ADP and ISM Hiring Miss Point to Weaker NFP Print

Greenback will likely remain under pressure until the release of the NFP. With respect to DXY (USD index) this could mean little chance to make a meaningful rally above 92.50 points. Despite the weak relationship between ADP and NFP in recent months, the bearish ADP surprise, based on the FX reaction on Wednesday, apparently forced market participants to pare down bets on a strong NFP release. The lack of upward pressure in Treasury yields also indicates lowered expectations for September Fed policy shift as the key macroeconomic variable, job growth, may not show the desired momentum. During yesterday's and today's trading session, the yield on 10-year US Treasury bonds declined and now offer a yield of 1.285% on the paper.

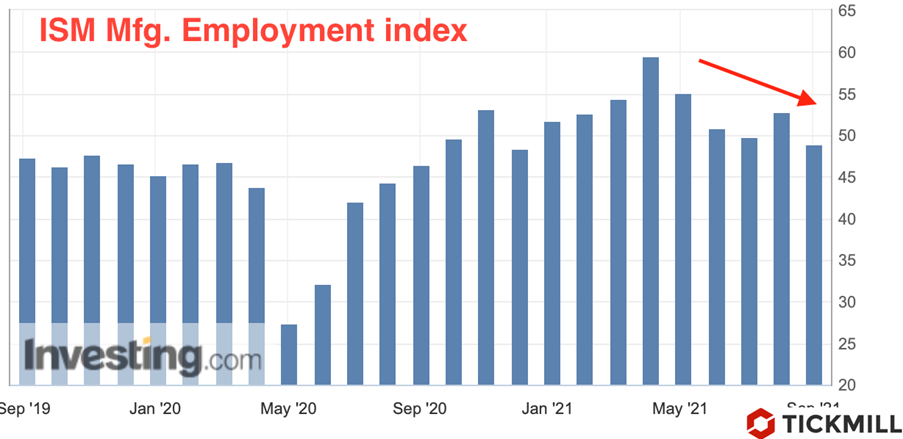

The ADP jobs estimate came almost twice lower than the forecast - 374K against the expected 613K. In addition, the hiring component in the ISM manufacturing activity index released yesterday also failed to meet expectations. The index actually went down from 52.9 to 49 points (contraction zone), that is, the overall hiring rate in the sector decreased compared to the previous month. In general, the index is on a slippery slope despite minor improvement from the previous month:

Unsurprisingly, the dollar resumed its decline yesterday, but initially saw an aggressive sell-off hit roadblocks around 92.40 points on the DXY. This is roughly the lowest level for a month. Below is a short-term technical setup for DXY:

At the beginning of the week, the price broke the uptrend support line (dashed line with a positive slope) and is now testing support, which is the upper border of the “wedge” pattern, which has been significant for the dollar index for almost a year (orange line). In the framework of the short-term downtrend, the price may correct up to a maximum of 92.50, and in the event of a negative NFP surprise, move into a decline, while support is likely to emerge slightly below the level of 92 points.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.