Crude Traders Eyeing US/China Trade Deadline

US Tariffs Weighing on Sentiment

Crude prices are starting the week on a soft, but muted, footing today with the futures market sitting just below the 63.83 level. The market slid heavily last week as optimism over Russia-Ukraine peace talks and US tariff uncertainty combined to create heavier bearish sentiment among oil traders. The return of sweeping US tariffs has been a big blow for crude prices with traders scaling back their global demand forecasts accordingly. This week, however, crude could see some short-term lift if the current trade truce between the US and China is extended beyond tomorrow’s current deadline. Such a move should see some optimism returning to the market. However, with Friday’s meeting between Trump and Putin looming large, any upside could prove short lived.

Russia Ceasefire Hopes

The prospect of a ceasefire (or even progress in peace talks) between Russia and Ukraine is seen as a key downward driver for crude prices. The removal of supply disruption and the prospect of Russian supply returning to the market (longer-term) are key headwinds for crude prices and the market has shown a downward reaction any time the situation has looked more hopeful. If we see positive headlines on the back of Friday’s talks, this could lead oil prices down lower near term. On the other hand, if talks fail and the prospect of a ceasefire seems unlikely, crude prices are vulnerable to a sharp reactionary move higher. As such, there is plenty of volatility risk for crude traders this week.

Technical Views

Crude

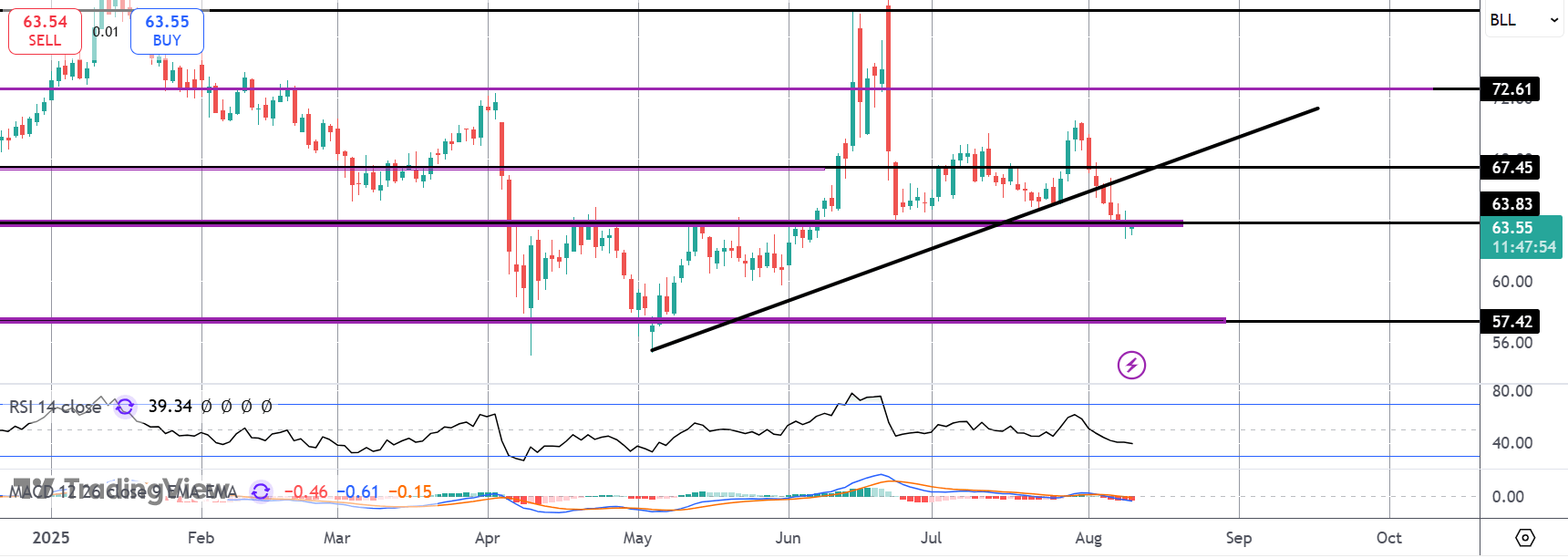

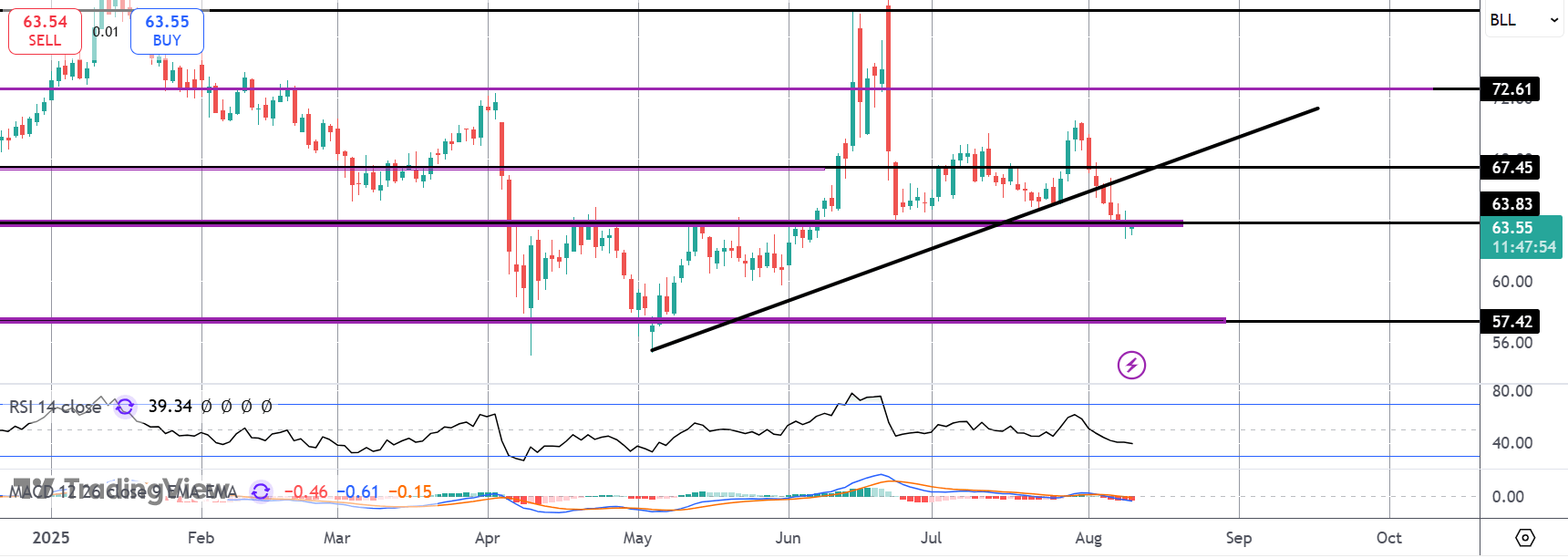

Crude prices have broken through the rising trend line from YTD lows are now testing support at the 63.83 level. If price breaks below here, focus is on a deeper move down to the 57.2 level next, in line with bearish momentum studies readings. Bulls need to see a move back above 67.45 to alleviate near-term downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.