Ueda Speaks on Rates

Following a sharp downturn on Friday, USDJPY is pushing higher once again today following remarks from BOJ governor Ueda. The BOJ chief refrained from giving any indication that the bank will press ahead with fresh tightening when it meets next month. In his last speech before that December meeting, Ueda warned that policy decisions will remain data dependant and subject to the path of economic activity.

JPY Bulls Left Empty Handed

Ueda’s comments clearly disappointed those who were looking for a more hawkish signal from the bank. The Yen has collapsed again in recent months with USDJPY trading up from lows around 140 in September to around 155 currently. Recently, there has been growing chatter around the potential for fresh intervention from the BOJ to help stem the weakness in the Yen.

Limited BOJ Intervention Risks

However, with Ueda saying the bank doesn’t see a large buildup of carry positions compared with the period before the sell off in July, the prospect of intervention seems dim ahead of December. Indeed, in a note issued by Citi today, the bank sees no likelihood of intervention unless USDJPY tops 160 but does feel the BOJ will hike again in December and by a further .5%. If BOJ officials start to hint at such a move ahead of the December meeting, this could help JPY recover near-term but will create a lot of pressure for the bank to follow through and deliver or risk a fresh plunge in JPY.

Technical Views

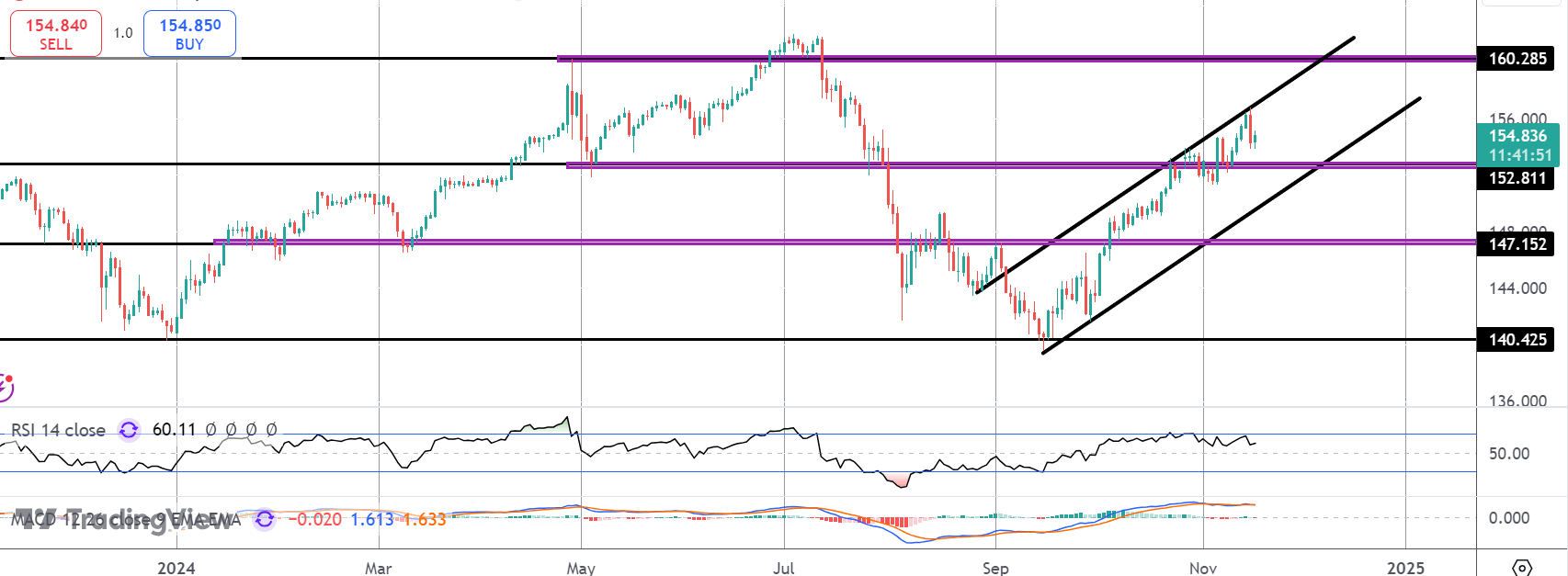

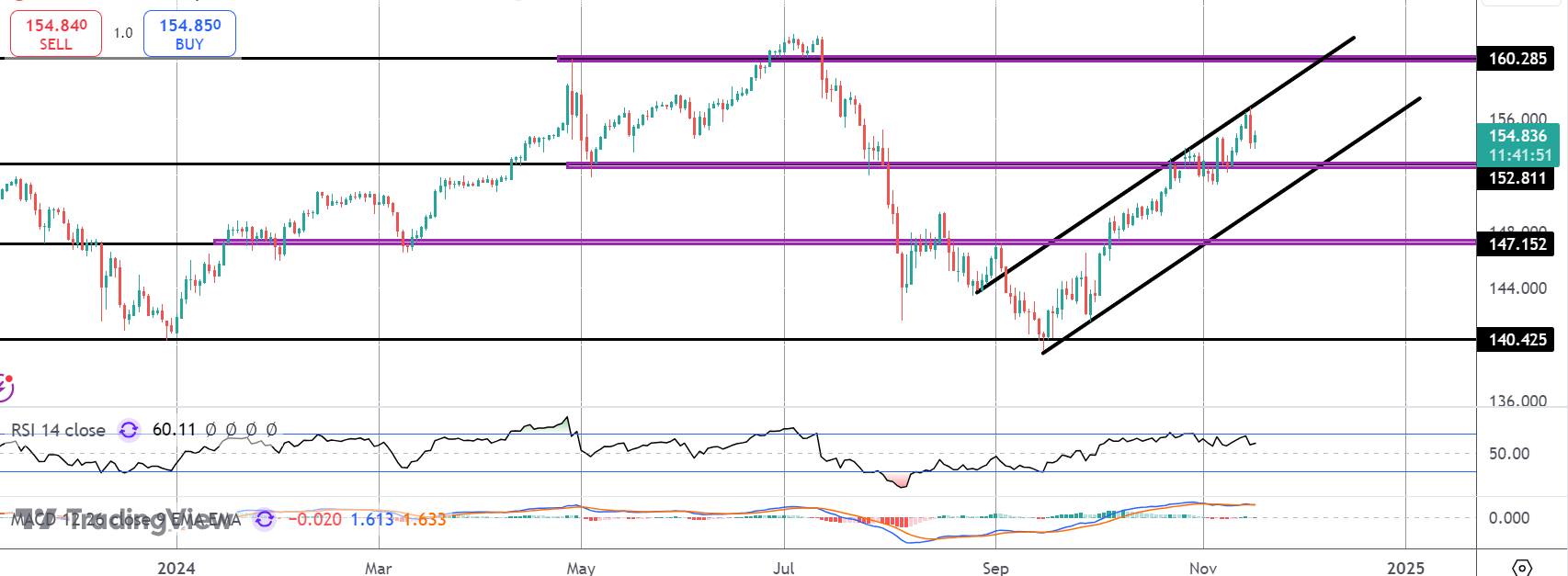

USDJPY

For now, the pair continues to push higher within a tight bull channel. While price holds above the 152.81 level, look for a test of the 160.28 level next. To the downside, if we break below 152.81 and the channel lows, 147.15 is the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.