Bitcoin Traders Battle Around Key Level

Bitcoin Attempting to Recover

Bitcoin futures are hovering around a crucial level as we kick off the new week. BTC was seen breaking sharply lower last week, piercing beneath the 57,215 level, before buyers stepped in to drive price back up off lows. Continued buying through early European trading on Monday is seeing price attempting to break back above the level currently. The move lower last week came amidst growing supply pressure linked to heavy Bitcoin selling by US and German governments (seized asset sales) and unloading of the Mt. Gox bankruptcy estate. The combined value of potential supply here is around $22 billion. Indeed, if it weren’t for the plunge lower in USD, BTC could be firmly lower.

USD Focus

While the current supply/demand backdrop looks bearish for BTC, there are clear bullish drivers to be recognised. Expectations for forthcoming easing from the Fed have surged higher over the last week as traders digest recent economic data. Friday’s jobs data fed into dovish expectations with the unemployment rate rising and wages falling again. Looking ahead this week, if we see Thursday’s US CPI data weaken for a third consecutive month, this should seal expectations for a September cut, weighing sharply on USD.

Bullish Longer-Term View

While BTC price action might prove choppy near-term as asset sales continue, if the Fed pushes ahead with expected easing over the remainder of the year this should see BTC recovering firmly through Q3/Q4. Indeed, BTC could end the year firmly higher if US inflation continues to fall and we see the Fed cutting rates more than once.

Technical Views

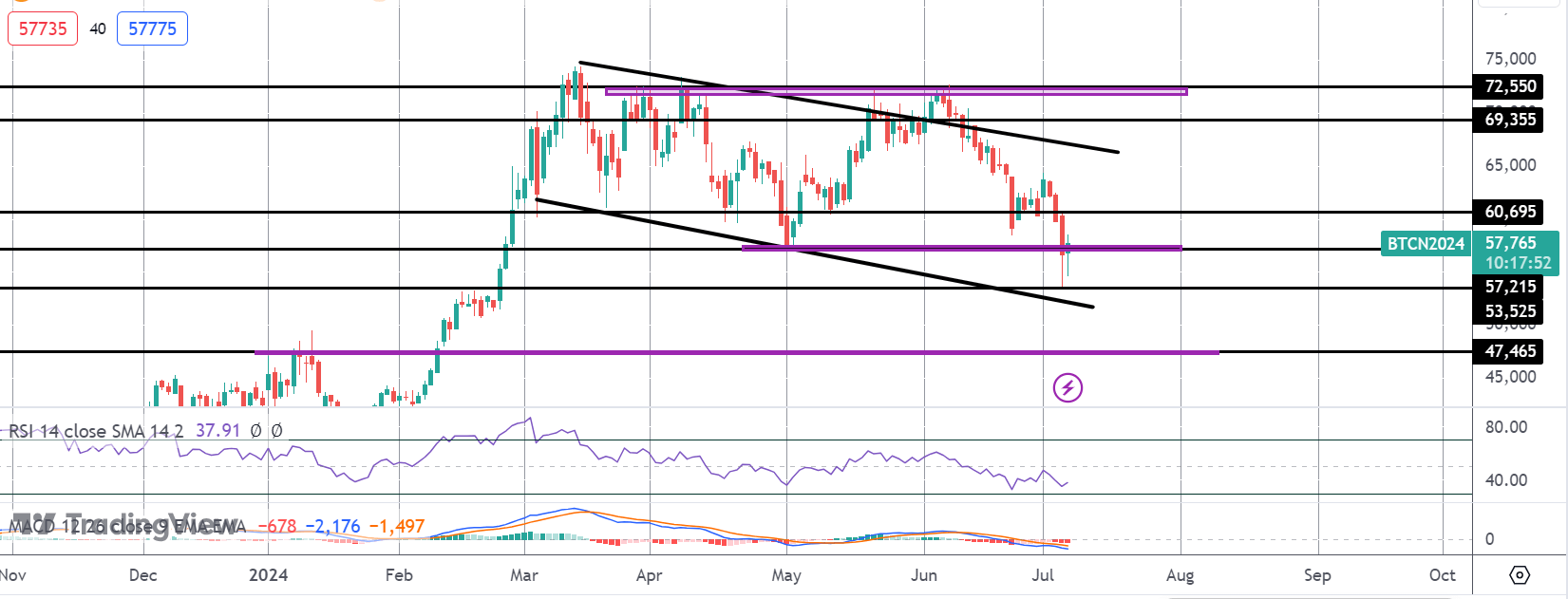

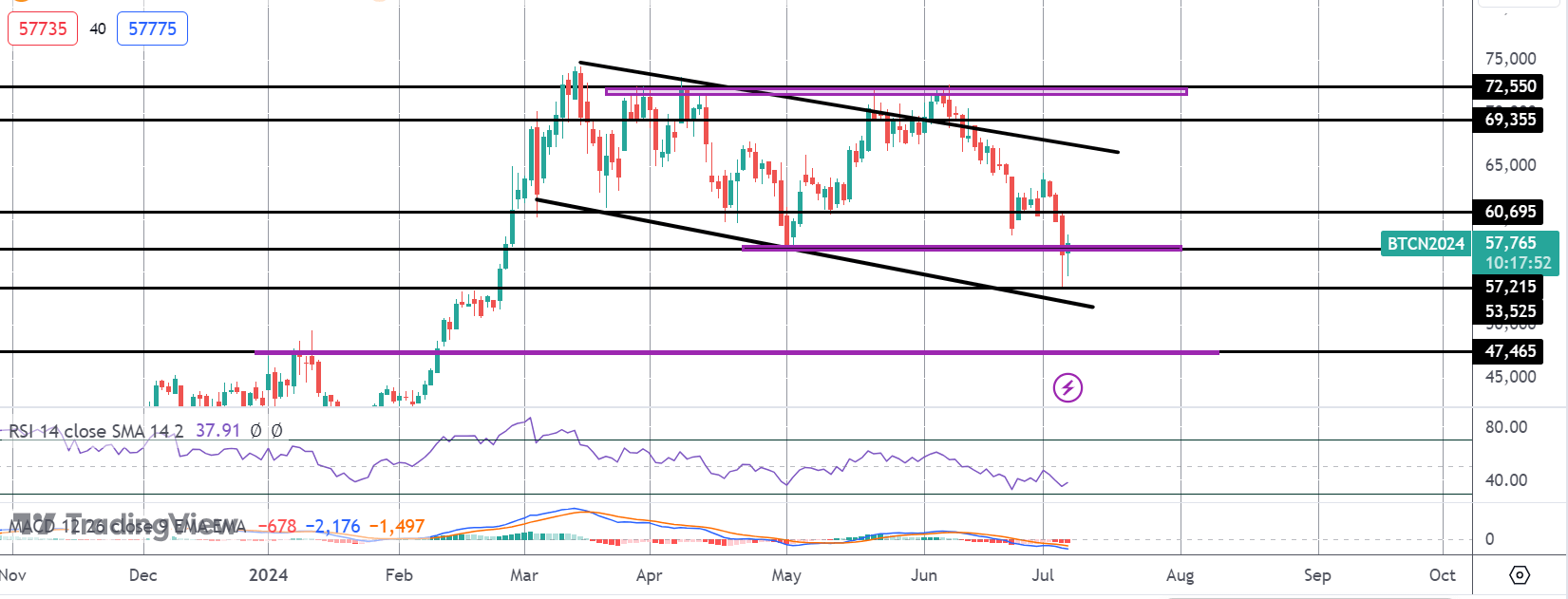

BTC

Near-term, 57,215 remains the key pivot for BTC. If bulls can get back above the level and consolidate, focus will turn back to a fresh push higher and a test of the bear channel highs with 69,355 and 72,550 above as structural resistance. To the downside, if current support at 53,525 breaks, focus will shift to a test of the bear channel lows and 47,465 below.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.