Crude Plunging As Trade War Rages

Crude Selling Continues

Crude oil continues to plunge lower this week with the futures market now down almost 20% from the April highs. Sharply lower global growth forecasts, in response to sweeping US tariffs, have hit the demand outlook for crude. At the same time, OPEC+ has signalled plans to boost crude output next month by more than initially planned. These factors combined have sparked heavy selling in crude with the futures market now trading multi-year lows and showing no signs of recovering as yet.

Trade War Escalation Risks

Retaliatory tariffs from China against the US, as well as chatter of further action to come, mean that traders are sensing a high likelihood of the trade war getting worse before it gets better. Indeed, the EU and UK are yet to respond with their own measures and with Trump vowing not to back down over trade, the near-term outlook for global trade has fallen off a cliff, reflected in the record drops we’re seeing across equities and commodities markets.

Trade Headlines Crucial

Looking ahead, crude prices look likely to continue lower unless we see any signs of amelioration in the trade landscape. Given the low likelihood of this crude futures should see fresh lows this week. US inflation on Thursday might help stem the selling if see any fresh decline in USD (would need a strong CPI undershoot) though if USD continues higher, this will create further headwinds for oil prices near-term.

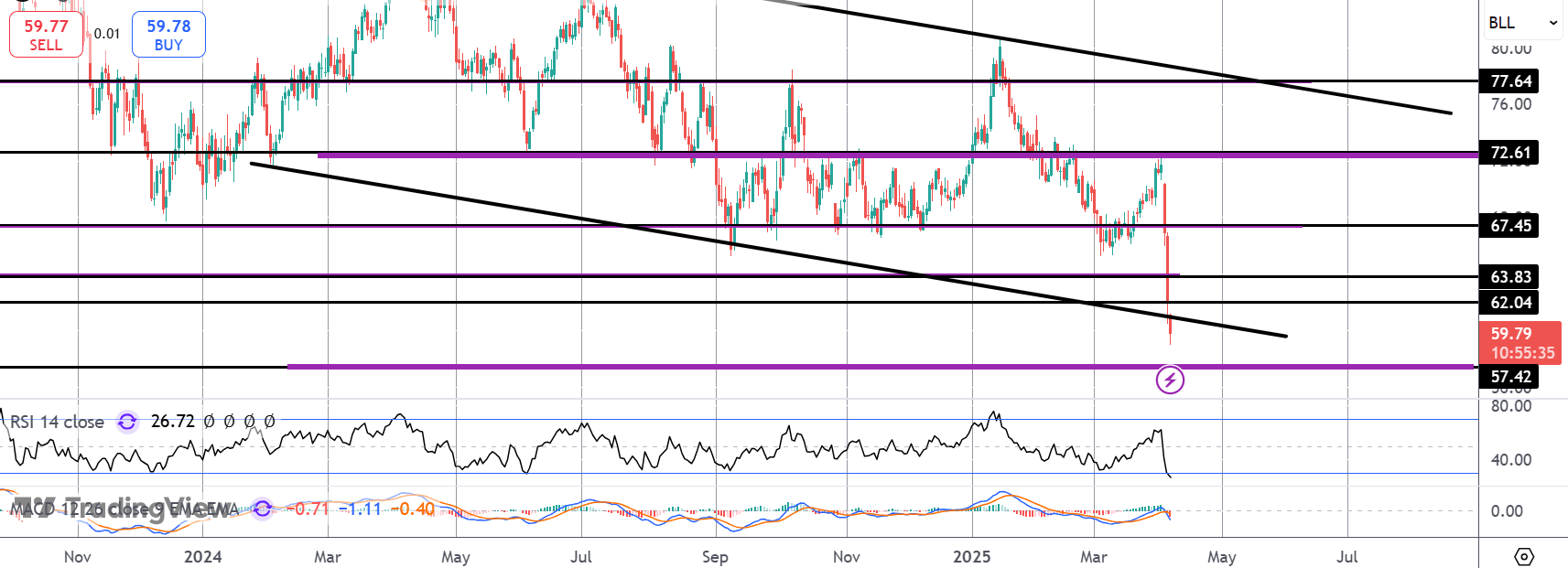

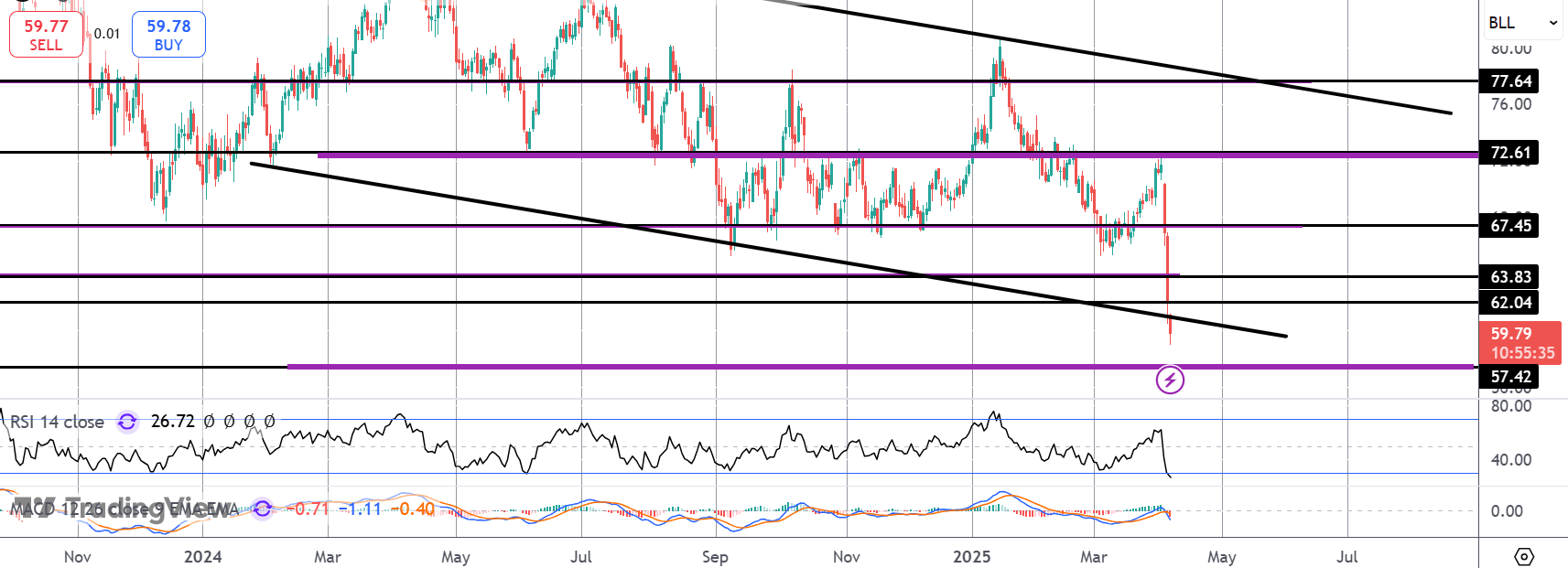

Technical Views

Crude

The sell off in crude has seen the market breaking down through several key support levels and now through the bear channel lows too. While below the 62-64 level support, the bearish outlook remains intact with focus on a test of 57.42 next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.