Aussie on the Up

The Australian Dollar is turning higher today on the back of a hawkish set of RBA minutes. The minutes, released overnight, showed that the RBA considered hiking rates again this month but ultimately decided to allow more time to assess the impact of recent tightening on the economy. This marks the third consecutive meeting at which the bank has left rates unchanged.

Rate Hike Risks Remain

Given the downside risks to the economy, which the bank warned about at this month’s meeting, traders had adjusted their tightening expectations lower. However, with the minutes showing that a further hike was much closer to being delivered than initially thought, the market is now adjusting its rate projections for the remainder of the year.

Inflation Still Key

Looking ahead, the bank confirmed this view, noting that “Some further tightening in policy may be required should inflation prove more persistent than expected”. With the RBA now back on traders’ radar, AUD looks poised for further upside near-term, particularly if we see any stickiness in inflation readings coming this month.

Technical Views

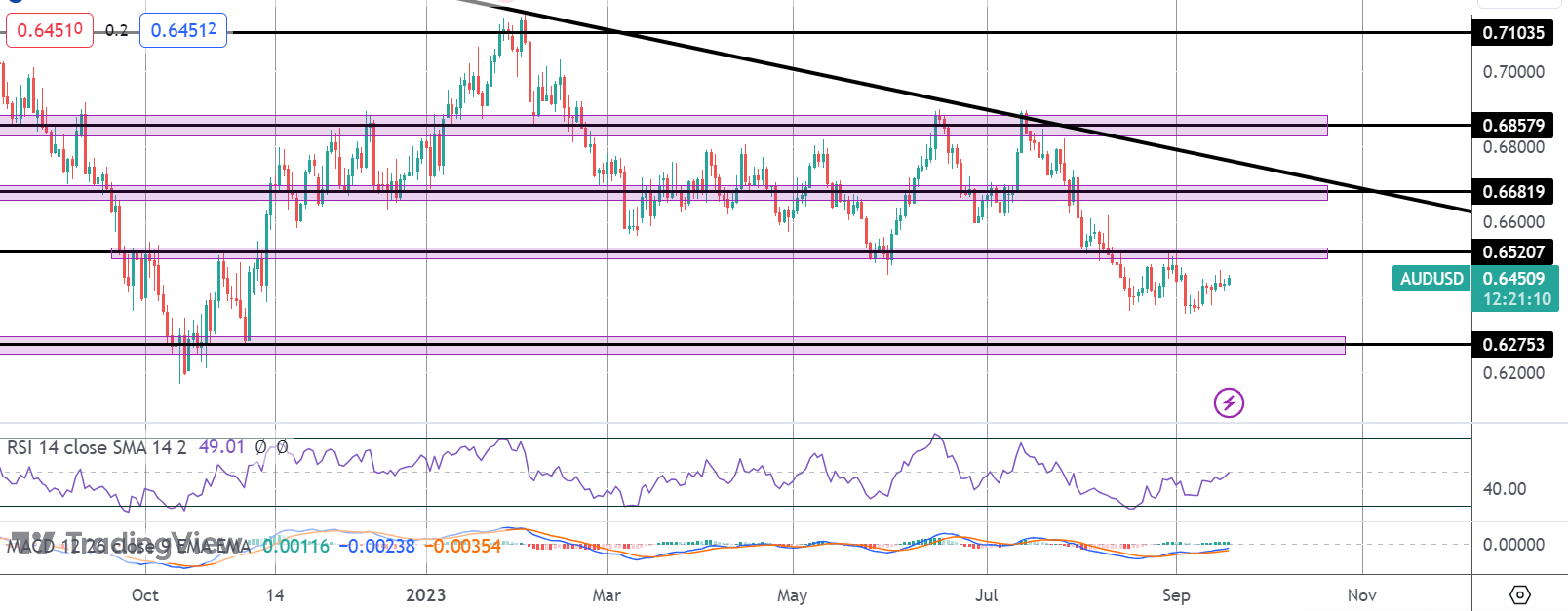

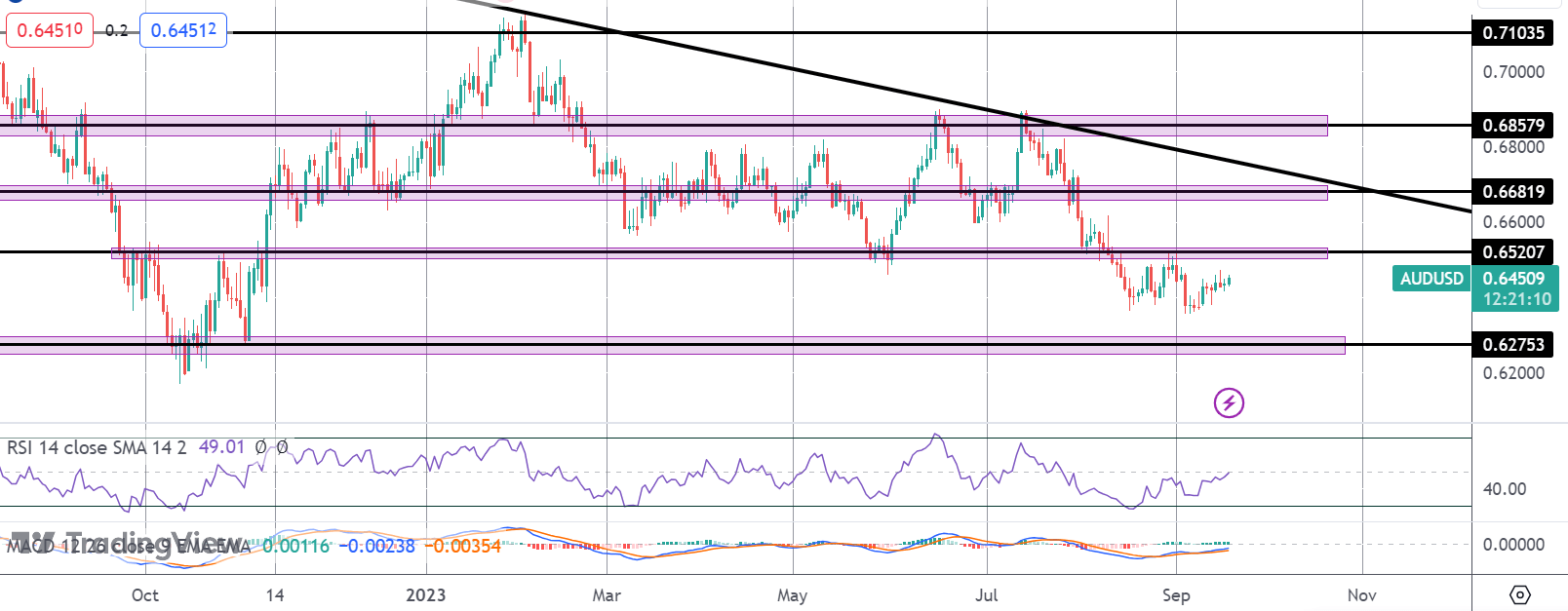

AUDUSD

Price action continues to hold in a block of consolidation below the .6520 level for now. On the back of the heavy sell off over July and August, the focus remains on a further push lower towards the .6275 level next. We are seeing some bullish divergence on momentum studies, however, though only a topside break of .6520 will register any interest.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.