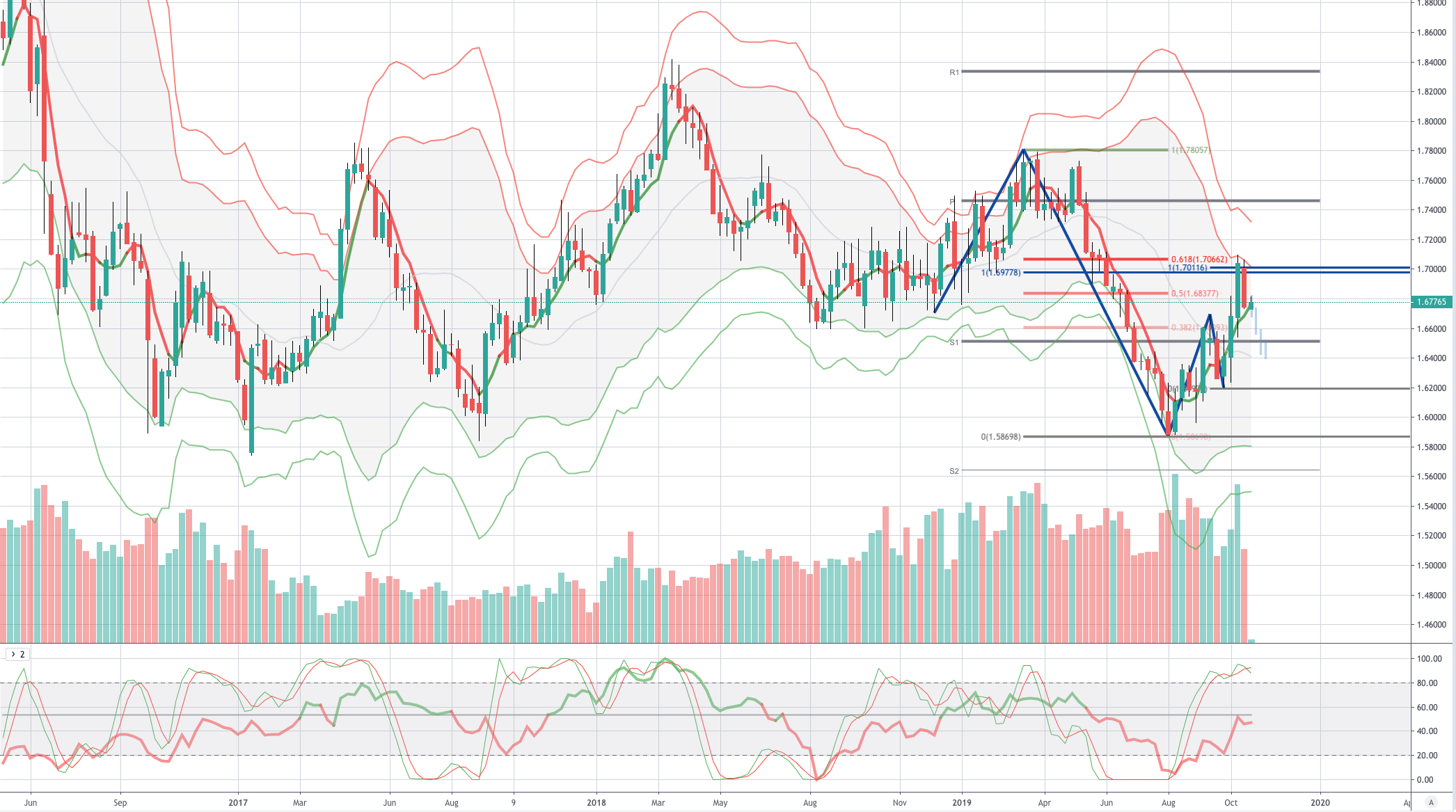

Chart of the Week Bearish GBPCAD

GBP: On the Brexit front, media reports suggest the EU will agree to a three-month ‘flextension’ to the Brexit deadline to 31 January, with the option of an earlier departure date if the Withdrawal Agreement is ratified. With the EU reportedly ready to grant an extension to the Brexit deadline by up to three months, the focus turns to an expected vote in the House of Commons today (probably late afternoon at the earliest) where two‑thirds of MPs are needed to consent to an early election on 12 December. It would need the support of Labour, but its leader Jeremy Corbyn yesterday said that it would not support it. If the vote fails, then the government may try to find other ways to instigate an early election.

CAD: The BoC rate decision Wednesday is the data highlight of the week. Regardless of the outlook for easier Fed policy, strong employment growth, higher wages, on target inflation and above expectations growth, mean that policy makers can sit on their hands and await developments, suggesting a neutral hold statement. Industry level GDP and IPPI data for Aug are out Thursday. The October Markit manufacturing PMI is released Friday.

From a technical and trading perspective the GBPCAD posted a bearish inside week reversal last week, after testing pivotal resistance at the 1.7000 (which retained symmetry and equidistant swing significance, coinciding with the 61.8% Fib retracement of the last decline), as 1.7000 continues to cap the correction, look for a breach of last weeks lows to open a test of 1.6400 as support, only new highs for the week will negate this view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!