Daily Market Outlook, August 1, 2023

Munnelly’s Market Commentary…

Asian equity markets showed a mostly positive trend, taking cues from Wall Street's S&P 500, which marked its 5th consecutive monthly gain. However, market participants were also digesting disappointing Chinese Caixin Manufacturing PMI data and the Reserve Bank of Australia's (RBA) decision to keep rates unchanged.

The Nikkei 225 gained 0.7%, supported by a weaker currency and positive earnings releases in Japan. A recent Bloomberg poll revealed that BoJ watchers do not expect any further policy shifts from the central bank this year, with April now considered the likely timing for any potential changes. The Hang Seng rose by 1.2%, and the Shanghai Composite increased by 0.1%, shrugging off the disappointing Chinese Caixin Manufacturing PMI data, which slipped into contraction territory for the first time in three months. Hong Kong's tech sector strength lifted the Hang Seng, while further support efforts from China helped buoy the mainland market.

The rest of the day's economic calendar is dominated by July manufacturing PMI updates. The Eurozone and the UK are expected to have second readings that are unlikely to be revised from the initial estimates. Both regions experienced declines in manufacturing activity, with the Eurozone's output index reaching a 38 month low and the UK's hitting a seven month low. However, there are positive signs of easing inflationary pressures in the sector.

Stateside, the first reading for the July PMI manufacturing index improved to a three month high, although it still remains below the 50 expansion level. There are signs that government incentives for 'green' industries are helping to boost demand for capital goods, offering hope that the sector's activity may be bottoming out. Nevertheless, the ISM manufacturing index for July is still expected to be below the expansion level of 50. Other data points for the US economy include construction spending, which has been impacted by higher rates but is showing tentative signs of improvement, and the job market turnover report from July. This data will provide insight into labour market conditions, with the key report on this topic being Friday's payrolls report for July.

CFTC Data As Of 25-07-23

USD net spec short grew in Jul 19-25 period, $IDX +1.34% in period

Rates remain key driver, after period close Fed, ECB lilted dovish

BoJ adjusted YCC JGB 10-yr intervention lvl to 1%, yen whipsawed

EUR$ -1.52% in period, specs -1,602 contracts now -177,230

$JPY +1.34% in period, specs +12,487 into strength now -77,752

GBP$ -1%, specs -4,734 contracts, now +58,995; after below f/c CPI

AUD$ -0.3% in period, specs -800 contracts; $CAD +0.03%, specs +5,009

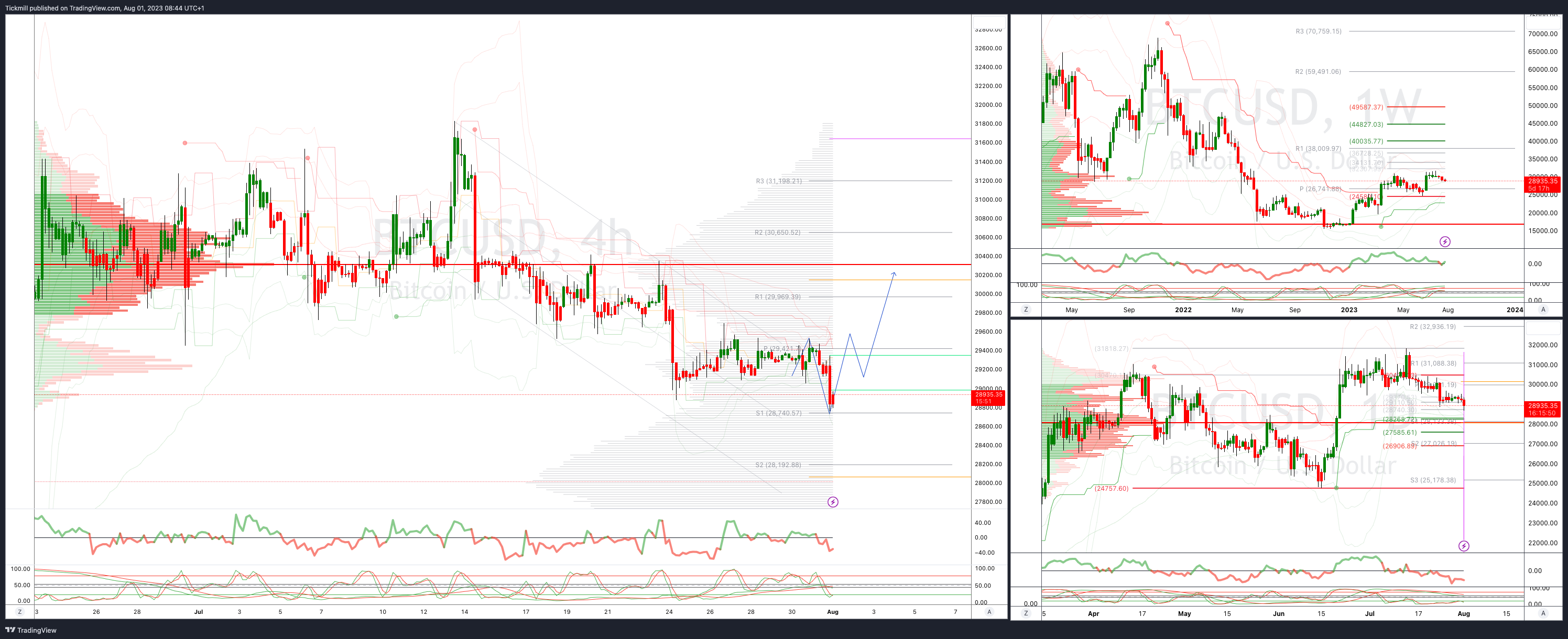

BTC -1.86% in period specs +516 contract by trend lows now -645 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900-05 (363M), 1.1000-10 (1.1BLN), 1.1030-40 (2.5BLN)

1.1045-55 (2.9BLN), 1.1100 (2BLN)

GBP/USD: 1.2850 (255M), 1.2855 (364M), 0.2865 (230M), 1.2900 (366M)

EUR/GBP: 0.8660 (490M), 0.8710 (339M)

AUD/USD: 0.6620-30 (850M). USD/CAD: 1.3285-1.3300 (818M)

USD/JPY: 142.00 (1.7BLN), 142.50 (710M), 143.00 (361M), 143.25 (400M)

Options Market Positioning

The implied volatility premiums for USD/JPY are notably lower for downside strikes compared to upside strikes. Additionally, trade flows are indicating a focus on pushing the USD/JPY pair towards 145.00, suggesting a potential downward movement in the exchange rate.

For EUR/USD, implied volatility is declining, but there is considerable interest in owning downside strikes, which is leading to a volatility premium for EUR puts over calls on the -1-month expiry risk reversals, currently standing at 0.25. This indicates that there is a preference for hedging against potential downside risks for the EUR/USD pair in the short term.

Overnight Newswire Updates of Note

Australian Borrowers Given Reprieve As Reserve Bank Pauses Again

Australian Manufacturing PMI Points To Soft Landing For Industry

China's July Factory Activity Swings Back To Contraction

Japan Jobless Rate Falls In Positive Sign For Wages, BOJ Goal

Japan Economy Minister Goto: BoJ's Move Wasn't Shift In Monetary Easing

China Curbs Exports Of Drone Equipment Amid US Tech Tension

US Commerce Sec. Plans August China Trip As Tensions Over Tech Controls Simmer

Judge Slams Ripple Decision In SEC's Case Against Terraform Labs

Toyota Profit Tops Estimates, Sticks To Full-Year Forecasts

HSBC Announces Fresh Buyback As Higher Rates Propel Profits

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

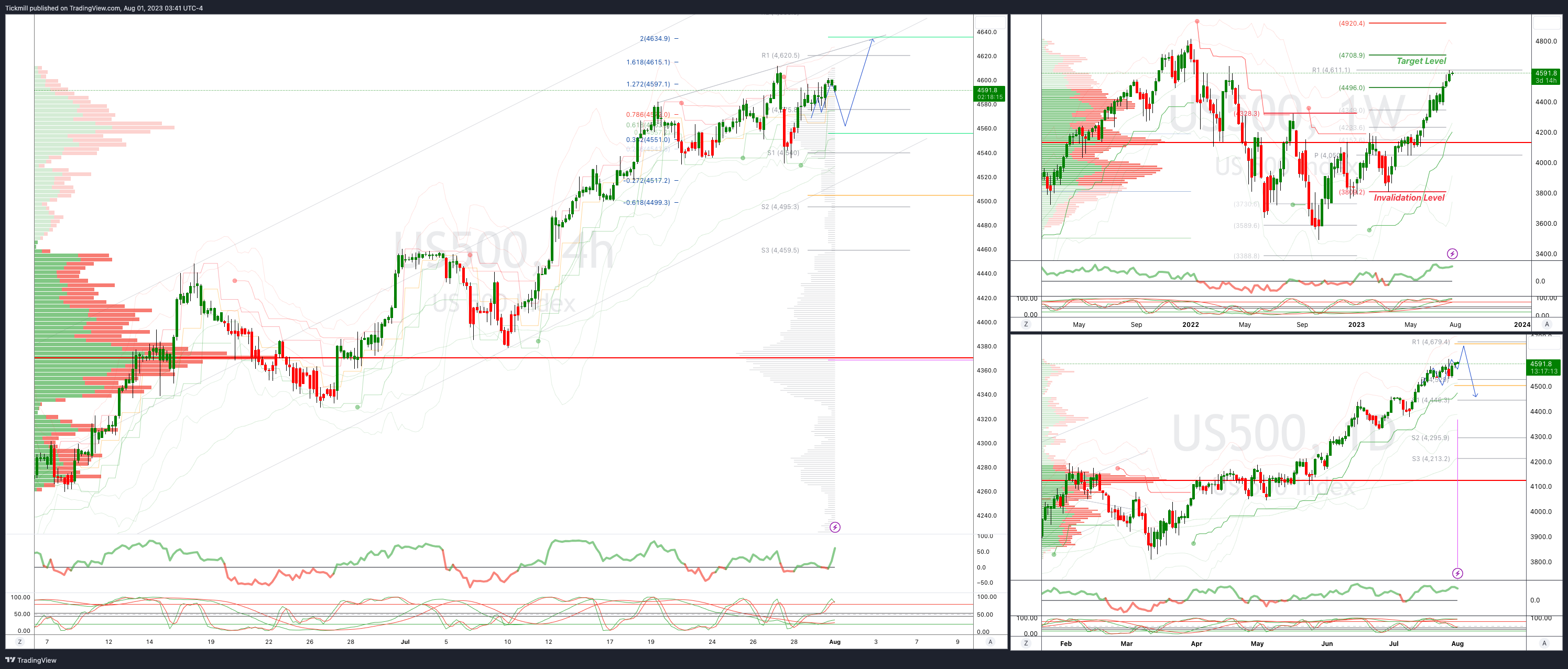

SP500 Intraday Bullish Above Bearish Below 4530

Below 4530 opens 4512

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bearish

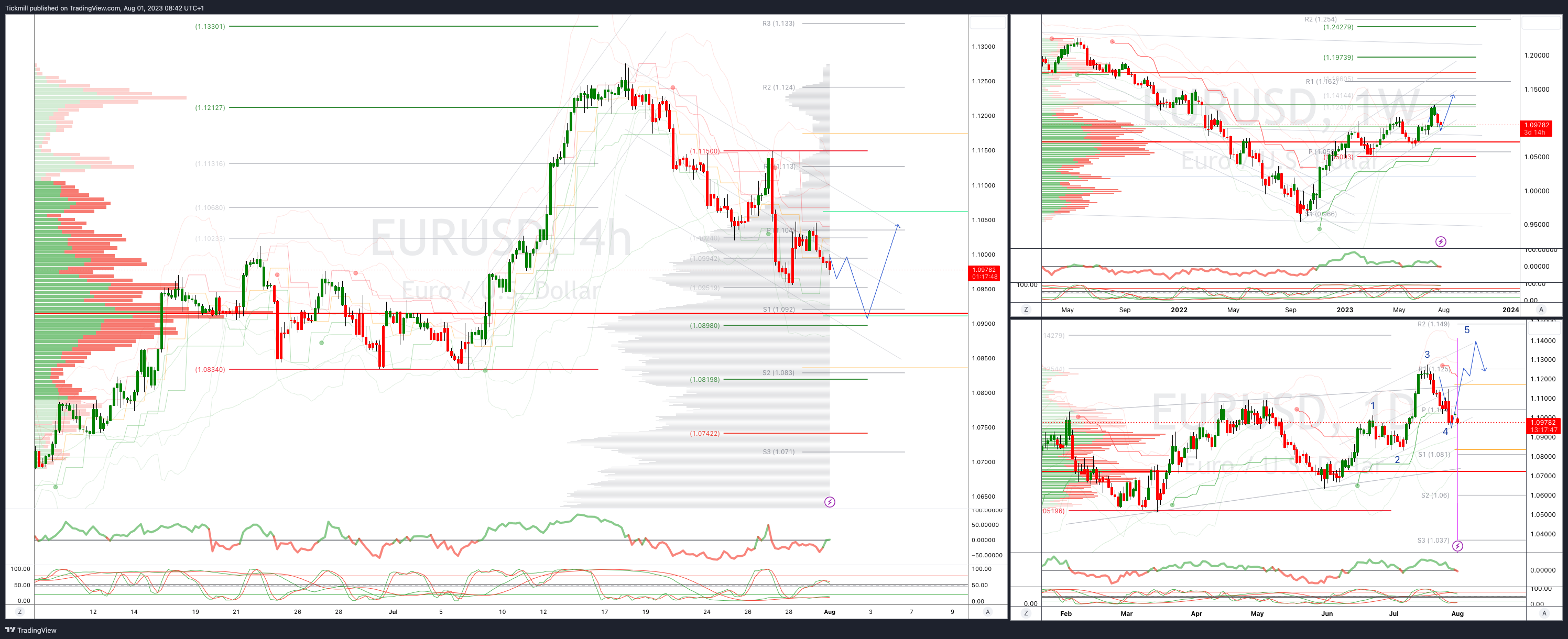

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

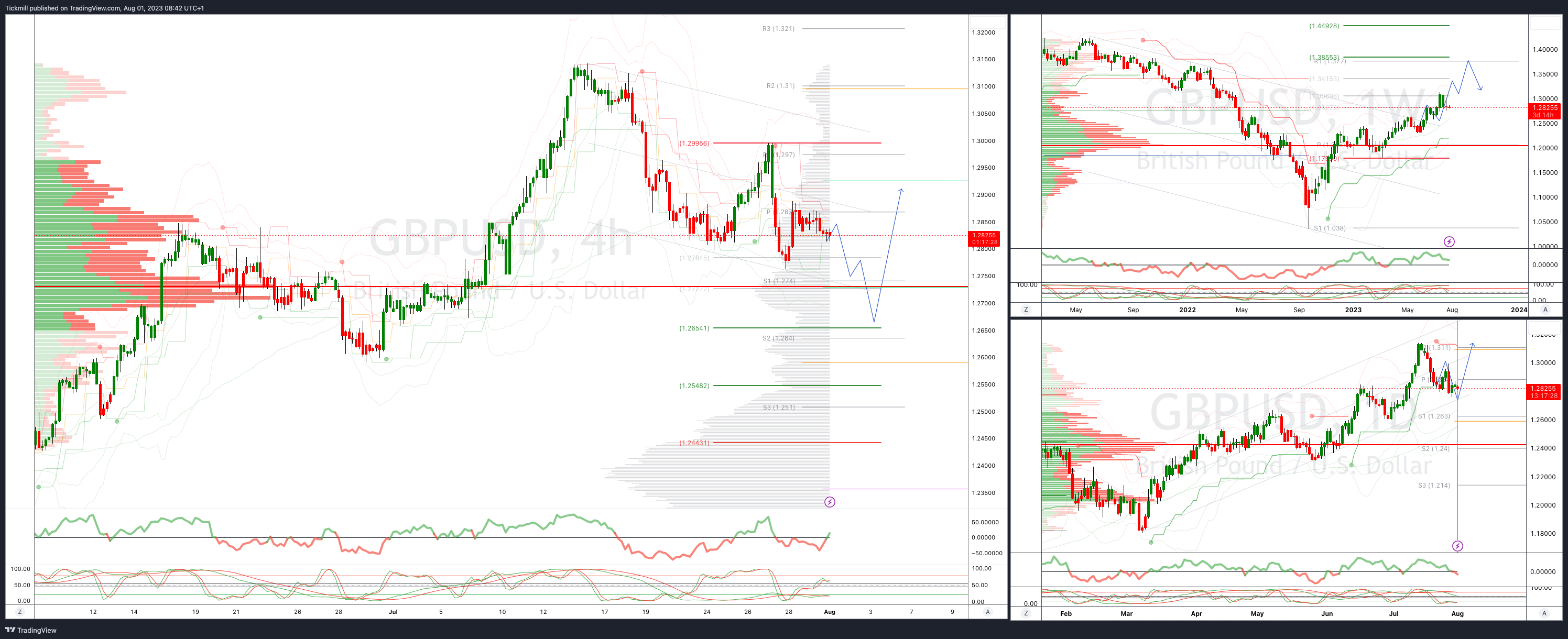

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bullish

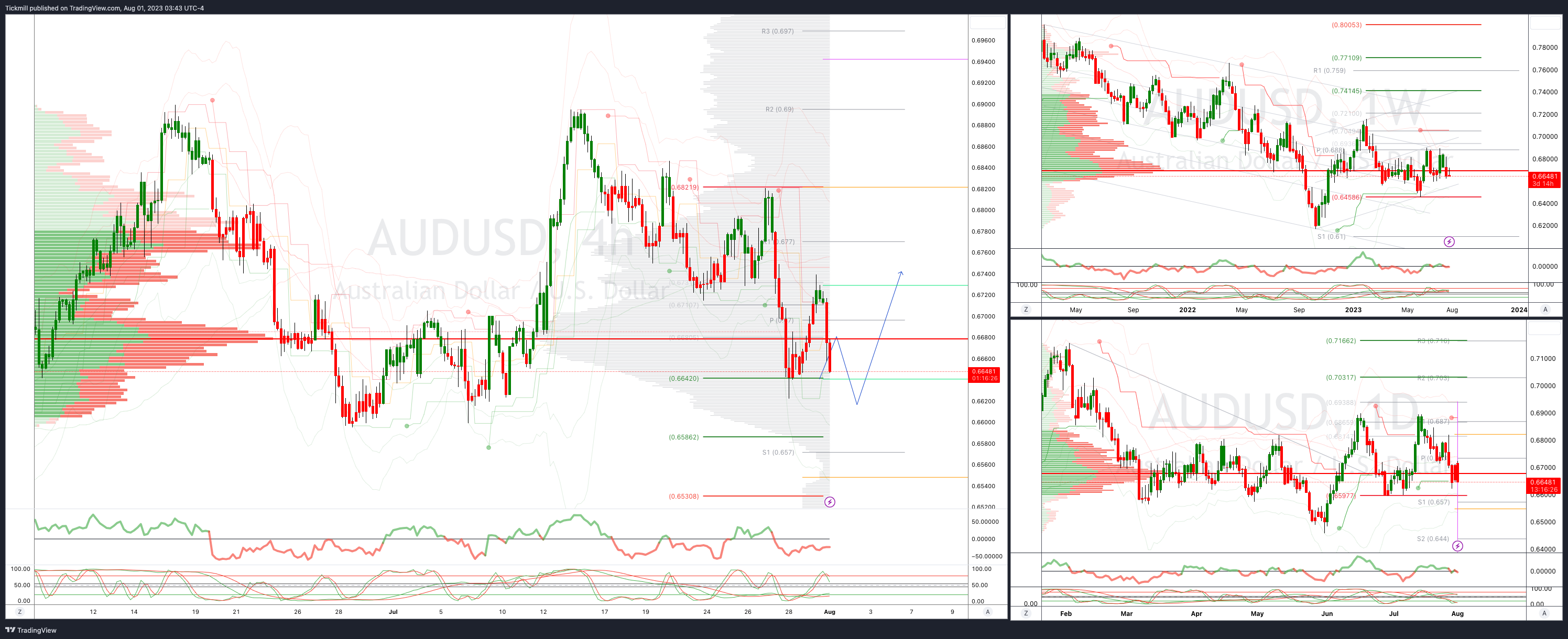

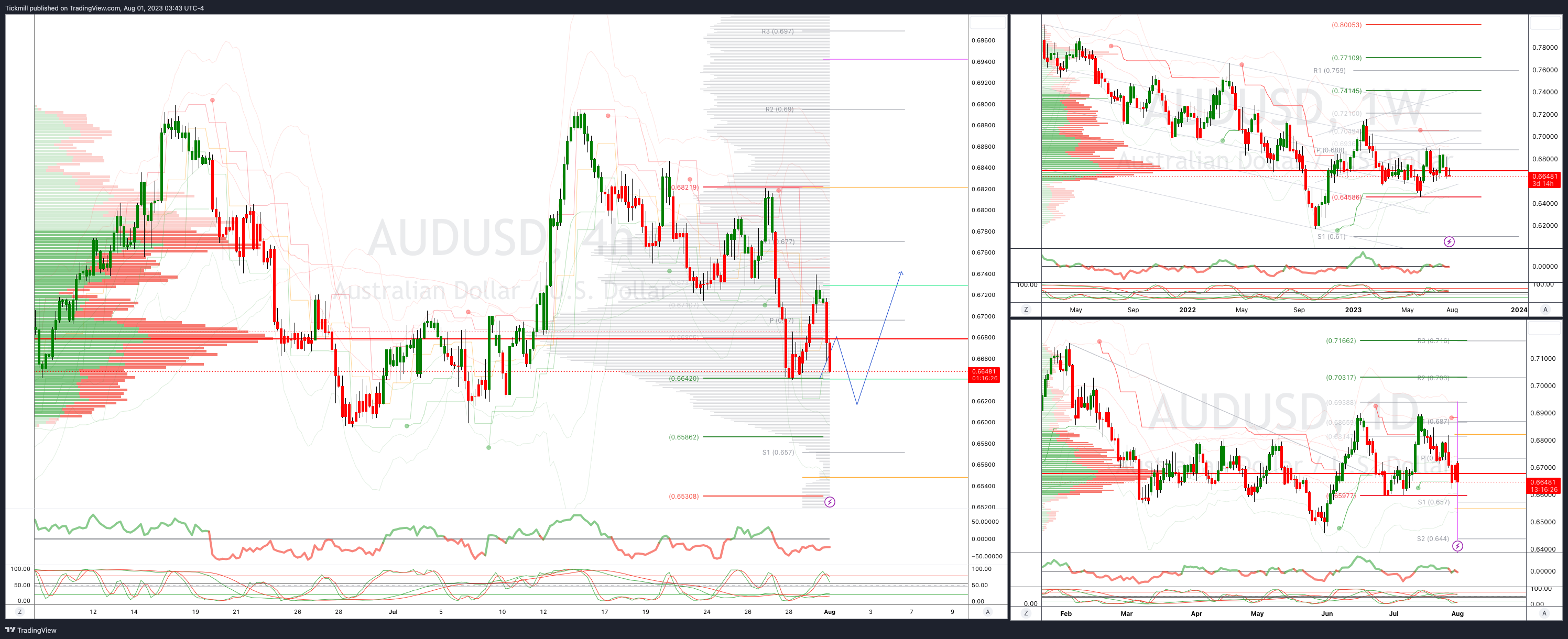

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6700

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bearsih

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!