Crude Testing Key Support As Sell-Off Deepens

Oil Slide Deepens

Oil prices have remained under pressure this week with rude futures now down almost 10% from the July highs. The sell-off comes amidst a fresh uptick in USD this week on the back of President Biden stepping down from the US Presidential race. With projections for a Trump win now turning higher on the back of this and Trump’s recent assassination attempt, USD has seen stronger inflows over the last week. The expected impact of a second Trump presidency has so far been a net-negative for commodities over fears of fresh trade wars and heightened geopolitical unrest, keeping USD underpinned through increased safe-haven inflows.

Crude Inventories Data

Looking ahead today, crude bulls are hopeful that the latest EIA data can bring some good news. On the back of the prior week’s 4.9-million-barrel draw, the market is expecting a further 2.6-million-barrel deficit this week as summer driving demand keeps inventories well used. Yesterday, the latest API data showed fuel stocks falling by just under 4 million barrels, marking their 4th consecutive weekly decline. If confirmed today that should help offer some support.

Trump Oil Impact

Focusing back on the US elections landscape, Trump’s recent reaffirmed commitment to the fossil fuel industry is not necessarily bullish. With US crude production at record highs, Trump’s ‘drill, baby, drill’ mantra raises fears of pushing the market into oversupply if producers ramp up activity further or new producers come online, suggesting further uncertainty linked to a Trump win.

Technical Views

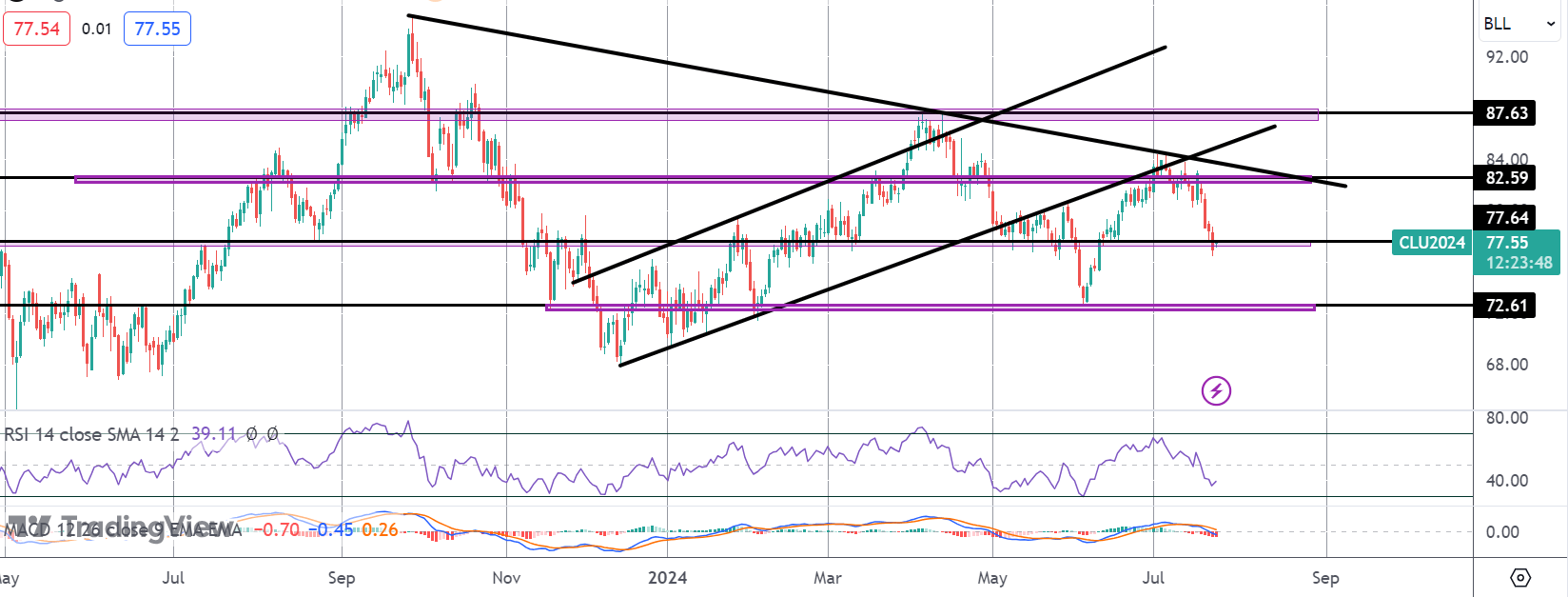

Crude

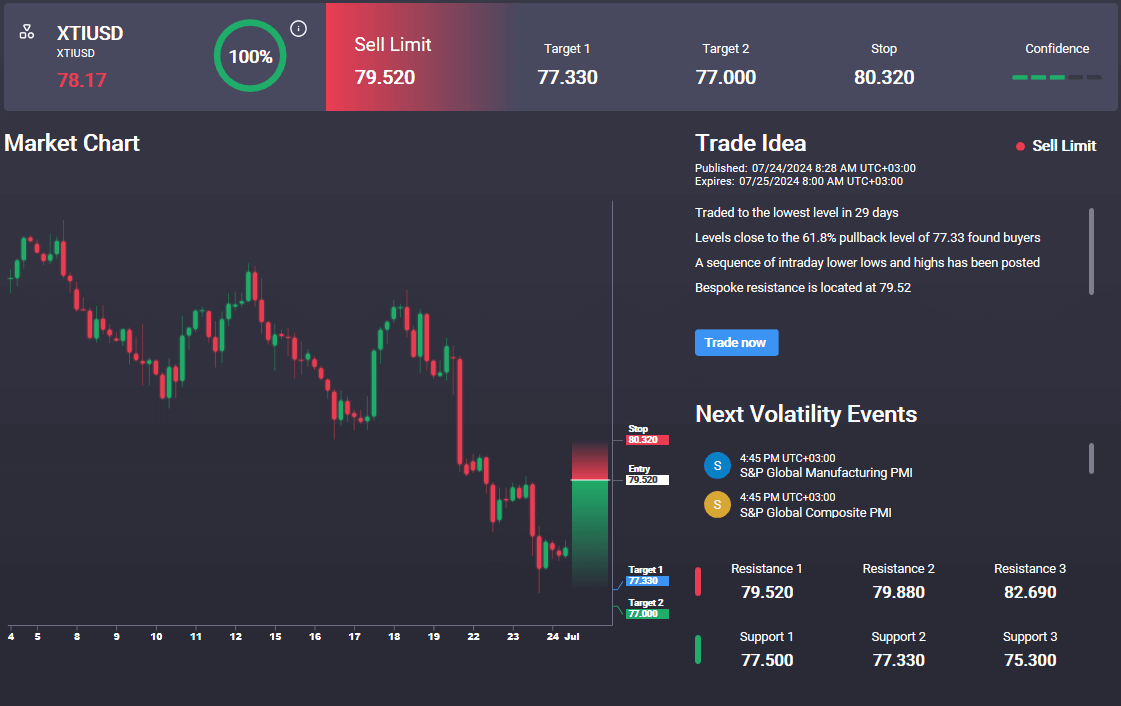

The sell-off in crude has seen the market falling sharply lower this week, price is now probing support at the 77.64 level. If broken, focus turns to deeper support at the 72.61 level next, in line with bearish momentum studies readings. In the Signal Centre today we have a sell limit set at 79.52 suggesting a preference to fade any recovery rally and stay short for deeper levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.