BTC Rally Fades on Mt. Gox Transfers

-1716887902.png)

BTC Under Pressure

Bitcoin prices have come under fresh selling pressure today. Following a firm push higher yesterday, BTC futures have shed almost 5% from Monday’s peak. The driver behind the move is news that the failed crypto exchange Mt. Gox is beginning to offload the roughly $9 billion worth of Bitcoin held in its bankruptcy estate.

Mt. Gox Crypto Moves On Watch

According to data from industry analytics group’s CryptoQuant and Arkham Intelligence, all 137k units of Bitcoin were moved from the exchanges wallet to begin the process of returning them to creditors. The key question now is whether those receiving the digital asset will hold onto them or sell them. If we se high levels of selling, this will weigh on BTC driving prices lower near-term.

Bullish Outlook Remains

Despite the current focus on this situation, the price reaction from any reported selling is likely to be short-lived. The broader macro backdrop remains bullish for BTC with US regulators looking increasingly friendly towards the crypto market, institutional demand continuing to rise and the Fed expected to begin easing monetary policy this year.

US Inflation

Looking ahead this week, US PCE data on Friday will be closely watched. With USD currently under pressure, any fresh downside in price data should spur further selling in the Dollar, helping underpin risk appetite and lead BTC higher.

Technical Views

BTC

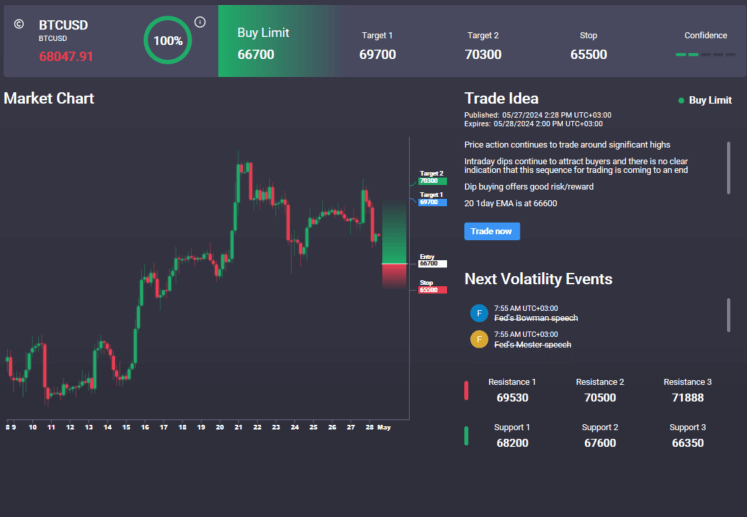

The rally in BTC has stalled for now into a test of the bear channel highs. Momentum studies are weakening here, suggesting growing risks of a pull-back lower. Key sup[ort levels to note are 66.625 and 64.540, with bulls needing to defend this area to keep the near-term focus on a breakout higher. Notably, we have a buy limit in the Signal Centre today set at 66.700, suggesting a preference to buy into any further weakness.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.