Chances of a Fed June Pause Grow, Focus Shifts on July Decision

The US inflation report for May could have caused serious market tremors yesterday, but this time the market's forecast was accurate. Core inflation accelerated to 0.4% on a monthly basis, while headline inflation slowed down to 4.0%. Considering the market consensus that the FOMC will skip a rate hike in June unless there are surprises in the incoming data, the chances of this outcome increased, which actually weakened the dollar a bit. However, further trading showed that the equilibrium before the FOMC is at 1.08 for EURUSD and 103 points for the Dollar Index (DXY). On the daily chart, it looks like that Euro’s strengthening against the dollar is at its initial stage:

The overall market reaction to the CPI report can be characterized as an increase in risk demand, as G10 currencies sensitive to business cycle fluctuations showed the highest intraday returns yesterday. For example, NOK and SEK performed well, which usually happens during rotation in search of yield within Europe. At the same time, the yen weakened and, overall, it has not followed the general pattern of strengthening against the dollar since the beginning of June. The technical chart of the yen index indicates consolidation before a possible downward breakthrough:

For USDJPY, this will roughly correspond to the level of 141.80-142.00, which was the peak in November 2022. According to the previous currency intervention, the tolerance limit of the Yen depreciation set by the Japanese authorities is 145 yen per dollar. The Bank of Japan's meeting on Friday could be a potential catalyst for the yen weakening, and the "suspicious" range of USDJPY, despite the dollar weakness, may indicate growing chances of disappointment with the decision on Friday, meaning that hawkish policy changes are unlikely to occur.

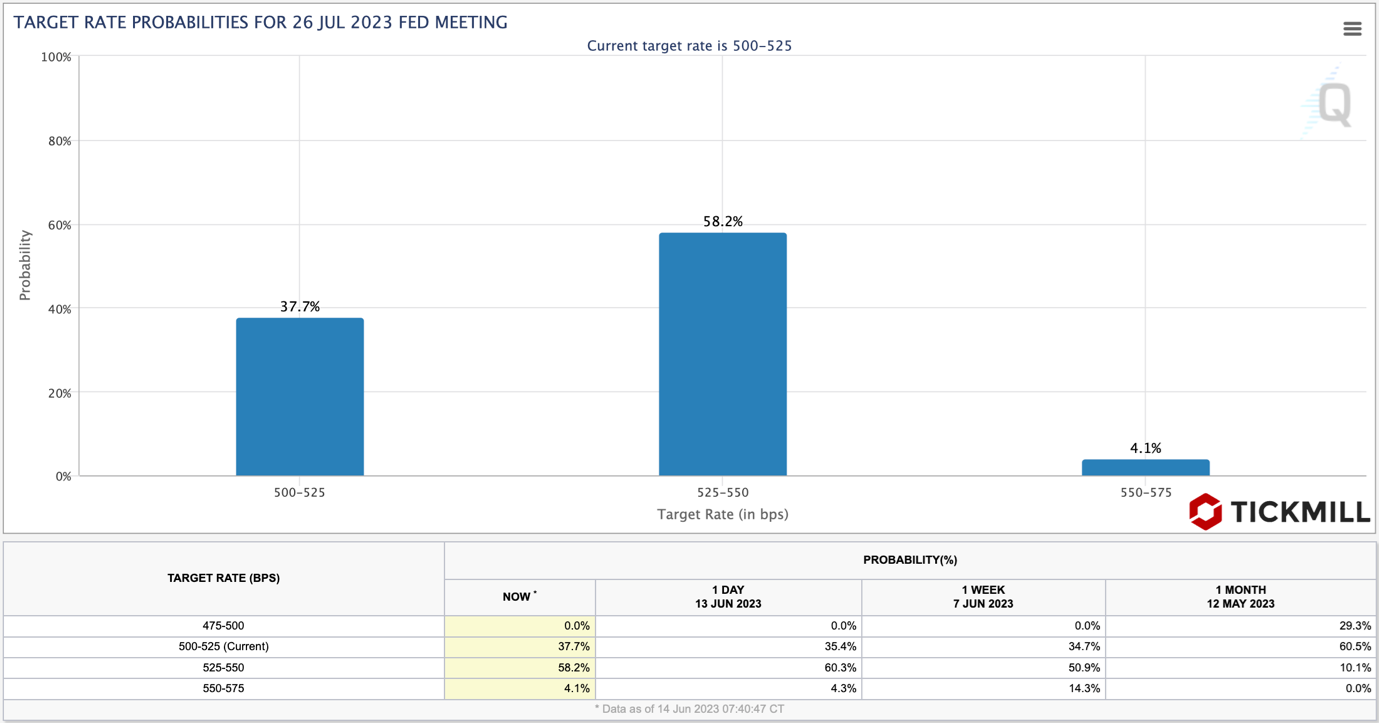

In addition to the FOMC statement and Powell's press conference, the markets will likely pay attention to the Dot Plot (expectations of top Federal Reserve officials regarding interest rates in 2023, 2024, and the long-term period). If the median forecast indicates another rate hike in 2023, the chances of a July hike will increase, which should support the dollar. Currently, the chances of tightening on July 26 are estimated at 58.2%, while the chances of a pause are at 37.7%:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.