Crude Ending Week Firmly Higher

US/China Talks

Crude prices are enjoying a strong recovery this week with the futures market on course to end the week more than 10% up of the lows. The rally has been linked to a softening of US/China trade tensions and rising optimism that the two economic superpowers can agree a deal (or at least an extension of terms) ahead of the upcoming Nov 10th tariff deadline. The key focus near-term will be the scheduled talks between US/China officials in Malaysia later today. If these talks progress well and we see positive headlines through the weekend, that should keep crude supported with the potential for a gap higher at the open on Sunday and a furtehr ally across next week. If talks falter, however, the market is vulnerable to a sharp drop lower as risk sentiment sours and hopes of a deal fade. As such, plenty of volatility risks this weekend.

US Inflation

The rally in crude this week shows traders are looking beyond a firmer US Dollar and focusing on the US/China trade story, However, today’s US inflation data could bring USD back into the spotlight. A fresh rise in inflation should propel USD higher today, if confirmed. Additionally, any upside surprise could see accelerated USD buying which might hamper gains in crude for now. On the other hand, if we see a downside surprise today, this will lead to an uptick in Fed easing expectations ahead of the FOMC next week. In this scenario, USD is likely to cool into the weekend which should lend additional support to crude.

Technical Views

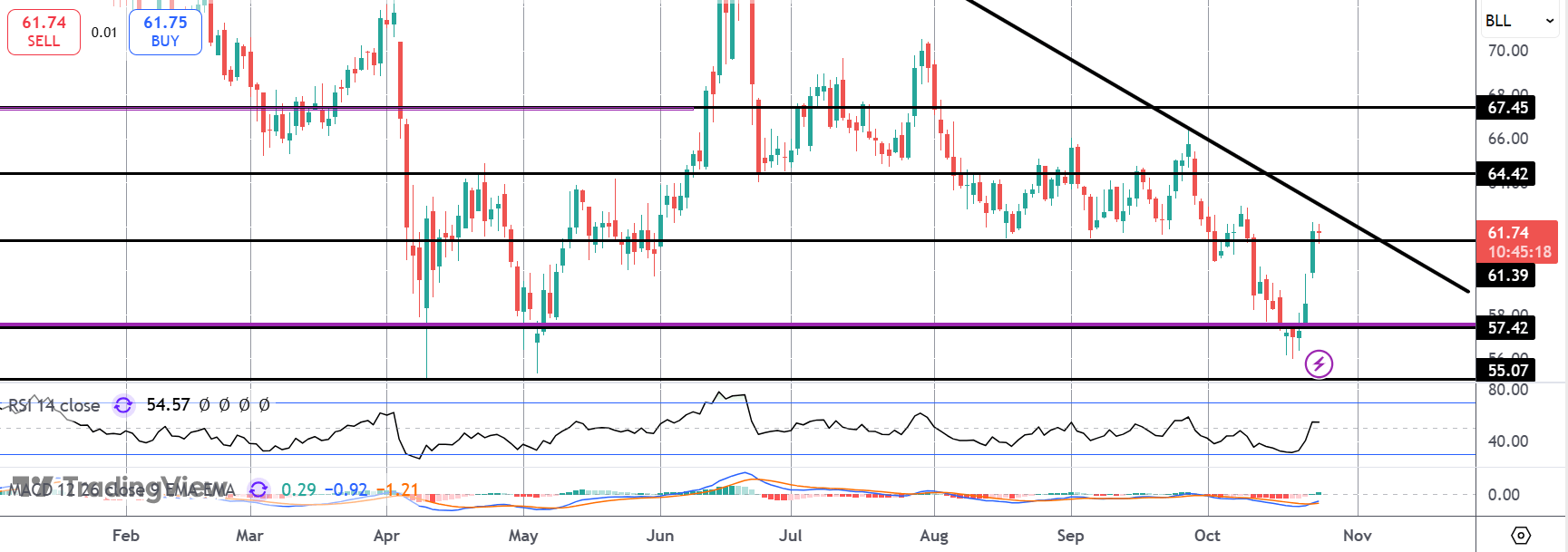

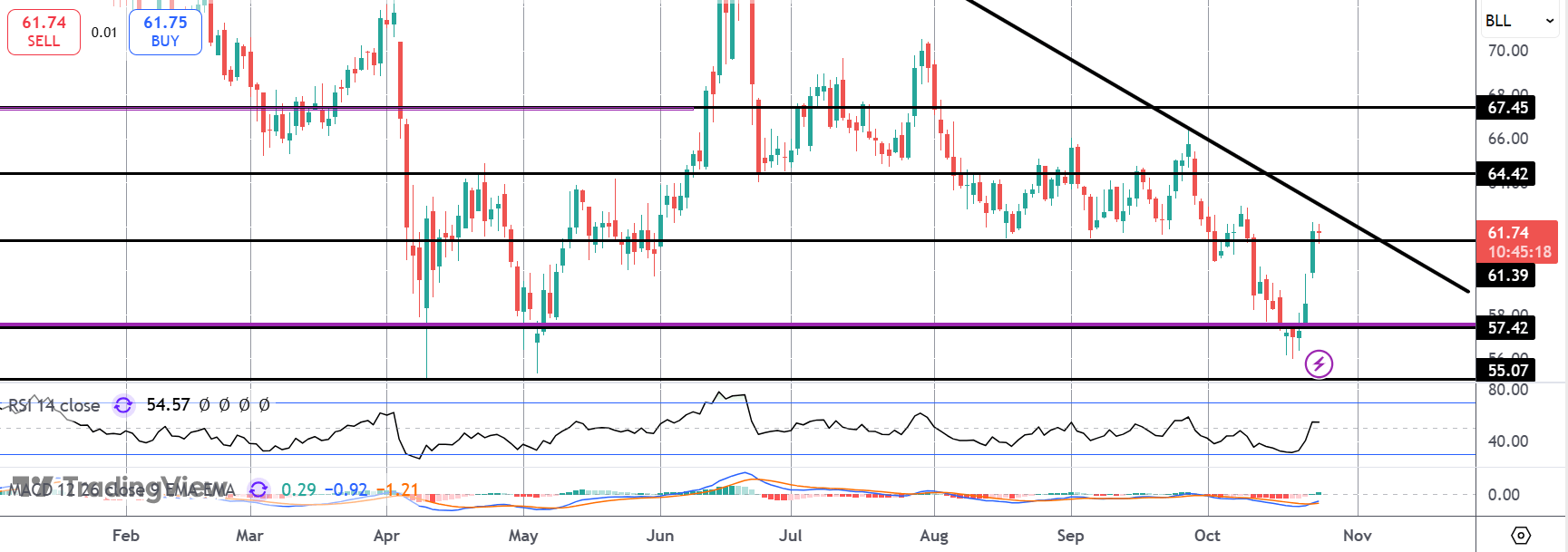

Crude

Prices have turned sharply higher off the latest test of YTD lows. The market is now testing above the 61.39 level, with the bear trend line sitting just above. If we break higher here, 64.41 will be the next hurdle for bulls ahead of the higher level at 67.45. Momentum studies are turning bullish here encouraging furtehr upside near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.