Crude Selling Intensifies Ahead of Trump-Putin Talks

Crude Slides Further

Crude prices are continuing to move lower midweek with the futures market now down more than 11% on the month. The move lower comes despite a fresh downturn in USD and shows that growing optimism over a potential Russia-Ukraine peace deal is now taking centre stage as a key market driver. Trump and Putin are due to meet on Friday and traders are hopeful that the meeting can lay the groundwork for peace ahead of Trump meeting with Zelensky next week.

Russia-Ukraine Peace Talks

If the talks go well and headlines are positive on the back of the meeting, crude prices are likely to slide further as traders adjust their supply forecasts. War in that region remains a key threat to distribution and sanctions on Russia oil have caused significant tightness in the global market. As such, the prospect of Russia crude returning to the market (even if not immediately), should put fresh pressure on crude prices near-term. If talks fail on Friday, however, and a peace deal looks unlikely near-term, this could fuel a sharp short-squeeze in crude with prices vulnerable to a quick spike higher as traders reassess the supply outlook.

EIA Data Due

Looking ahead today, focus will be on the latest EIA inventories update. The group is forecast to report a 1million barrel drawdown, extending the drawdown from the prior week’s 3-million-barrel decline. Given the bigger focus on Russia peace talks, today’s data is unlikely to impact price action much unless we see a big surprise on either side of the market.

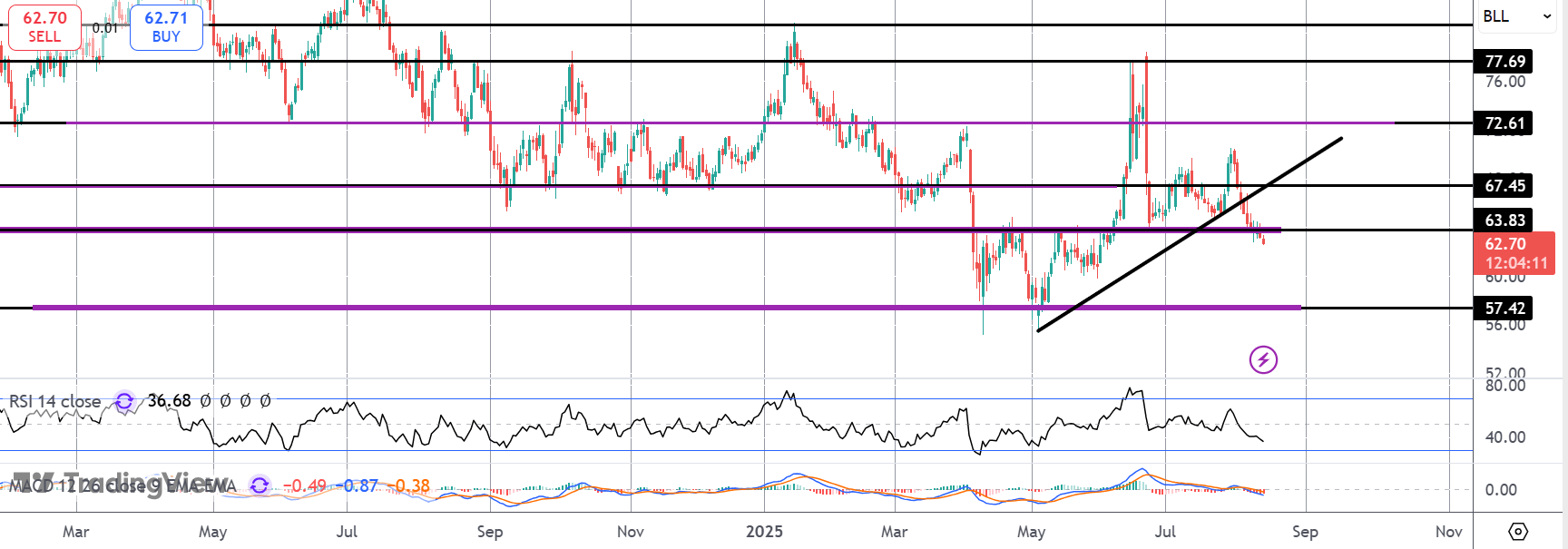

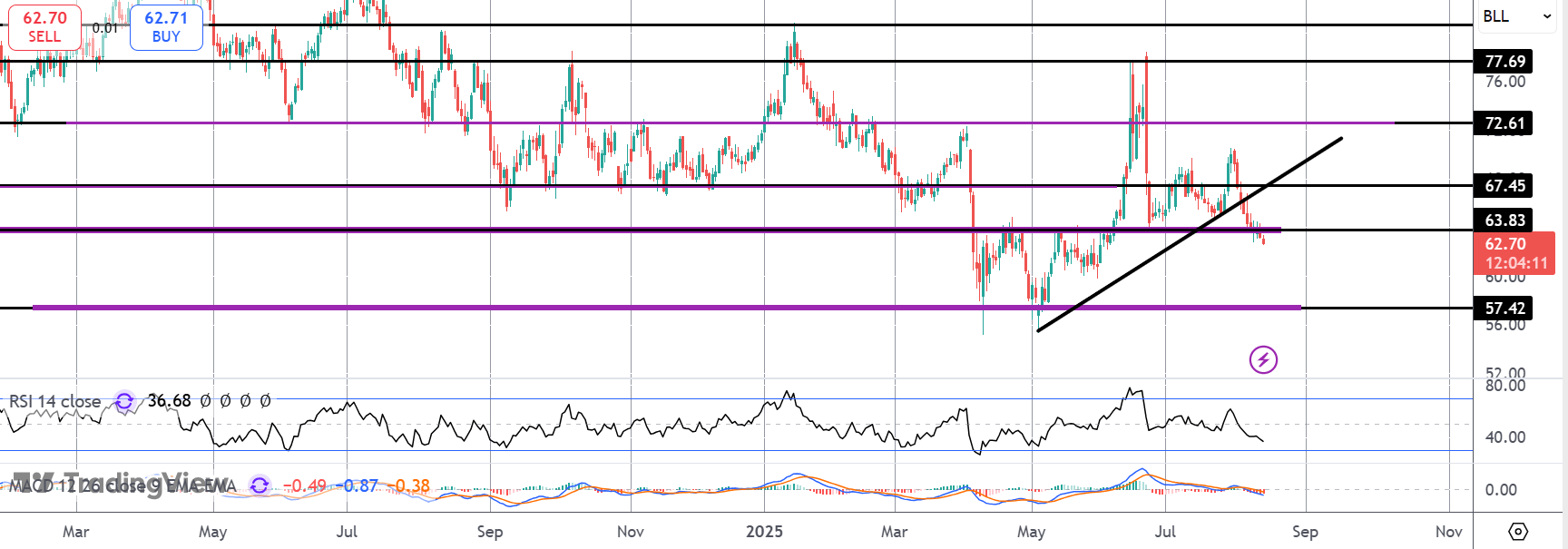

Technical Views

Crude

The sell off in crude has seen the market breaking down below the rising trend line from YTD lows and below the 63.83 support level. With momentum studies bearish, focus is on a continuation lower while below this point with 57.42 the next target for bears.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.