Daily Market Outlook, April 25, 2022

Daily Market Outlook, April 25, 2022

Overnight Headlines

- Emmanuel Macron Defeats Marine Le Pen To Be Re-Elected President

- Japan To Spend 6.2 Trillion Yen On Economic Measures - Nikkei

- Germany To Borrow Extra 40 Billion Euros To Cushion War Blow

- Asia Bonds Lose $155 Billion As China Woes Add To Rates Pressure

- Treasuries Gain As Fed Tightening Fuels Concerns Over US Growth

- Oil Prices Extend Losses As Shanghai Lockdowns Hit Demand Outlook

- Brussels Prepares To Hit Russia With ‘Smart Sanctions’ On Oil Imports

- EU’s Borrell Says No EU Agreement On Russian Energy Embargo

- Stocks Slide, Oil Drops, Dollar Climbs As Rate Hike Concern In Focus

- Foxconn Suspends Production At Two Factories In Eastern City Of Kunshan

- Twitter Is In Discussion To Sell Itself To Elon Musk For $43 Billion - WSJ

The Week Ahead

- Global growth concerns have started to grip investors as the coming week reveals the first read on Q1 GDP from the U.S., Eurozone, and Canada. Other U.S. data include core PCE index, durable goods, University of Michigan consumer sentiment and new home sales. Other key EZ data include German IFO and EZ CPI. There isn’t any key UK data of note this week.

- China will be releasing industrial profit data on Wednesday, while the official and Caixin PMIs for April are due Saturday. Japan will this week publish employment data along with retail sales and industrial output.

- Australia's CPI on Wednesday will be important for fine-tuning the Reserve Bank of Australia's rate-hike expectations. The focus will be on the trimmed and weighted mean which are expected to come in at 3.4% and 3.3% Y/Y respectively.

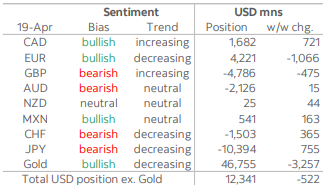

CFTC Data

- The aggregate bullish USD position fell again for the third consecutive time this week in a period when the USD gained ground against all the currencies that we cover in this report, with the exception of the CAD. The overall position fell by USD522mn, after a USD1.4bn decline last week, to total USD12.3bn or about USD4.0bn off its recent high in late-March. The JPY and CHF lagged almost all the major currencies this week with respective losses of 2.7% and 2% against the USD amid the weight of widening yield differentials versus the USD. However, their respective bearish positions were reduced slightly over the period as gross shorts declined and gross longs increased. Speculators reduced by USD755mn the large JPY short to total USD10.4bn, more than reversing the USD648mn move against the yen last week. In the case of the CHF, a USD365mn shift in its favour undid the bets against it in the previous two weeks, taking the net short to USD1.5bn.

- The EUR’s break under 1.08 has triggered a weakening in EUR sentiment as investors reduced the currency’s aggregate long by USD1.1bn to total USD4.2bn. This shift roughly unwinds 2/3rds of the previous week’s move of USD1.6bn favouring the EUR, with more reductions likely ahead as the currency looks on track extend recent losses to perhaps test the pandemic low of 1.0636. The GBP’s short position (with the currency unchanged over the period) rose further as accounts added USD457mn to the aggregate short that now totals USD4.8bn—its highest level since late2019. Since the data cutoff, the GBP has dropped to its weakest level since Sep 2020.

- After the BoC’s 50bps hike last Wednesday and ahead of inflation data this week (which easily beat expectations), investor sentiment in the CAD improved over the week with a USD721mn rise in its aggregate long that now takes the bullish position to USD1.7bn—or about USD2.5bn below the largest position of the currencies in this report, that of the EUR. The CAD was the top performing major currency in the week to Tuesday by virtue of a small 0.2% gain vs the USD. According to the data, speculators had not held such a positive outlook on the CAD since last July, although price action over the past two sessions with USDCAD on track to close above 1.27 today would suggest a moderation in CAD-bullish sentiment in recent trading.

- The AUD and NZD, which saw losses of 1.1% and 1.6% respectively over the week, saw practically no change in their respective positions. The large AUD short fell by USD15mn, far from last week’s USD702mn reduction, to remain around USD2.1bn. The diminutive NZD short turned into an inconsequential NZD long of USD25mn through a week that included a large hike by the RBNZ—but with disappointing guidance suggesting a lower terminal rate than markets are expecting.

- Finally, the MXN position improved slightly despite struggles to remain under the 20 pesos per USD mark this week. Accounts shifted USD163mn for the MXN to take its aggregate long position to USD541mn—its highest since early-March.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0700 (943M), 1.0800-05 (520M), 1.0825 (502M) 1.0925 (503M)

- USD/JPY: 128.00 (425M), 128.85 (334M).

- GBP/USD: 1.3150 (284M)

- USD/CAD: 1.2700 (280M), 1.2605 (330M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.12 Bullish above

- EUR/USD tanking into Europe, eyes on 1.0636 low 3/31

- EUR/USD remains under the gun into European trading, off another leg

- Asia sees fall from 1.1076 high very early after Macron win confirmed

- Collapse thereafter with win already discounted by many

- Late Asia trade sees extension lower to 1.0729 EBS, lowest in months

- 1.0728 low April 2020, 1.0636 spike low in March 2020, now spec target?

- Concerns over growth despite strong PMIs, dovish ECB dominate

- Ukraine-Russia conflict and EZ inflation also cited by dealers

- Some support eyed ahead of E943 mln option expiries slated in NY today

GBPUSD Bias: Bearish below 1.3350 Bullish above.

- GBP/USD breach of a key 50% Fibo significant for bears

- Bear run extends below 1.2800 and no sign of any corrective action

- 14-day negative momentum has increased and RSI is in o/s territory

- A similar picture on the weekly chart

- Both charts are also clear below the 30-period lower Bolli

- Rebound risk is high but our 1.2975 offer might be too optimistic

- Break below the key 1.2832 50% Fibo 1.1413-1.4250 is significant

- The next Fibo off that move serves as a bear target at 1.2497

USDJPY Bias: Bullish above 120 Bearish below

- USD/JPY dragged down on JPY cross weakness in holiday-thinned trading

- ANZAC Day holiday Down Under keeping market thin, volatile especially early

- USD/JPY from 128.87 EBS high after Gotobi Tokyo fix to 128.24

- Option expiries today - 128.00 $425 mln, 128.85 $334 mln

- Demand decent into fix but dries up thereafter, US yields easing back too

- Yield on Treasury 10s off from 2.975% Friday, 2.895% early Asia to 2.843%

- Risk off after Wall St plunge Fri, Nikkei -1.5% @26,696, E-Minis -0.5% @4245

- EUR/JPY 139.18 on new of Macron win to 138.25 EBS, bias still down

- GBP/JPY 165.32 to 164.06 and AUD/JPY 93.40 to 92.09 as longs bail, hedging

- Japan Mar corp service price index +0.9% m/m, +1.3% y/y, Feb +0.2%, +1.0%

- BoJ cites rises international freight rates for push up in CSPI index

AUDUSD Bias: Bullish above .7300 Bearish below

- AUD/USD pressured by extended sell-off in metals and industrial metals

- Iron ore futures tank by more than 11% early, sending the AUD/USD below twds 0.7200

- Spot iron ore in China slumps by 8% last to $143/tonne, demand deem amid covid-19 outbreak, lockdowns

- Fall in commodity prices add to pressure in AUD, last at 0.7189-61

- China NDRC told steel firms to adhere to green development, further cutting demand

- AUD/USD eyes 0.7165, low last on 15th March, stronger support cited at 0.7100, bears tgt 0.70 nearterm

- Failure at 0.7165 today amid overshot in 21day BB risks bounce back to 0.7250 intraday

- Focus on Q1 GDP due on Wed, mtks expect another strong set of numbers

- Most economists expect the RBA to hike rates in June

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!