Chart of The Day NZDUSD

Chart of The Day NZDUSD

NZDUSD Probable Price Path & Potential Reversal Zone

NZD: As risk aversion in the market heats up, commodity currencies such as the New Zealand dollar may see increased volatility in the short term. The New Zealand dollar strengthened against the US dollar Friday, rising 0.3% to 0.719, a slight increase of 0.1% throughout the month, and positive returns for three consecutive months. Chinese Manufacturing Purchasing Managers' Index was worse than expected. The New Zealand dollar fell by as much as 0.6% to 0.715 this morning.

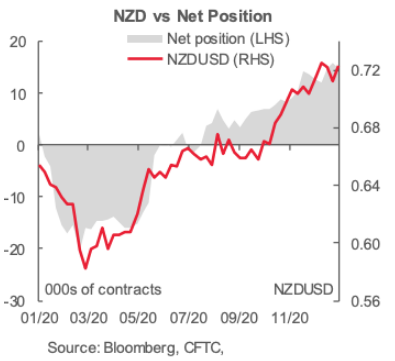

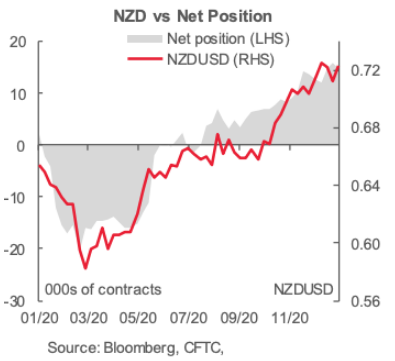

According to CFTC data, as of last Tuesday, the net long position of New Zealand dollars held by institutional investors decreased by about 1,700 to slightly less than 6,000. There have been six weeks of decline in the past seven weeks; the net long position of New Zealand dollars held by leveraged funds increased by about 1,300 reaching more than 6,100, highest levels since 2018

New Zealand will release employment data on Wednesday, and the unemployment rate may rise 0.3 percentage points to 5.6%; Thursday it will release December building permits and February business confidence index.

USD: The global stock market closed down Friday, and the market is still watching the US stock market’s "short position" activity of institutional investors. The U.S. dollar exchange rate developed separately against major currencies. The U.S. dollar index closed up 0.1% to 90.6, but rose 0.4% on a weekly basis. In January, it rose by 0.7%, ending the two-month decline. U.S. 10-year Treasury bill yields rose 2 basis points to 1.066%.

10 Republican senators put forward an economic stimulus package of about US$600 billion, believing that the package is more targeted and will gain support from Democrats. The details of the plan will be announced today. Republican lawmakers have opposed President Biden’s $1.9 trillion stimulus package, including raising the national minimum wage and expanding aid to state governments.

Robert Kaplan, President of the Dallas Federal Reserve Bank, predicts that there will be very heated discussions within the Fed on the bond purchase plan. He also promised to remain patient in judging when the size of bond purchases can be reduced. He predicts that the US economy will grow by 5% this year. This growth rate depends on the fiscal measures provided by the US government

In the US today the January Institute of Supply Management Manufacturing Index will be reported. The market is expected to slightly fall to 60 from a 33-month high of 60.7. Most watched this week will be US jobs data released Friday.

From a technical perspective the NZDUSD appears to be in the latter stages of an ABC corrective pattern which should see prices test trend support ahead of the .7000 handle, bulls will be watching for bullish reversal patterns here to re-engage bullish exposure setting a base to target a retest and breach of the prior cycle highs at .7300 en-route to a test of .7450 and the projected ascending trendline resistance.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!