Bitcoin Correction Gathering Pace

BTC Under Pressure

Bitcoin bulls are having a less-than-ideal start to the week with BTC futures continuing to soften from the all-time highs printed last week. An unexpected uptick in US data on Thursday, alongside growing uncertainty around Trump/Putin/Zelensky peace talks, has weighed on crypto sentiment. Indeed, the Bitcoin market cap was seen cooling around 6% to just above $4 trillion from record highs seen earlier last week.

FOMC Minutes

Looking ahead this week, traders will be watching the FOMC minutes for clues as to how the Fed is likely to act not just next month but over the remainder of the year. Pricing for a cut next month has cooled back to around 85% from over 95% ahead of Thursday’s PPI upside surprise. Soaring PPI suggest there is still room for a fresh CPI uptick if those costs don’t subside. For BTC, any further US data strength is likely to continue to weaken easing expectations ahead of the September FOMC, pushing BTC down deeper. However, any data weakness should reinforce easing forecasts, boosting BTC and the broader risk complex.

Russia-Ukraine-US Talks

In terms of risk, ongoing negotiations around a potential Russia-Ukraine peace deal remain key to watch also. Nothing concrete came from Trump’s meeting with Putin and with Zelensky expected to turn down Trump’s proposal this week of ceding land to Russia, the path to a deal remains unclear. As such, BTC could correct deeper on any negative news flow around talks this week while any surprise breakthrough should see prices return to highs on a lift in risk appetite.

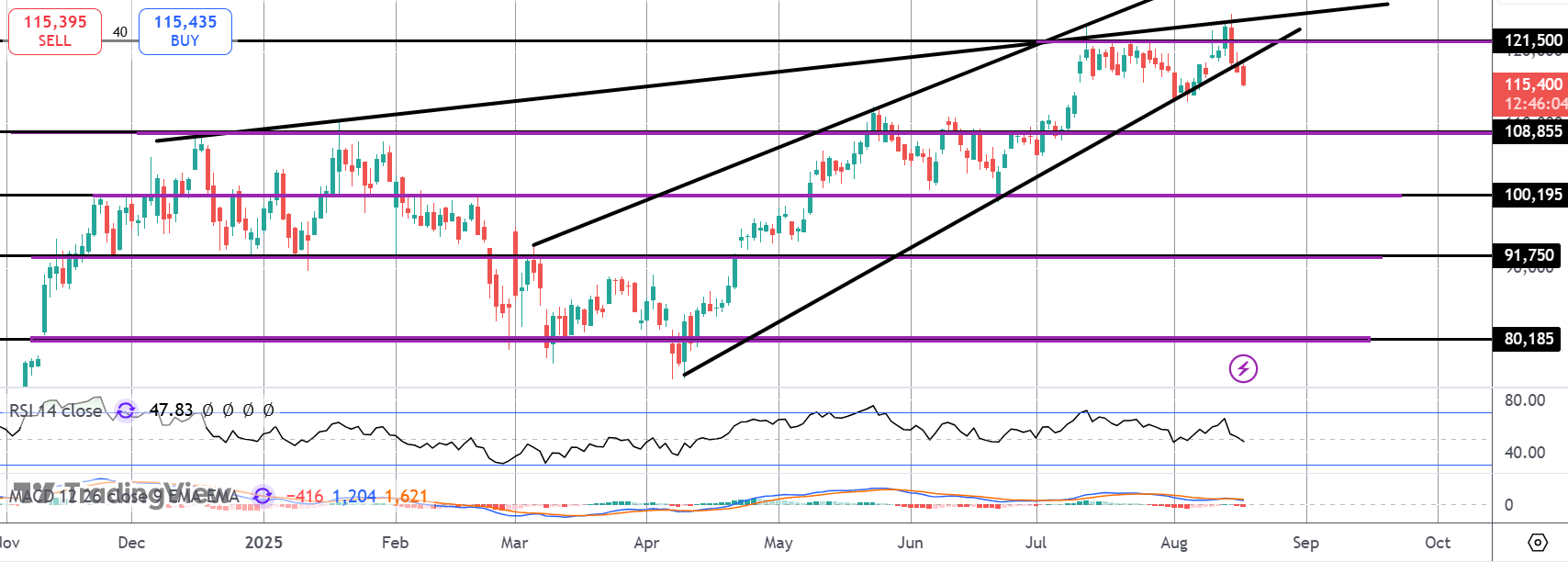

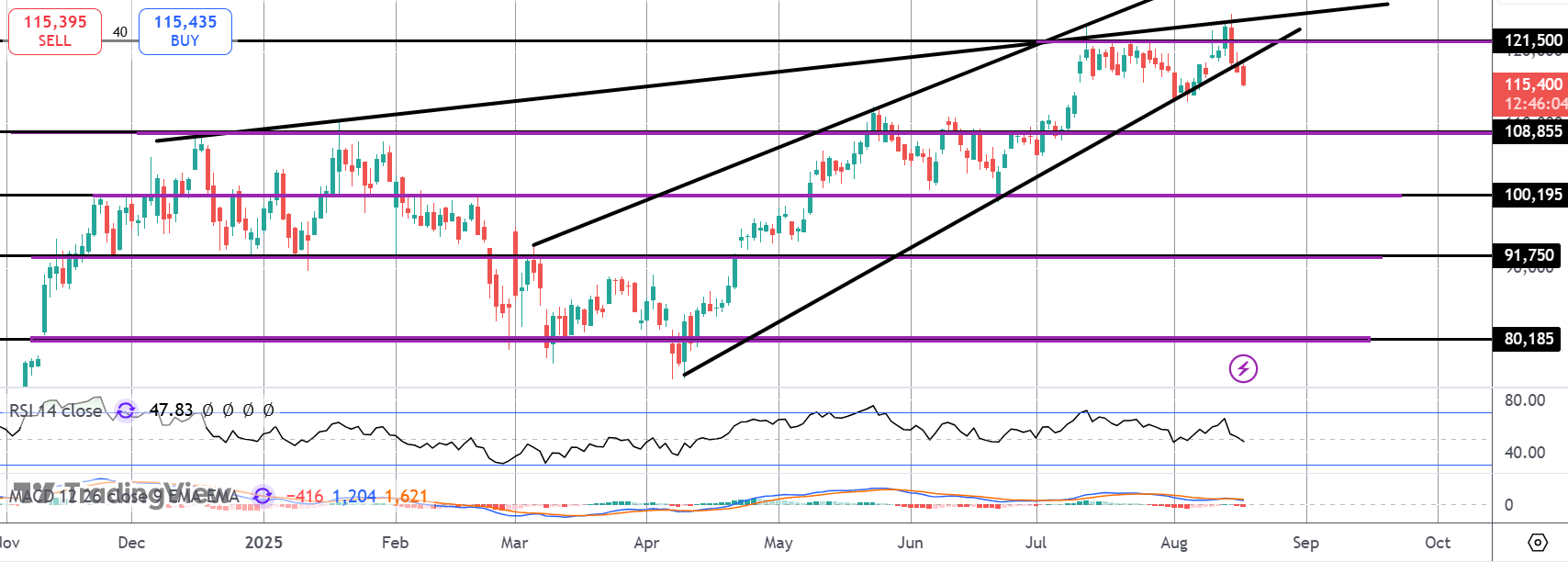

Technical Views

BTC

The failure at $121,500 has seen the market breaking down below the bull channel and rising wedge structures. With momentum studies turned bearish, focus is on a test of the $108,855 support which bulls need to defend to prevent a deeper run down to $100,195 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.