Can NASDAQ Recover Following NVIDIA Beat?

Stocks Boosted by NVIDIA Results

Risk assets are climbing today as markets enjoy fresh upside impetus on the back of a bumper set of results from chipmaker NVIDIA. The company topped both earnings and revenues forecasts yesterday, which were already set well above the prior quarter’s results. On the numbers front, NVIDIA posted Q4 EPS of $5.16, above the $4.593 the market was looking for. Similarly, revenues were seen at $22.103 billion vs $20.395 billion.

Nasdaq In the Green

With the US Dollar softening today and the tech sector pushing higher, the NASDAQ looks set to enjoy a return to the upside following the recent correction lower. Looking ahead today, traders will receive the latest set of US PMI figures. However, unless we see a strong upside beat, these figures shouldn’t derail the current rally in stocks.

Bullish Outlook

Goldman Sachs yesterday called NVIDIA ‘the most important stock in the world right now’ with others referring to it as a generational leader. The company’s position at the forefront of the AI drive has garnered plenty of attention for the stock and with results continuing to surprise to the upside, the outlook remains firmly bullish for now. Indeed, for the current quarter, the company offered guidance which was around three-times higher than that of Wall Street.

Technical Views

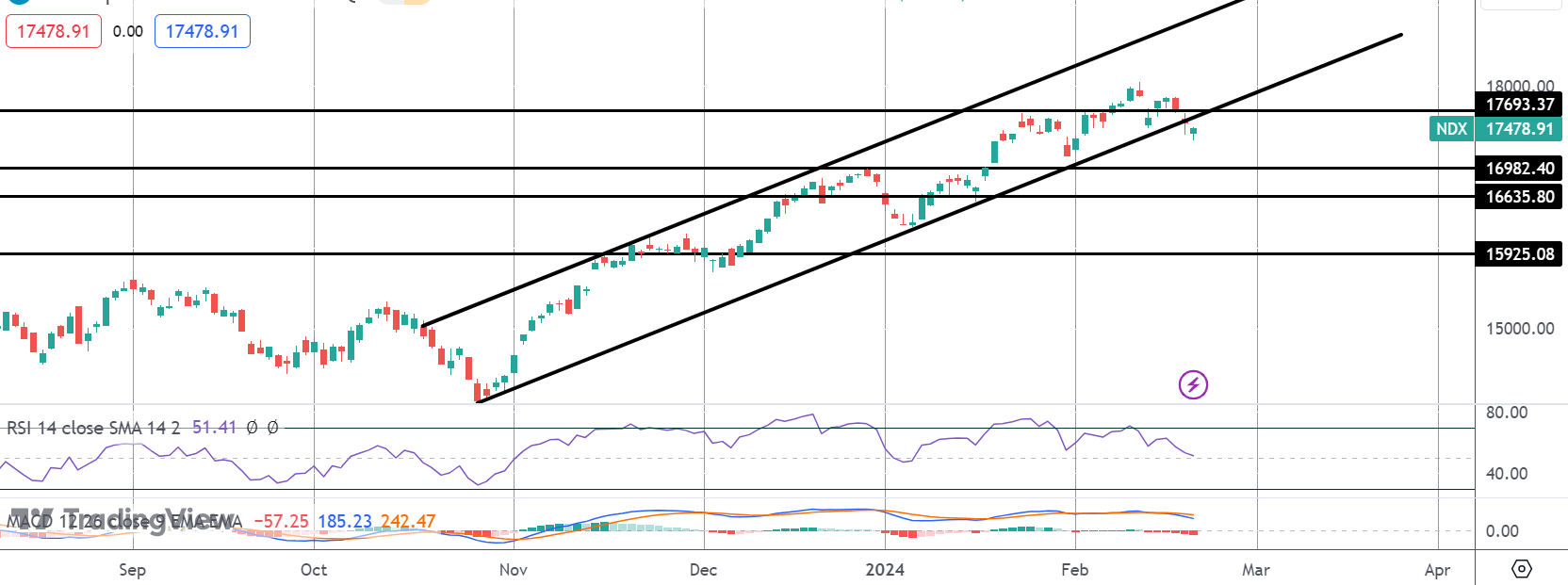

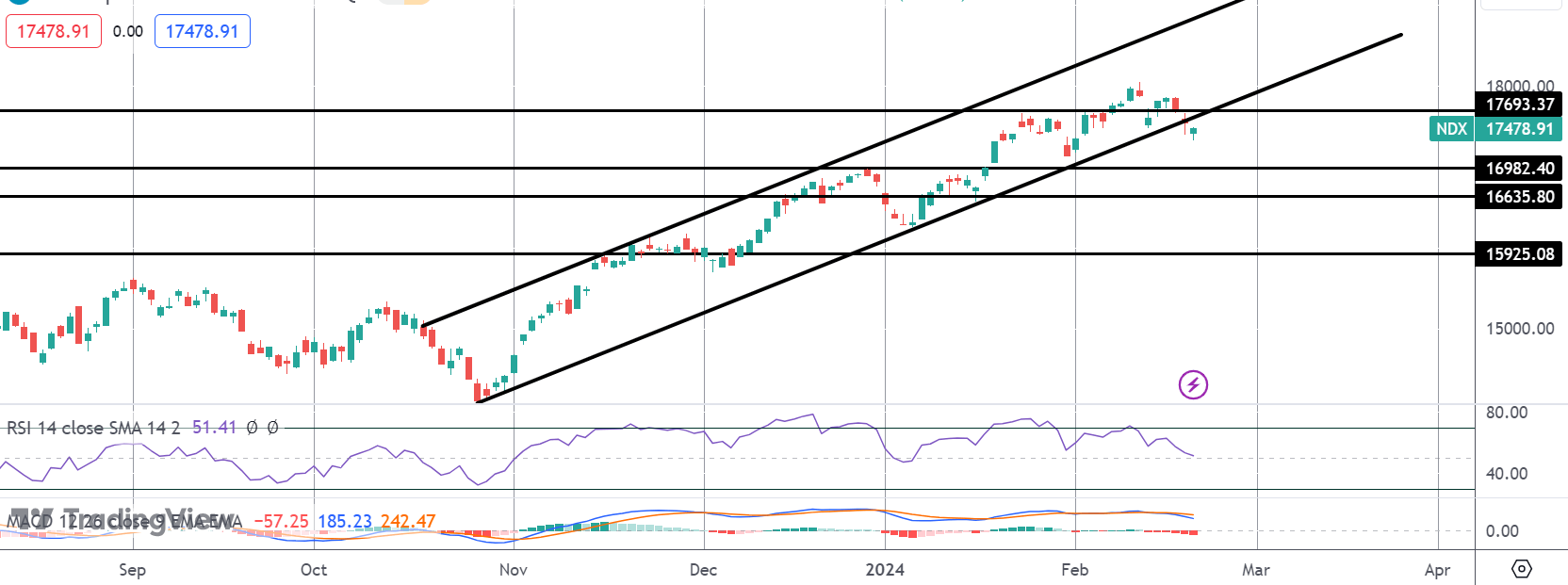

Nasdaq

The correction lower from highs around the 18000 level has seen the market testing below the bull channel. Price has found support for now, however, keeping focus on further upside. However, momentum studies are bearish here, highlighting risks of a deeper move lower. 16982 – 16635 will be the key support area bulls need to defend to avoid risks of a trend reversal.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.