Daily Market Outlook, August 10, 2020

Following the collapse in talks between the Republicans and Democrats on a stimulus package, over the weekend, US President Trump signed a number of executive measures aimed at providing relief from the economic damage sustained during the pandemic. These included a $400 per week increase in unemployment benefits, a suspension of the payroll tax and a postponement of student loan payments through to the end of 2020. Asian equity market is up this morning, though overall gains are limited.

Despite the US Congress reaching a stalemate over the next fiscal stimulus package, concerns that the US recovery may be running out of steam has abated somewhat after a string of recent better-than-expected data releases. Last week, both the July ISM manufacturing and services surveys increased unexpectedly, while weekly initial jobless – which had risen in the prior two weeks, raising fears that the labour market may be stalling – dropped to the lowest level since the start of the pandemic. Nonfarm payrolls gains did slow, but less than forecast, with the economy adding a further 1.76m jobs in July. While the executive actions signed by President Trump should provide some near-term support to risk sentiment, a broader stimulus packages is likely to be required in order to see a sustained improvement, particularly with the number of confirmed Covid-19 cases in the US rising above the 5mn mark.

Any signs on further developments with regard to US fiscal policy, is likely to remain a key focus for markets today, particularly with only second-tier releases due. The Euro area Sentix survey is expected to show another improvement in August, moving further away from the all-time low reached in April. Meanwhile, the US JOLTS job openings survey will provide a broader sense as to how labour demand fared in June, although following Friday’s July payrolls report it is likely to be seen as old news. Fed policymaker Evans is due to speak at an event on workforce issues but is not scheduled to discuss current economic conditions or monetary policy.

Early tomorrow, the ONS will release the UK labour market numbers for June. In last week’s Bank of England update, the MPC highlighted one of the major risks to the outlook stemmed from the labour market and how firms deal with the winding down of the Coronavirus Job Retention Scheme. Official statistics so far still show the unemployment rate at 3.9%, close to it's all-time low of 3.8%, which is somewhat at odds with other reports, including HMRC employment data and jobless claims data. Expect it to increase to 4.2% in the three months to June, with further rises in the coming months. The BoE expects most furloughed staff to return to employment, but nevertheless sees the unemployment rate rising to around 7.5% by the end of 2020.

This week’s snapshot of FX market sentiment reflects essentially the same themes as last week—speculative accounts are increasingly bearish on the USD but the EUR is the primary vehicle being used to express this view. The aggregate USD short position, reflected across all the main currencies we monitor, reached USD28.9bn through Tuesday, an increase of USD4.455bn, effectively back to peak USD bearish levels seen in 2018 and 2012. Net non-commercial EUR longs rose USD3.6bn to reach a new record of USD26.6bn, or the equivalent of 181k contracts. Once again, the primary motivation behind the extension is the addition of gross EUR long positions, which rose 20k contracts this week to total 262k. Gross EUR shorts remain largely steady at 81k contracts, in line with trends over the past month. Net JPY longs represent the next largest single currency position and rose USD325mn this week to USD3.7bn. Net CHF longs rose a slightly larger USD446mn to total USD1.6bn.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1800 (3BLN)

- GBPUSD: 1.2900 (352M)

- AUDUSD: 0.7000 (1BLN), 0.7140 (271M)

- USDJPY: 105.00-05 (1.1BLN), 105.50 (1.65BLN), 107.05 (400M)

Technical & Trade Views

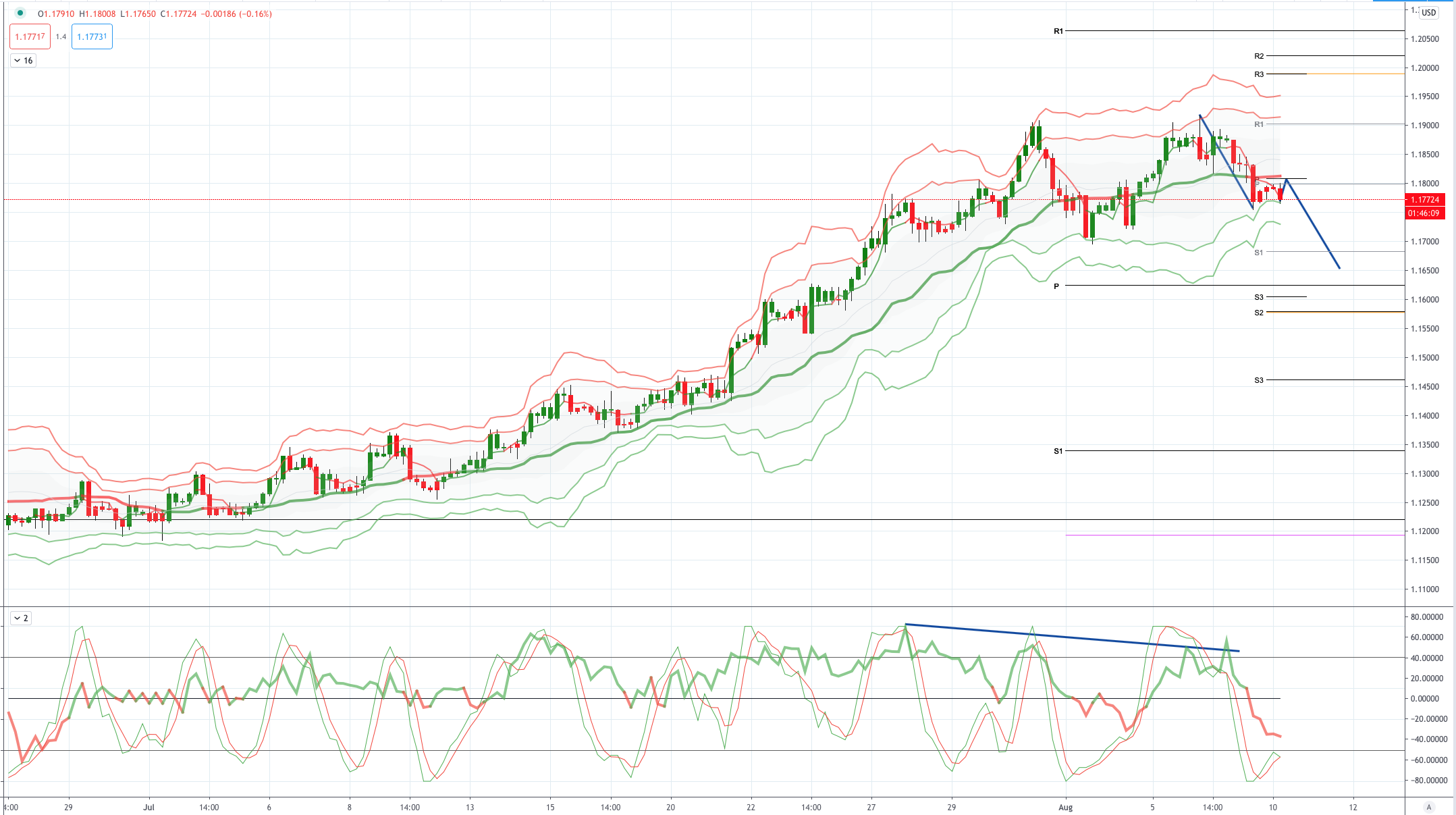

EURUSD Bias: Bullish above 1.1820 Bearish Below

EURUSD From a technical and trading perspective, as 1.1810 acts as resistance anticipate another corrective leg lower to test bids back towards 1.16. A daily close back through 1.1820 would negate the corrective thesis, opening a retest of 1.19 UPDATE 1.19 retest played out now there is a potential for a double top to develop, will need to see a H4 close sub 1.1850 to open a retest of 1.17 support UPDATE momentum divergence addressed, as 1.18 actas as resistance look for a test of 1.1650

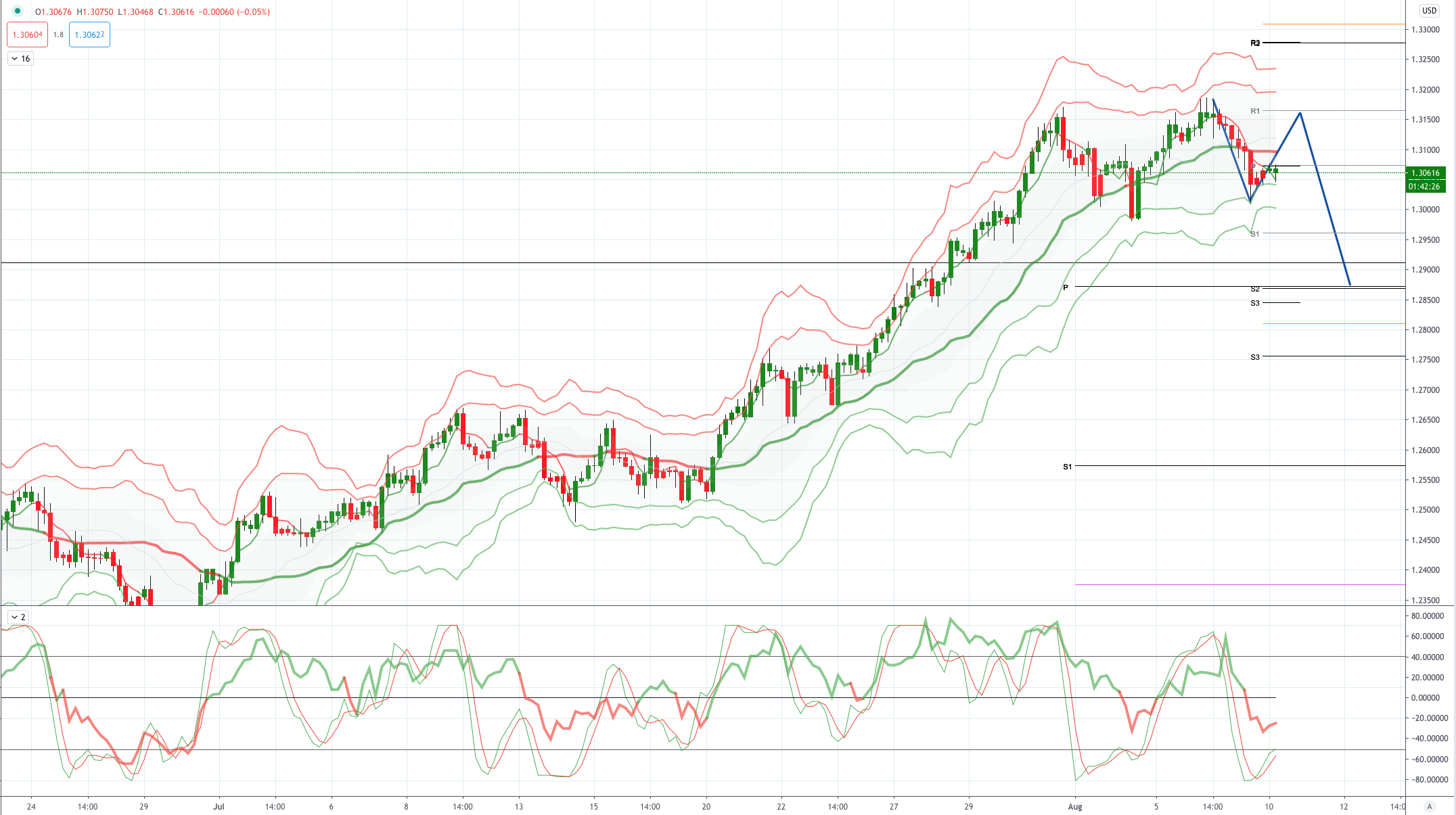

GBPUSD Bias: Bullish above 1.30 targeting 1.3250

GBPUSD From a technical and trading perspective, price tested pivotal trendline resistance at 1.3166, anticipated profit taking pull back playing out. As 1.30 continues to attract buying interest look for a test of 1.3250. UPDATE as 1.13160 acts as resistance potential for 1.2860 before higher

USDJPY Bias: Bullish above 105.50 targeting 107.50

USDJPY From a technical and trading perspective, anticipated test of the equality objective at 104.50 attract big bids, printing a key reversal pattern on Friday, as discussed in today’s Chart Hit, as 105.50 acts as a support look for a test of the equality objective to 107.50.

AUDUSD Bias: Bearish below .7170/90 targeting .6950

AUDUSD From a technical and trading perspective, test of stops and offers above .7220 has delivered the anticipated corrective phase, as .7170/90 now acts as resistance look for a test .6950 as ascending support. UPDATE potential double top in place to deliver the test of ascending trend channel support now at .7000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!