Bitcoin Eyeing YTD Lows As Plunge Worsens

BTC Selling Deepens

Bitcoin prices are ending the week heavily lower with the futures market now down 15% on the week following a fresh sell off yesterday. The move comes amidst a broader risk off dynamic we’ve seen as AI-bubble concerns resurfaced yesterday on the back of bumper earnings from NVIDIA. Riska assets rallied initially after the chip-maker beat earnings and revenues estimates for Q3 and offered strong guidance. However, the rally ran out of steam as an upside surprise in the delayed September NFP data saw focus turning back to diluted December easing expectations.

Upside NFP Surprise

Yesterday’s headline NFP reading was seen jumping to 112k from 22k prior, above the 55k the market was looking for. While the overall data-set was not firmly bullish, with the unemployment rate rising to 4.4% from 4.3% and wages cooling to 0.2% from 0.3%, the headline figure was enough to spook investors further. Indeed, a December rate cut is now priced at just 33% and with news that the October and November NFP sets wont be released until after the December FOMC, there seems little chance of a dovish repricing in coming weeks. With this in mind, BTC looks vulnerable to further downside particularly if we see the current de-risking gain momentum in response to any more US data upside.

Technical Views

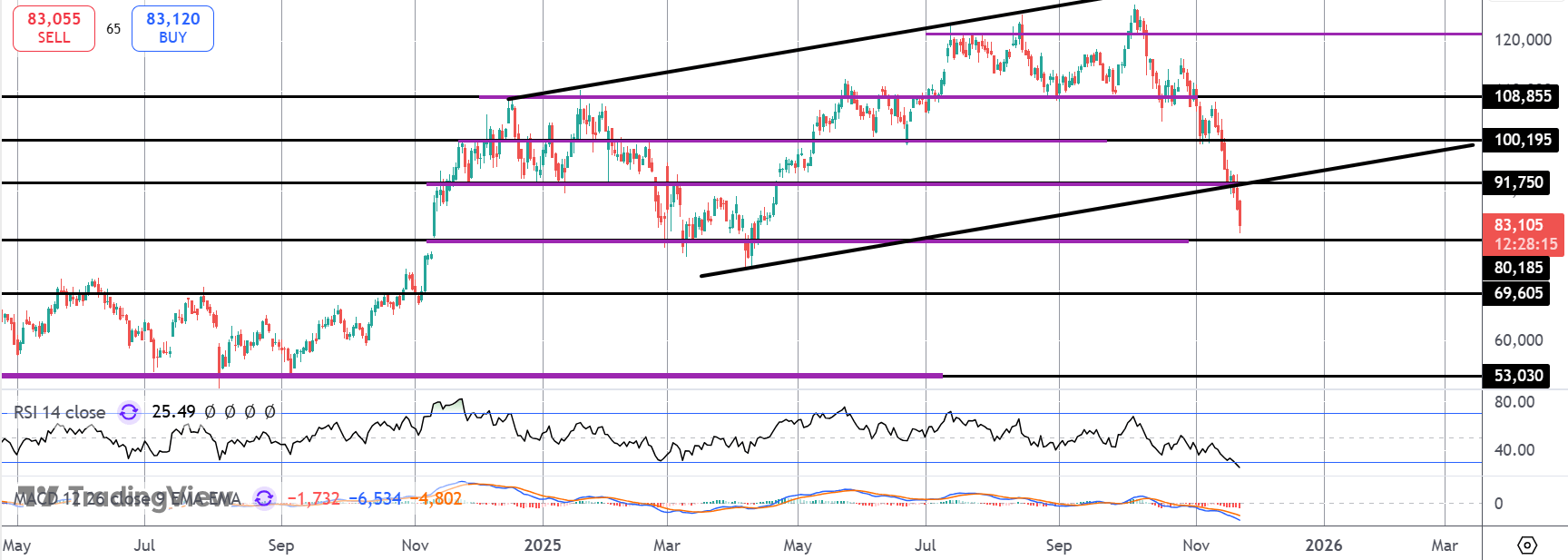

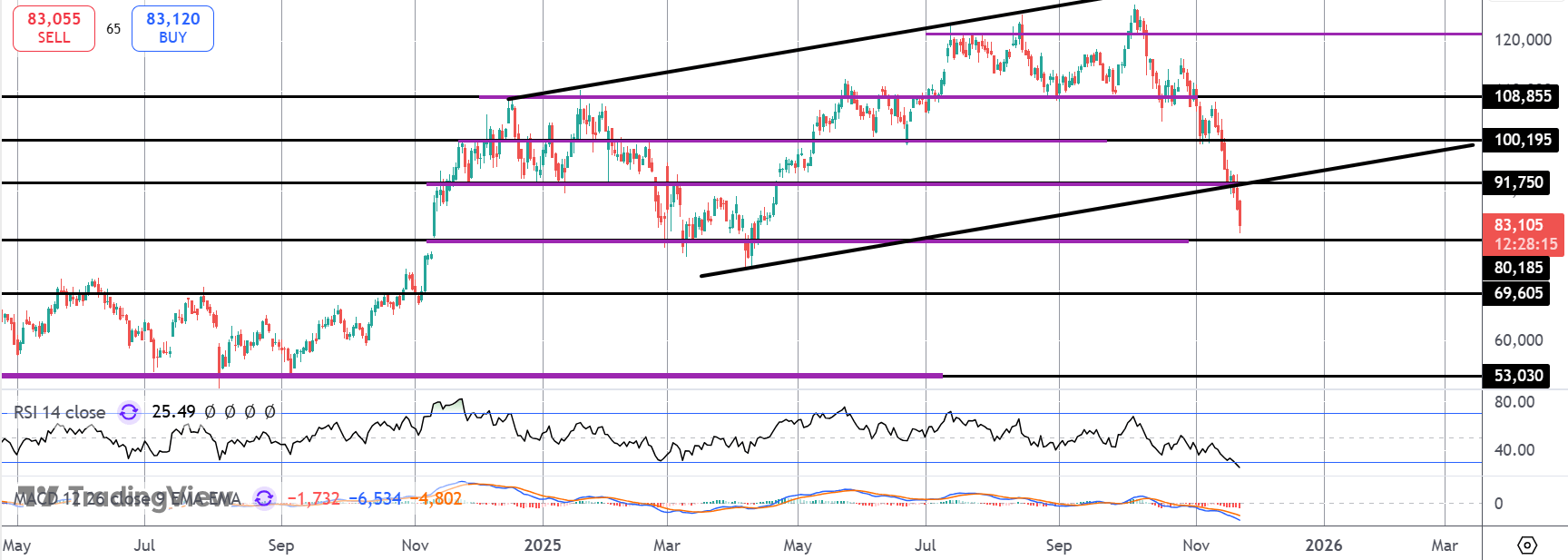

BTC

The sell off has seen the market breaking down through the $91,750 level and the bull channel lows. Price is now testing the $80,185 level support with the YTD lows just beneath. Momentum studies are firmly bearish, keeping risks pointed lower. If we break to new lows, $69,605 will be the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.