Daily Market Outlook, April 13, 2020

Before the long Easter weekend, the US benchmark market, the S&P500 closed at +1.45% on Thursday, aided by investor hopes that US and European Covid-19 infections may be reaching a turning point soon and drug experiments were promising. That said, US’ Covid-19 fatalities crossed 20,500, basically overtaking Italy, even as US president Trump said he would announce on Tuesday a council of “very, very great doctors and business people” to advise him on when to reopen the US economy.

Three-month LIBOR fell to 1.21888% last Thursday after the Fed announced another $2.3 trillion of measures. Meanwhile, ECB’s de Guindos warned that Europe may see a more severe recession than the rest of the world, but the first signs of growth may be visible from 3Q20. This came after EU finance ministers agreed on a EUR540b stimulus package, which includes deploying the European Stability Mechanism to offer credit lines of up to EUR240b, subject to approval as soon as this week, whilst Italy extended its nationwide lockdown until 3 May.

OPEC+ also finally agreed to cut output by 9.7m barrels per day, but failed to lift crude oil prices. Over in Asia, Fitch cut Malaysia’s sovereign credit rate outlook from stable to negative, citing that the economy is “heavily affected” by Covid-19 and may shrink 1% this year. Malaysia had announced the extension of its Movement Control Order for another two weeks till 28 April.

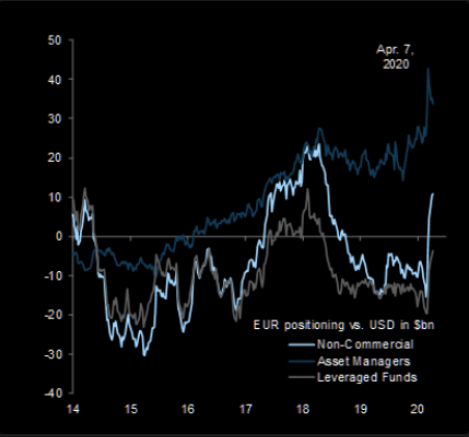

On the CFTC front, leveraged accounts reduced their implied USD longs, especially against the EUR and AUD, while non-commercial accounts deepened their implied USD shorts marginally. Overall, even though the short term players moved against the USD in the latest week, but note that the absolute change in positions has been very small over the past four weeks, suggesting that the community itself is also tentative and uncertain over the broad USD outlook.

This will be another holiday-shortened week for some developed countries, including Canada and most of Europe which will enjoy an extended long-weekend for Easter Monday today. US exchanges will reopen today, where the focus will shift to the corporate earnings reporting season.

The US economic docket remains in focus this week and the key data includes March retail sales which will be released on Wednesday, and according to the Reuters poll, it may contract by 3.4% m/m, but the range of estimates is wildly wide, with the most optimistic forecast of -0.6% and the worst forecast at -24.6%) due to the very uncertain impact from COVID-19. March industrial production data will also be rolled out on Wednesday, and according to the Reuters poll, it may contract by 3.9% m/m.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- USDJPY: 109.50/60 620m. 107.50 1.17bn

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.09 targeting 1.1250)

EURUSD From a technical and trading perspective, daily chart has flipped bullis has per the near term volume weighted average price, the anticipated move through 1.890 has injected further upside momentum challenging the first decision point at 1.0960/80, through this area opens a test of pivotal 1.1070/80, if bulls can sustain a breach here then 1.1250/80 is the primary upside objective. On the day only a close sub 1.09 would concern the bullish bias

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a move back through 1.24 would suggest a broader corrective phase to unwind near term overbought momentum, 1.20/1.1950 will be pivotal this week, if bulls fail to defend this area, a deeper decline could ensue to test bids and stops below 1.17 NO CHANGE IN VIEW

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, double bottom delays downside objective with a whipsaw back to 110 before lower again. Through 107 would suggest downside targets are directly in play NO CHANGE IN VIEW

AUDUSD (Intraday bias: Bullish above .6200 targeting .6430)

AUDUSD From a technical and trading perspective, as .6200 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6250 would concert the bullish bias.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!