Bitcoin Rallying Over Early 2025 Trading

BTC Pushing Higher

Bitcoin is in the spotlight this week with the leading crypto asset kicking off the new year with a fresh push higher. BTC futures have gained around 9% over the first few trading days of 2025 as optimism kicks back in ahead of Trump’s inauguration next week. Many crypto bulls and market commentators are still calling for firmly higher crypto prices this year, with Trump’s administration expected to give the crypto industry a strong boost via easier regulatory conditions and the prospect of a strategic US Bitcoin reserve fund.

Institutional Demand Rebounding

After a decline in late December, BTC ETFs have seen a fresh wave of inflows over early 2025 trading. BTC ETFs have recorded gains of more than $500 million over the first few days of 2025 as institutional traders look to position for the expected bull move to come once Trump takes office next week. Indeed, the surge in demand comes on the back of a record year for Bitcoin with 2024 seeing four times the record high demand seen in 2021, according to CoinShares. With new BTC ETFs proposed this year, including some that combines BTC exposure and options as well as a ‘Bitcoin bond’, demand is expected to continue to soar.

USD & The NFP

Looking ahead this week, BTC traders will be watching USD into the jobs report on Friday. Given the current pullback in the Dollar, any weakness in the report should amplify USD selling, driving further demand for BTC near-term before focus switches to Trump next week as he takes office again.

Technical Views

BTC

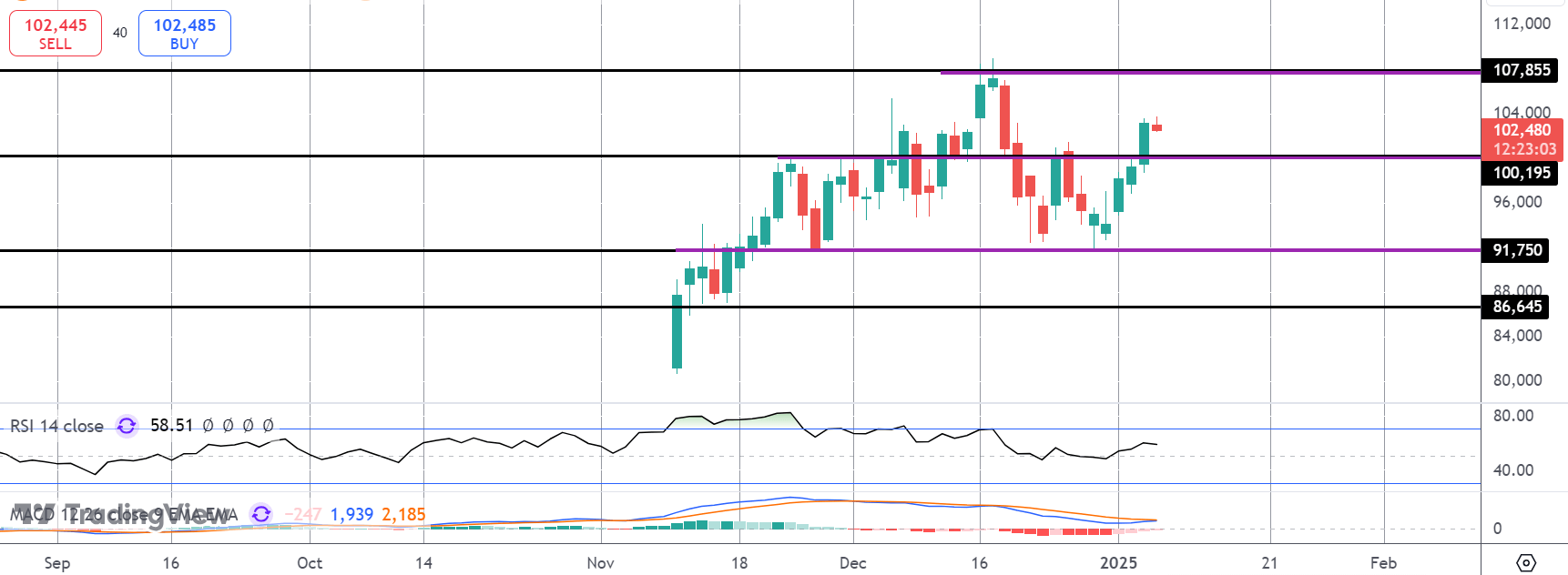

The rally off the 91,750 level has seen the market breaking back above 100,195. While above here, and with momentum studies turning higher, focus is on a fresh test of the 107,855 highs. Below 100,195, 91,750 remains the key support to watch with bears needing to see a break of that level to shift focus from fresh highs near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.