The IndeX Files 07-01-2020

US-Iran Fears Offset US-Sino Trade Deal Hopes

Over recent sessions, the global equities landscape has been dominated by news-flow around US/Iranian tensions. America’s killing of top Iranian general Soleimani last week has sparked a worrying reaction from Iran which has vowed to avenge Soleimani’s death with the blood of American’s.

Equities were heavily lower on Friday as reports of the assassination broke. While downside has stalled for now, the risks appear skewed to the downside in light of Iran’s threats of retaliation and America’s similar threats to return any retaliation with vigour.

This latest conflict between the US and Iran, which echoes the situation seen last summer following Iran shooting down a US drone, is frustrating for equities traders. Sentiment had been firmly bullish across global asset markets in light of the better news around the US-Sino trade deal. The US announced that the phase one deal will be signed less than a fortnight from now, with a Chinese delegation due to come to the US for the signing. Talks will then proceed, aimed at delivering a phase two deal as the next objective. In light of the situation between the US and Iran, which remains incredibly tense, the US-Sino trade talks have fallen out of immediate focus for now.

Technical View

DAX (Bearish below 13186.22)

From a technical viewpoint. The momentum divergence at play in the DAX seems to be showing up in price now with the index moving below the monthly pivot at 13186.22. below here, a further push down to test longer VWAP seems likely.

S&P500 (Bullish above 3186.75 )

From a technical viewpoint. Despite the sell off, the correction remains shallow so far and with price still above the monthly pivot at 3186.75, the near term outlook remains favourable. That said, if we do break down further, the next main support area will be the yearly pivot at 2979.

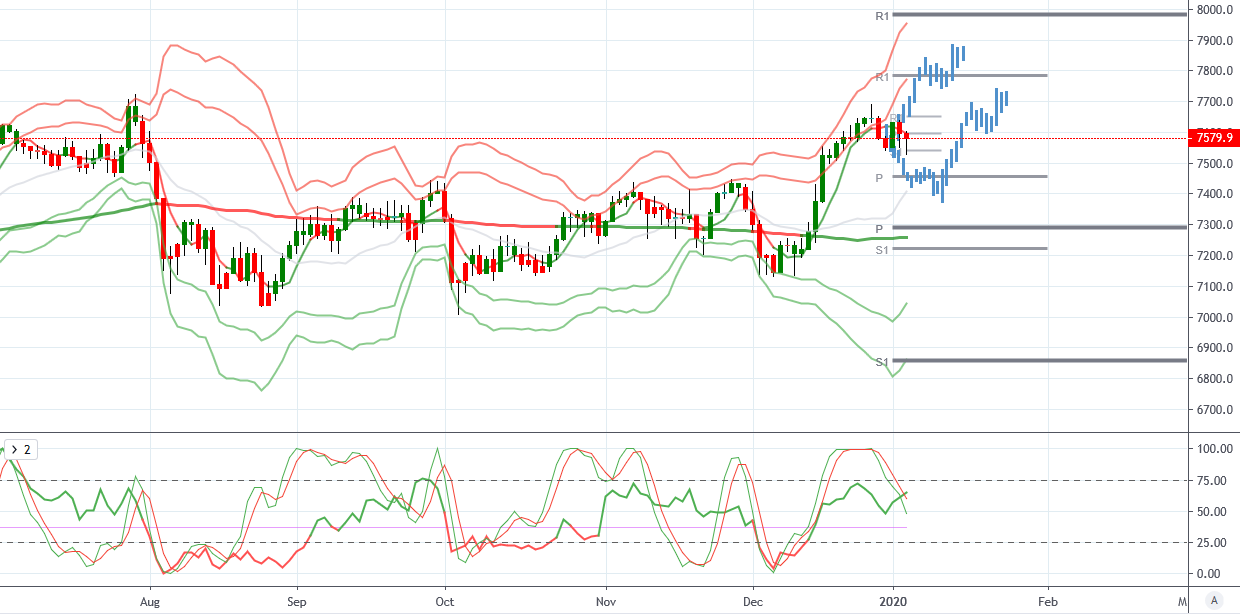

FTSE (Bullish above 7455.4)

From a technical viewpoint. Price is still above the 7455.4 for now meaning that the current consolidation could still break to the upside, in line with bullish VWAP. If we move lower from here, the monthly pivot, in line with recent broken highs should offer first support ahead of the yearly pivot at 7295.3

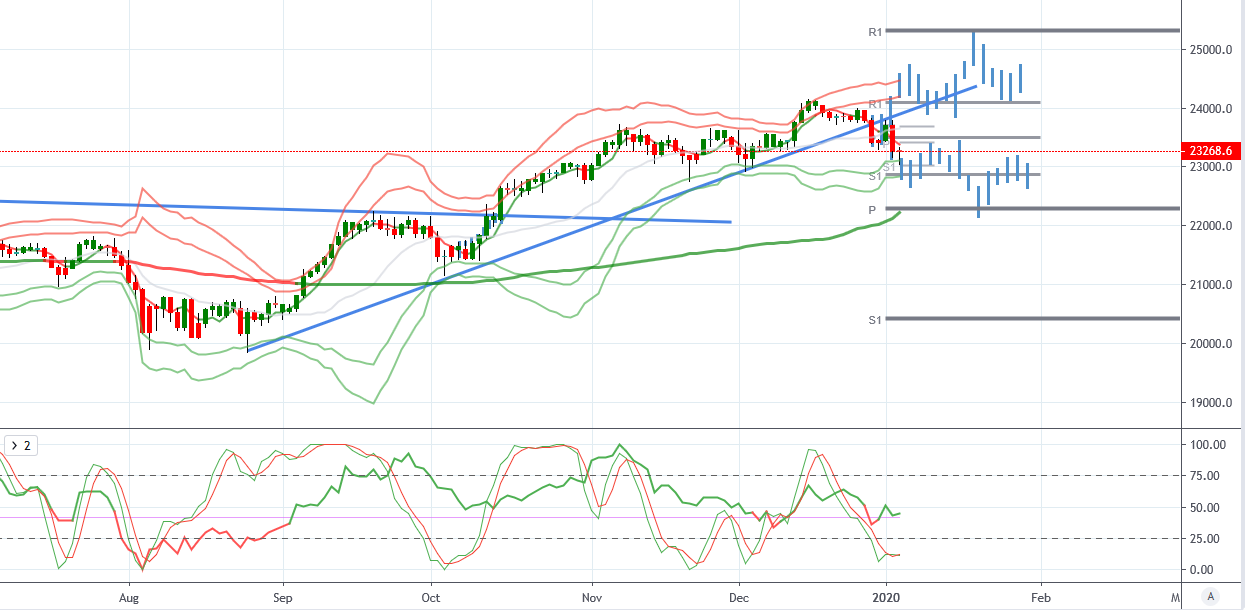

Nikkei (Bearish below 23498.4)

From a technical viewpoint. Price has slipped back below the monthly pivot at 23498.4. While below here, there is the risk of a further move lower back down to the yearly pivot at 22287, though with longer term VWAP positive, we should see some support there.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!