Daily Market Outlook, August 26, 2020

Daily Market Outlook, August 26, 2020

The equity market is mostly lower during the Asian trading session. Yesterday saw risk assets buoyed by US-China trade deal optimism, but gains were pared following an unexpected fall in US consumer confidence in August to a six-year low, reflecting increasing concerns about the impact of the pandemic on jobs. Futures markets for stocks, however, were slightly higher in Europe. Germany announced it will extend its furlough scheme until the end of 2021.

There is not much to see today, at least in terms of scheduled economic data and events. French consumer confidence, released earlier this morning, was unchanged at 94 in August, remaining below levels seen at the start of the year. This afternoon’s US July durable goods orders is the only noteworthy release, which we forecast to rise by 4.0%. That would reaffirm the recovery since the low point in April, but the outlook for capital spending remains uncertain with demand and corporate profits affected by the health crisis.

Central bank speakers today include Bank of England Chief Economist Andy Haldane. He is scheduled to speak on creative industries at an Edinburgh event. While interesting, that suggests there may not be much on monetary policy for financial markets to chew on. Other speakers today include ECB Executive Board member Isabel Schnabel at a virtual meeting of the European Economic Association. Richmond Fed President Thomas Barkin is also due to speak.

Market participants, however, will be waiting for the start of the two-day Jackson Hole symposium, held remotely, starting tomorrow with Fed Chairman Jerome Powell due to speak. Bank of England Governor Andrew Bailey will also speak at the event on Friday.

CITI: Month-End FX Hedge Rebalancing: August 2020 Preliminary Estimate

The preliminary estimate of month-end FX hedge rebalancing flows points to a net USD selling need on Monday, 31 August. Good performance of Japanese assets means that the sell USDJPY signal is amongst the weakest this month. The signal to buy GBPUSD is strongest at 0.96 historic std. dev, although below the 1 std. dev threshold that we consider significant.The FX impact suggests USD selling against EUR and GBP at month end.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1700 (320M), 1.1775 (800M), 1.1790-1.1800 (700M), 1.1830 (720M), 1.1850-60 (650M)

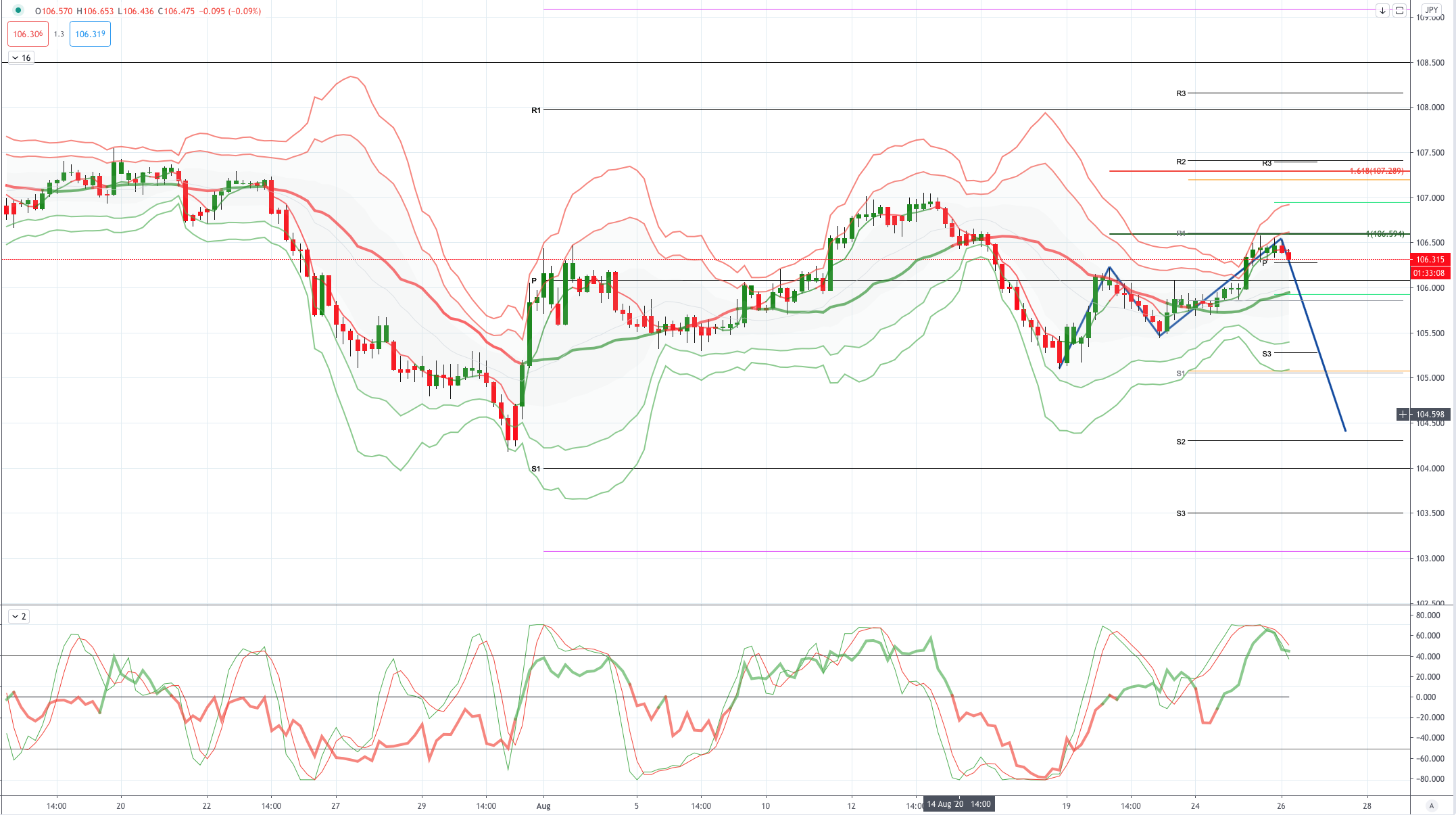

- USDJPY: 105.00 (3.2BLN), 105.40-55 (1.2BLN), 105.75 (1BLN), 106.00 (1BLN), 106.15 (420M), 106.30-35 (380M), 106.40-50 (600M), 106.90-107.10 (1.5BLN)

- GBPUSD: 1.3150 (384M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.17 targeting 1.20

EURUSD From a technical and trading perspective, the breach of trendline support and suggests that we may be entering an extended consolidation phase, as 1.1860/80 contains upside attempts look for a retest of 1.17 base before another attempt to test the psychological 1.20 UPDATE continued rotation around 1.18 ahead of Fed Chairs speech on Thursday, likely to be the catalyst for the next leg

GBPUSD Bias: Bullish above 1.32 Bearish below targeting 1.30

GBPUSD From a technical and trading perspective, erratic price action into the end of last week, printing three daily reversal patterns, Friday’s bearish reversal on the Daily time frame flipped the daily chart bearish again, as 1.32 now acts as resistance look for a test of range support to 1.30

USDJPY Bias: Bullish above 105.50 Bearish below

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. Note DTCC shows a massive USD 7-billion 105.00 strike option expiries this week. Biggest collection Wednesday - USD 3.2-billion, and Thursday - 1.6-billion. Several billion Wed-Thurs from 105.75 to 105.40 too, but little above 106.00

AUDUSD Bias: Bullish above .7200 Bearish below

AUDUSD From a technical and trading perspective, reversal from the test of offers above .7250 finds support at .7150 as this contains the downside look for another run at .7300 before a more meaningful reversal UPDATE a closing breach of .7140 would delay the upside objectives suggesting a test of base support back to .7080

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!