BoJ Needs to come up with more Easing to Look “Strong”

For an ordinary investor, the rally of Nikkei 225 index to the yearly high on Thursday and Yen status as a model of stability in FX market seem to be welcomed achievements of the BoJ’s policy. However, for the Central Bank itself, this represents a serious dilemma, since the policy inexplicably works only to “please the market”, while the problem of ensuring normal and stable inflation has remained unresolved for many years. But if there is somebody to blame for this, it is the BoJ itself.

At the meeting in September, Kuroda stated that the Central Bank favors to pursue a preventive policy that should play the role of insurance. This idea was also quite synchronously voiced by other world central bankers, which suggests coordination of actions and methods. It is reasonable to assume then, that one Central Bank can lead the others in some common policy. A preventive policy means a concrete response (that is, monetary expansion) to exacerbated domestic and external risks before signs of weakness appear in the statistical data. And there are such risks for Japan - a slowdown in the economies of the United States, the Eurozone, and China, which is accordingly confirmed by the negative shifts in the economic data and outlook for September - October period and dovish decisions of Central Banks of those countries.

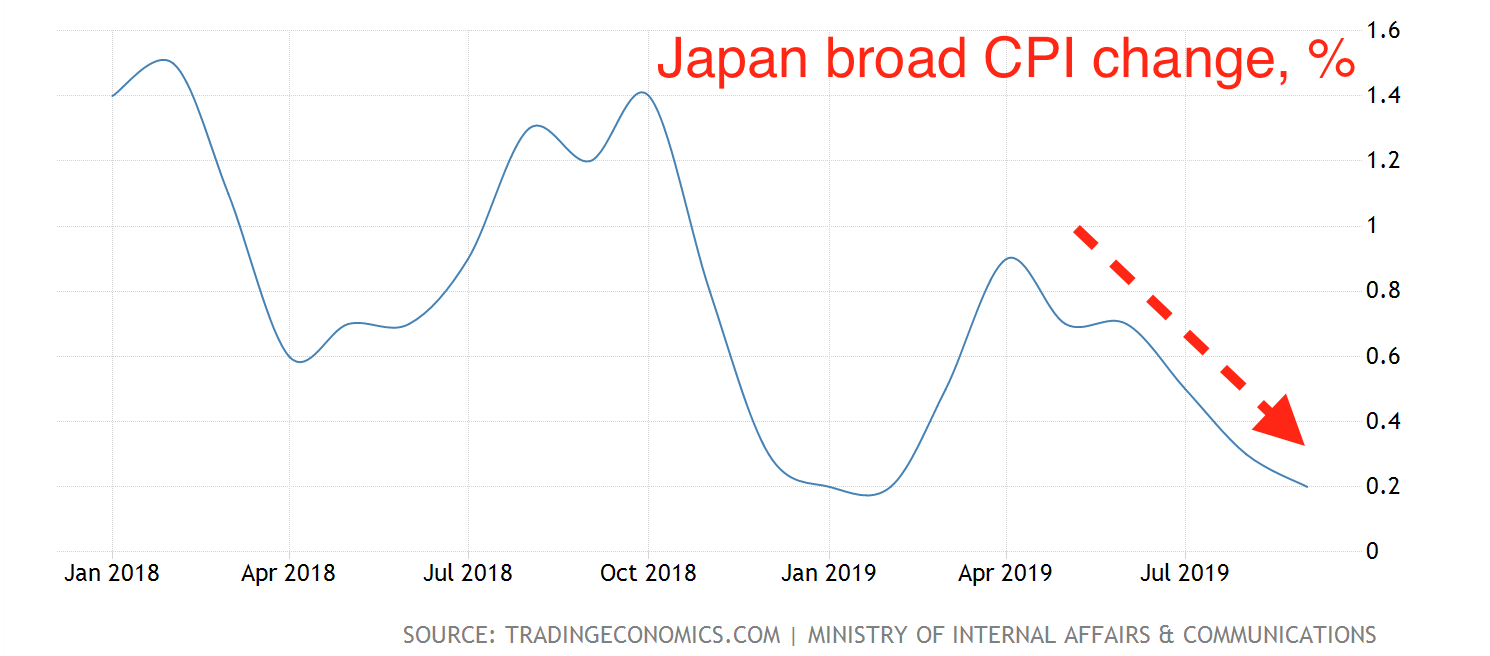

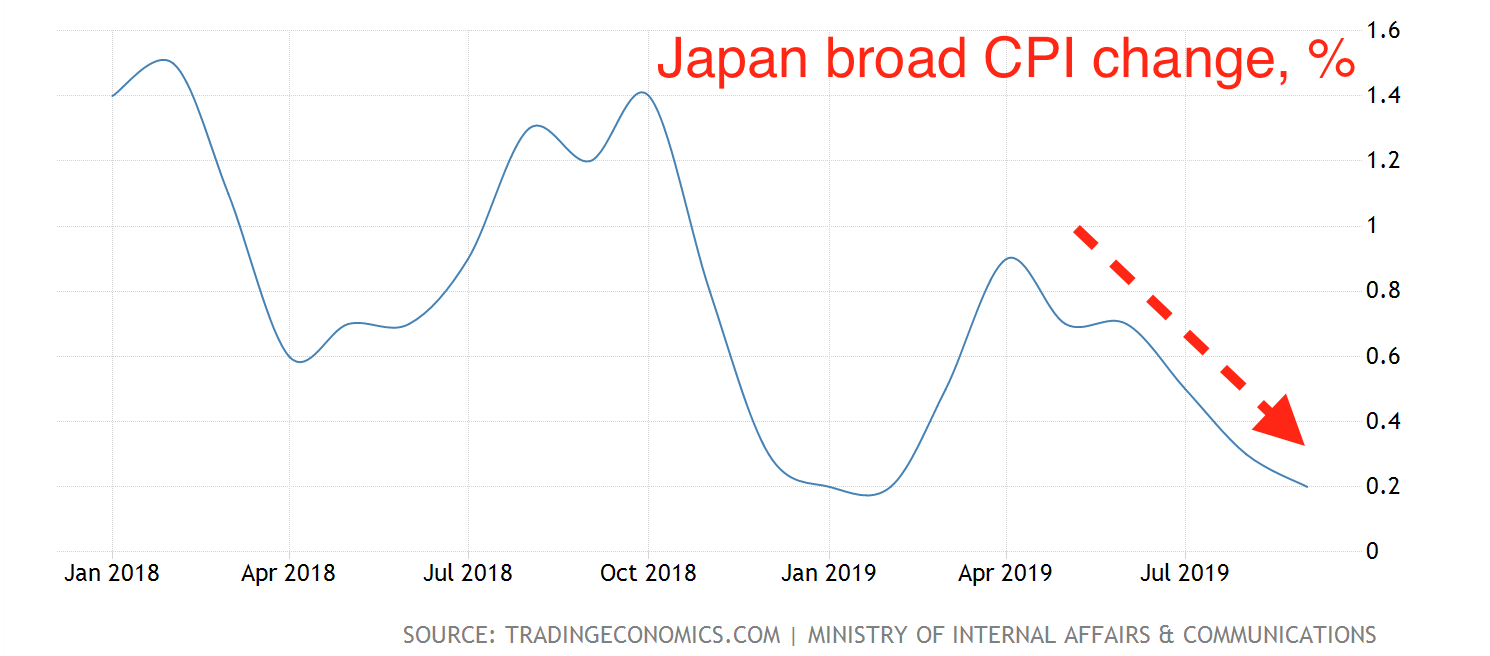

Therefore, an indication in September about the growing role of preventive actions in the policy of the BoJ suggests that Kuroda is likely to come up with concrete proposals on Thursday, that is, monetary expansion in some traditional (interest rate cut) or non-traditional form (increase in operations on the bond market and the stock market targeting more lower long-term rates) or their mix. Inflation, which has sharply slowed down since April 2019, also tells the BoJ to push the gas pedal - in just six months, inflation fell from almost 1% to 0.2% and momentum is expected to fade further:

The Central Bank may also prefer to keep more ammo till the risks or slowdown become clearly visible. However, trying to avoid concrete actions at the upcoming meeting, the Bank of Japan risks creating the impression of empty policy reserves. To kill two birds with one stone, the Central Bank may come up with a combination of a small reduction in interest rate and an increase in ETF purchases by 1 trillion yen (9.2 billion dollars). Now the Central Bank is buying up assets in the market at a rate of 6 trillion yen (55.2 billion dollars).

The September figures from the Japan Investment Trusts Association showed that the total net worth of ETFs rose 3.9 trillion to a record 104.3 trillion yen. However, 3.8 trillion yen accounted for rising stock prices, and net inflows amounted to less than 100 billion yen. If we subtract 140 billion yen of the Bank of Japan's purchase of funds from this value, the net cash inflow was even negative. As you can see, an increase in purchases of ETFs by the Central Bank may have obvious consequences in terms of price distortions in the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.