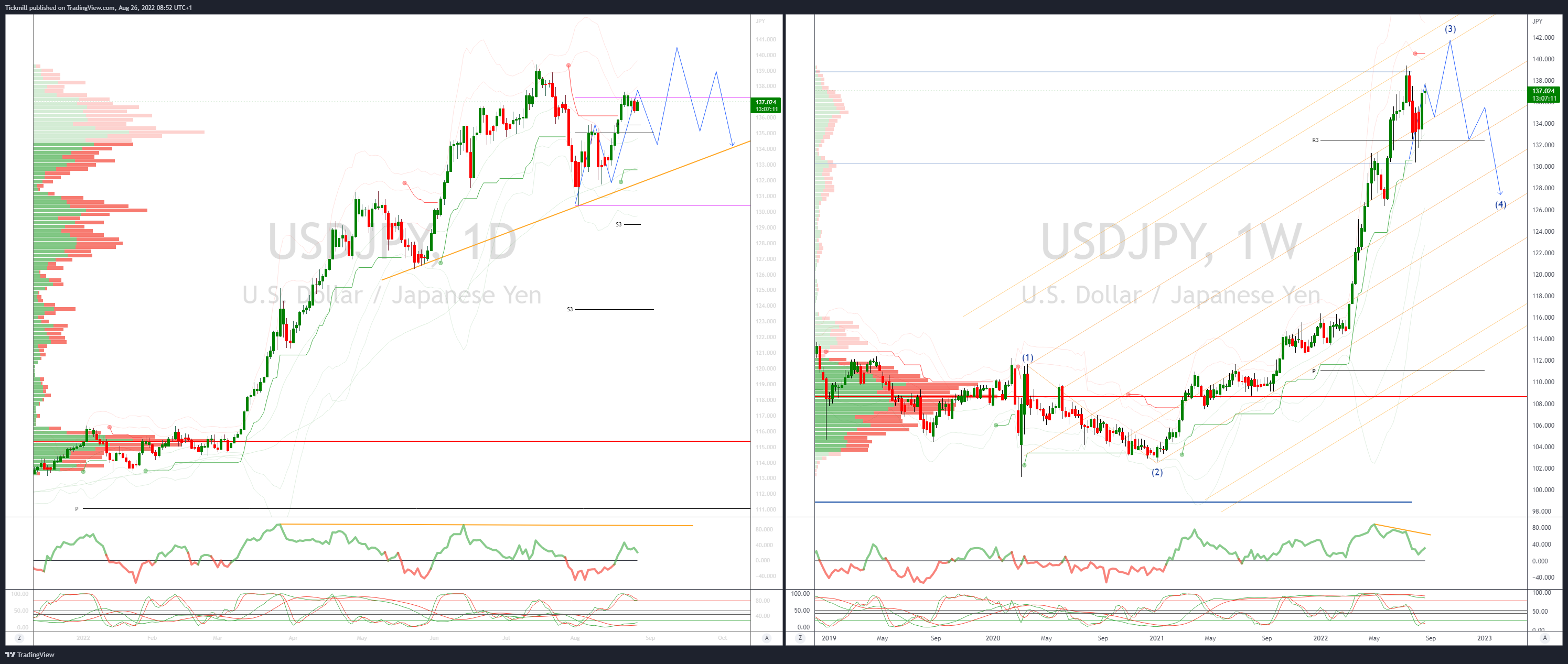

USDJPY Bias: Bullish above 133.40

- USDJPY bid and set to retest projected range resistance 137.50

- Retail traders squaring books ahead of Jackson Hole event risk

- Japanese importers and retail will be looking to buy the dips, likely close to 135.60

- Dealers expect more chop ahead of more US data, Fed Jackson Hold meet

- 20 Day VWAP is bullish, 5 Day bullish

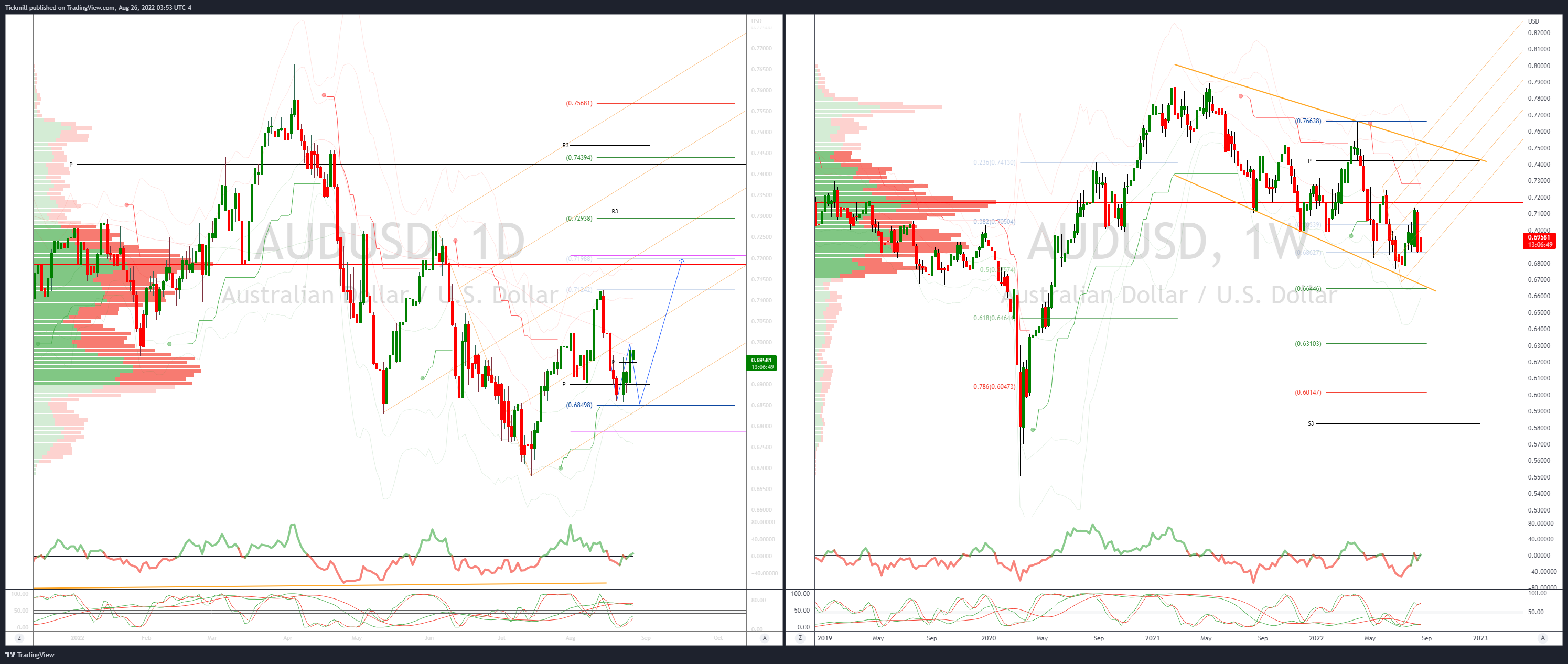

AUDUSD Bias: Bearish below .71

- Consolidating yesterday's gains

- Further support from buoyant risk sentiment, caution ahead of Powell speech

- Resistance is at 0.7010

- Testing 20 Day VWAP from below

- A break below 0.6850 would open the way to the trend low at 0.6682

- 20 Day VWAP is bearish, 5 Day bullish

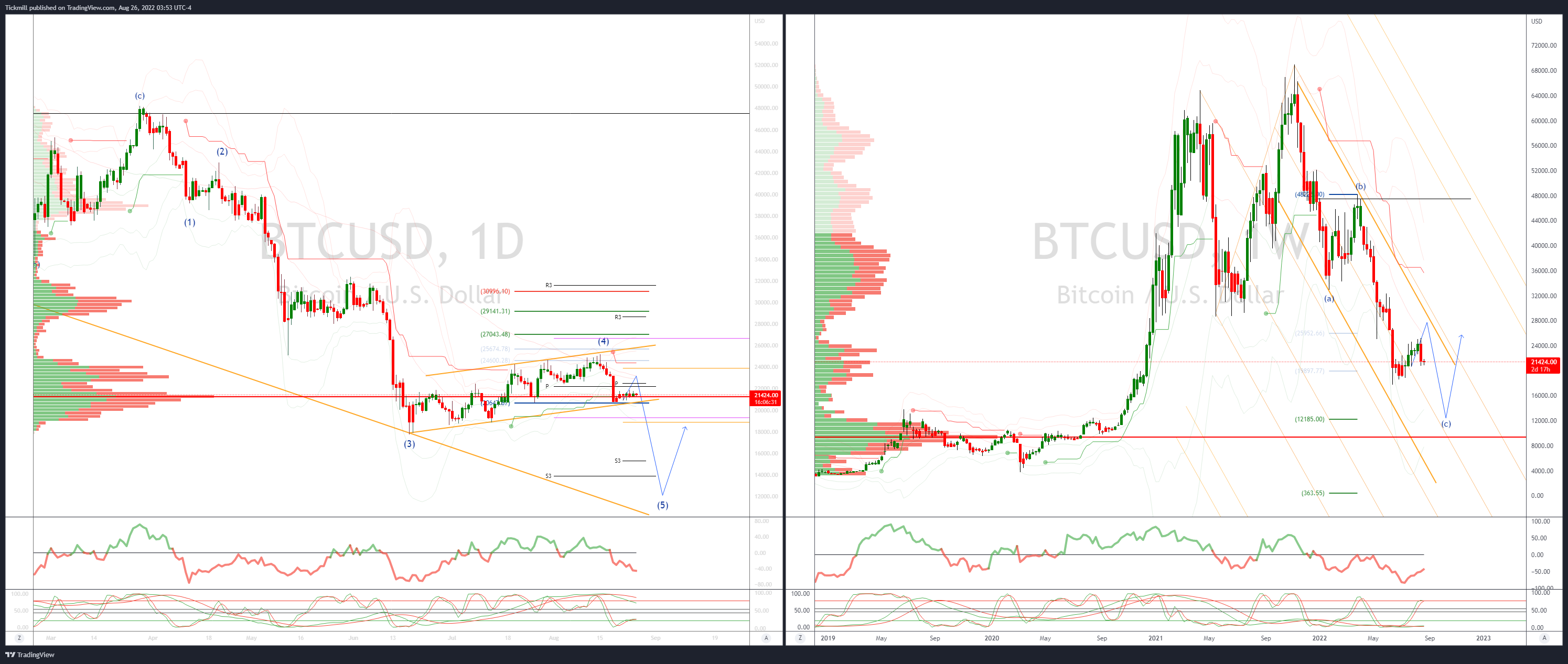

BTCUSD Bias: Bearish below 25.3K

- BTC continues to rotate within 22/21k range

- USD offered ahead of Jackson Hole event risk

- BTC supported by lower VWAP (20.9k) for now, then Jul 13 low 18.9k

- Res Aug 21 high 21.8k, 22.1k, 23k's 50% Fib of 25.2-20.7k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!