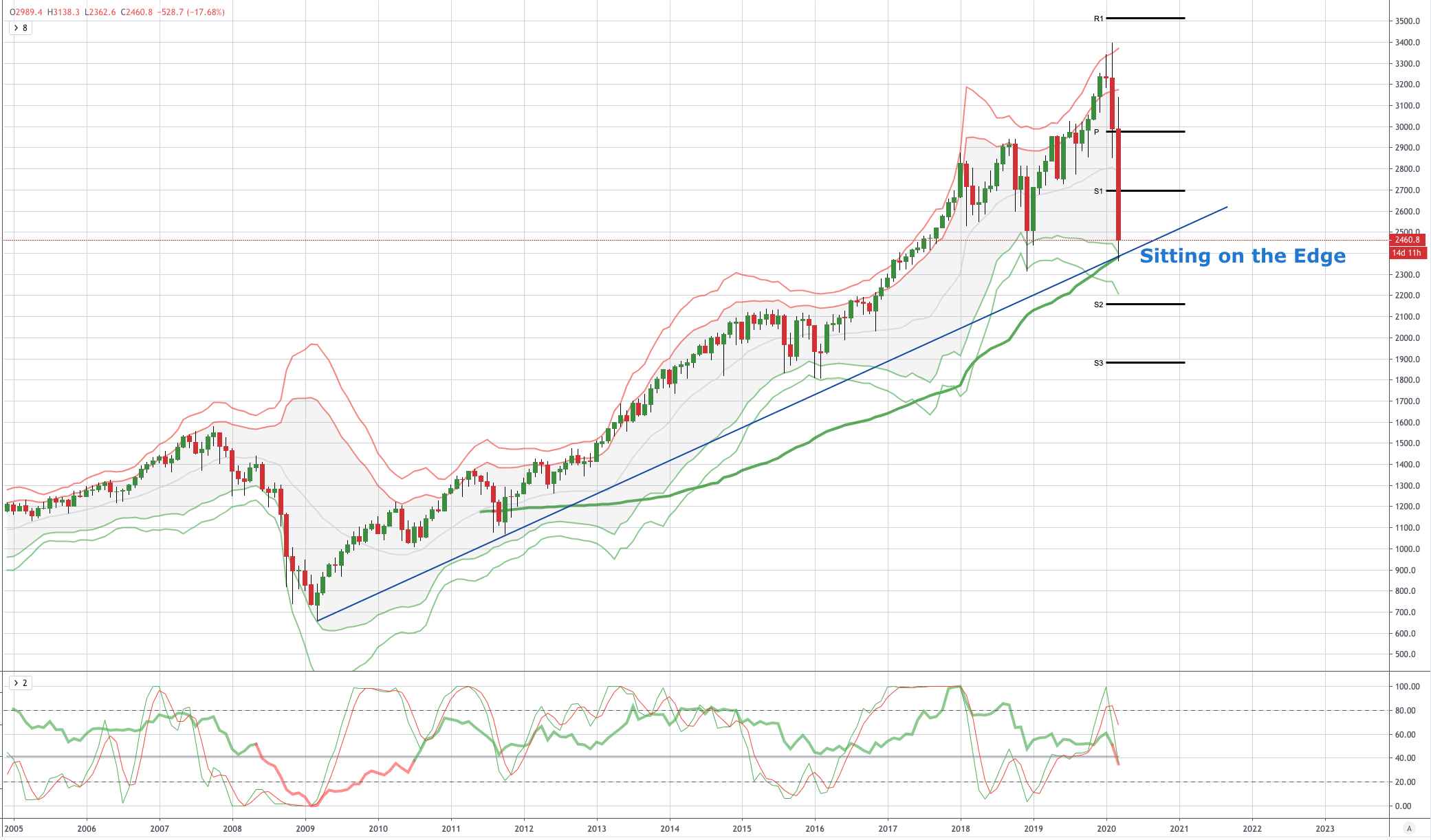

Chart of the Day US500 (S&P500)

S&P500 Sitting on the Edge

Investment Banks Credit Suisse & JPMorgan highlight the increasing potential for a bear market rally to develop eminently

JPMorgan note

“Time for a bear market rally whipsaw?

CTAs now short equities

- Systematic strategies have sold vast amounts of equities and run their lowest exposure levels this cycle based on our models.

- Volatility Targeting funds’ equity exposure is now at its lowest level since the GFC and CTAs’ equity beta plunged to flat

- However, our models suggest exposure is likely lower and CTAs are net short, given momentum signals are negative across the term structure for all major global indices (the difference is due to data lags, the lookback window to calculate the beta, noise from large moves in other asset classes, etc.)”

Credit Suisse also highlight

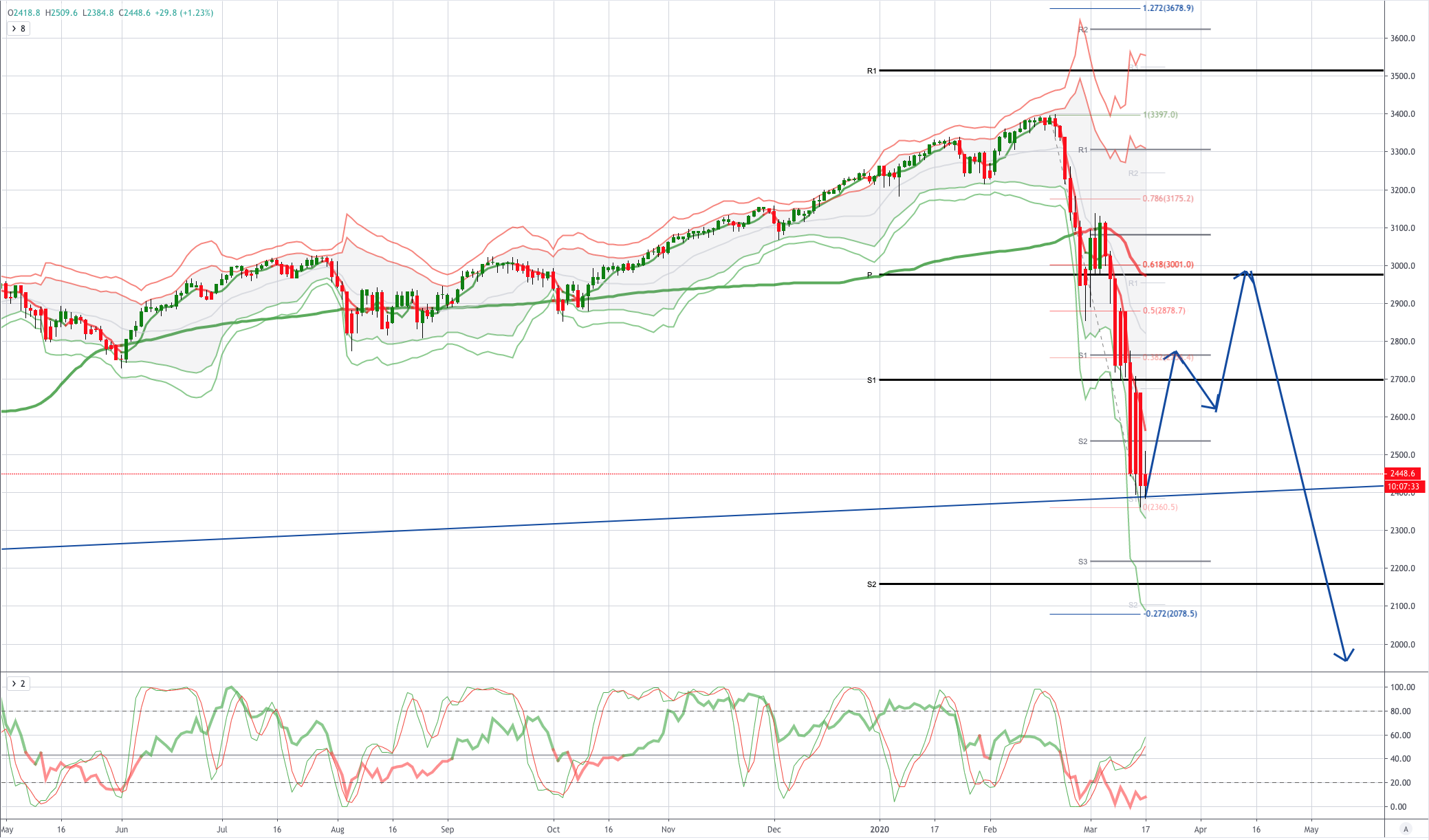

“after 3 weeks of aggressive selling...This community was LONG $50b of S&P just 3 weeks ago (99th percentile in terms of historical length)...they are now SHORT -$21b S&P (4th percentile rank in terms of length). We expect CTAs to COVER (they are now buyers) $4b of S&P over the next week taking their shorts to -$17b. First level covering meaningfully accelerates is LT threshold of 2973 which is clearly a long ways away at this point”

From a technical & trading perspective the S&P500 continues to test the monthly trendline support from the 2009 lows along with symmetry swing support which represents an equality in price decline from the 08/09 declines versus the current price drop. As we continue to see this trendline defended on a closing basis combined with the positioning information above, it increases the potential for a near term short covering rally to ensue, we could reasonably expect a three wave correction to ultimately target a retest of the yearly pivot point and the 50/61.8% Fibonacci retracement zone towards 3000, if this pattern plays out this zone will be pivotal in defining the next market phase. Without the catalyst of vaccine or cure it is likely sellers will emerge for the next leg of downside price discovery. Updates will follow in my weekly live analysis sessions register here to join me as I share the perspectives and analysis of a professional trader with 15yrs experiences in navigating both bull and bear markets profitably

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!