Chart of the Day - USDJPY

Chart of the Day

US domestic politics will stay on the impeachment inquiry into US President Donald Trump as the House of Representatives will televise publicly the Congressional hearings on President Trump's impeachment inquiry this week. US diplomats William Taylor and George Kent will testify before the House of Representative Intelligence Committee on Wednesday, whilst the former US ambassador to Ukraine Marie Yovanovitch will testify on Friday. All three diplomats have already testified behind closed doors. That said, the market continues to see it unlikely that the Republican-controlled Senate would convict President Trump. The broader USD is likely to be sensitive to comments by President Trump, who is making a luncheon speech at the Economic Club of New York. Markets will be looking for any new insights in regards to the ‘phase 1’ deal with China, but also any comments in regards to tariffs on European auto companies. The President set a self-imposed mid-November decision deadline in this regard.

JPY: Japan current condition index tumbled after sales tax hike: The Economic and Social Research Institute in Tokyo reported that its Economy Watchers Survey current conditions index fell sharply by 10pts to 36.7 in October (Sep: 46.7) as sentiment slipped across households and businesses when the latest sales tax hike kicked in last month. It appears though that Japanese households and businesses are more optimistic over outlook of the economy as the expectations index picked up nearly 7pts to 43.7 in the same month (Sep: 36.9).

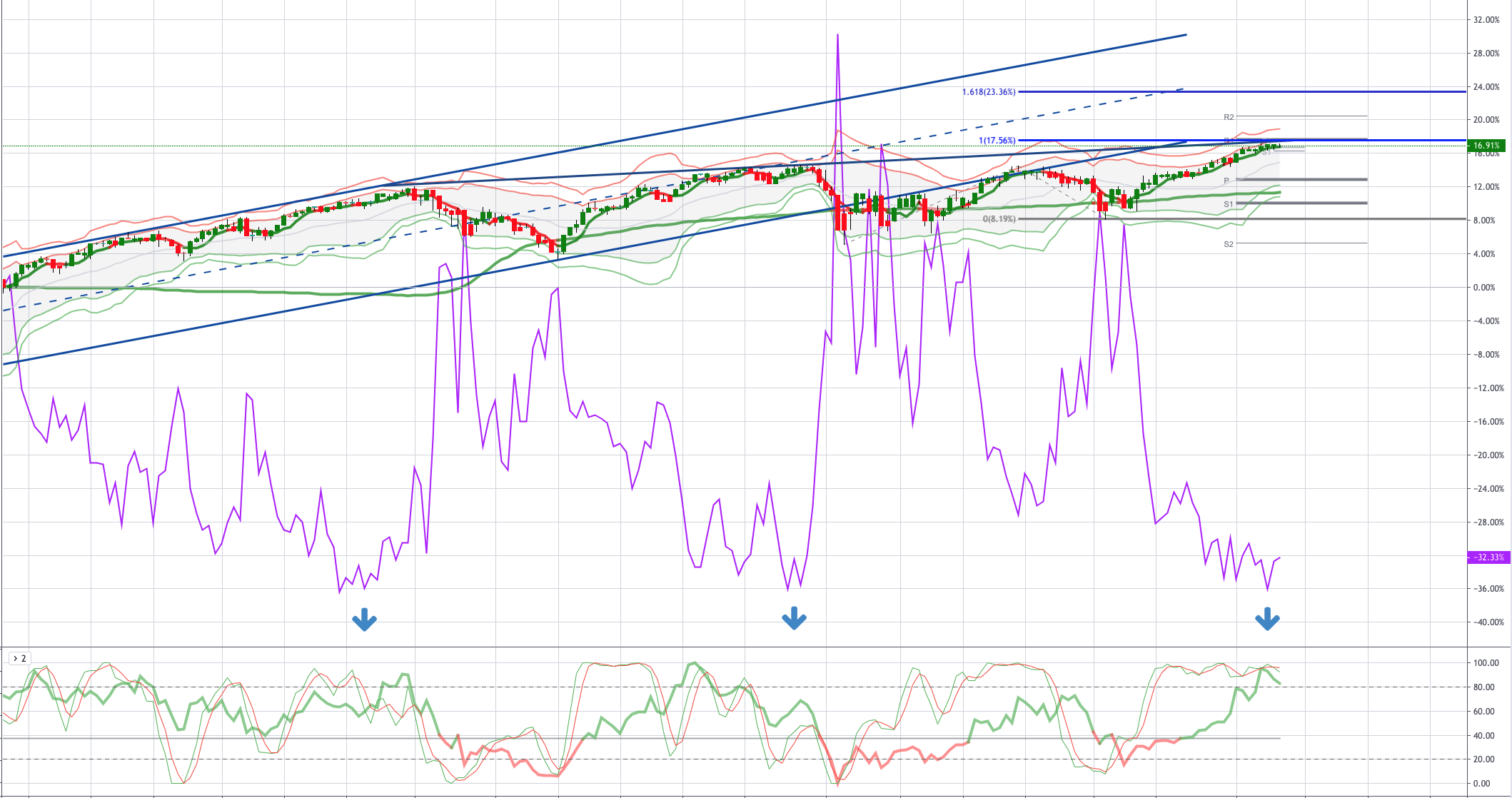

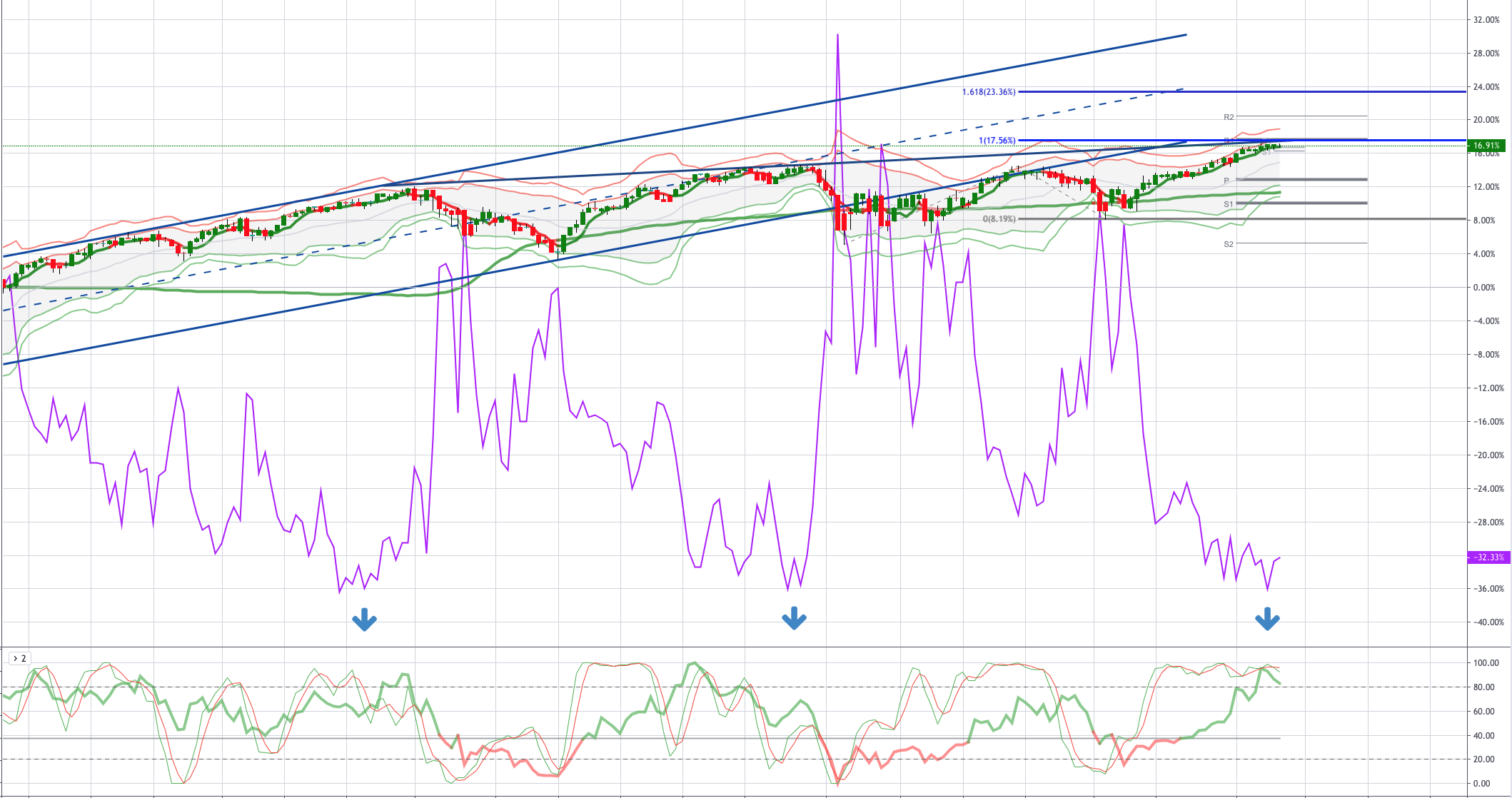

From a technical and trading perspective USDJPY only a close above 109.60 will inject further upside momentum setting the stage for a grind higher to target the equidistant swing objectives sited at 110.57/69, however the continued failure to capture ground above 109.60 is causing concern to bulls. Risk sentiment is being weighed by continued Geopolitical concerns (US/China & Hong Kong Chaos). I would also draw attention to the current S&P500 and VIX positioning. The VIX is trading at levels that have witnessed market corrections in recent months, as highlighted in the chart. There is a window for risk shake out ahead of the annual year end ramp in risk markets, this will likely see a shakeout in weak USDJPY longs. The USDJPY daily chart flipped short yesterday, a breach of yesterday's lows offers decent risk reward parameters for 1:2 trade to the short side, with a protective stop above today’s highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!